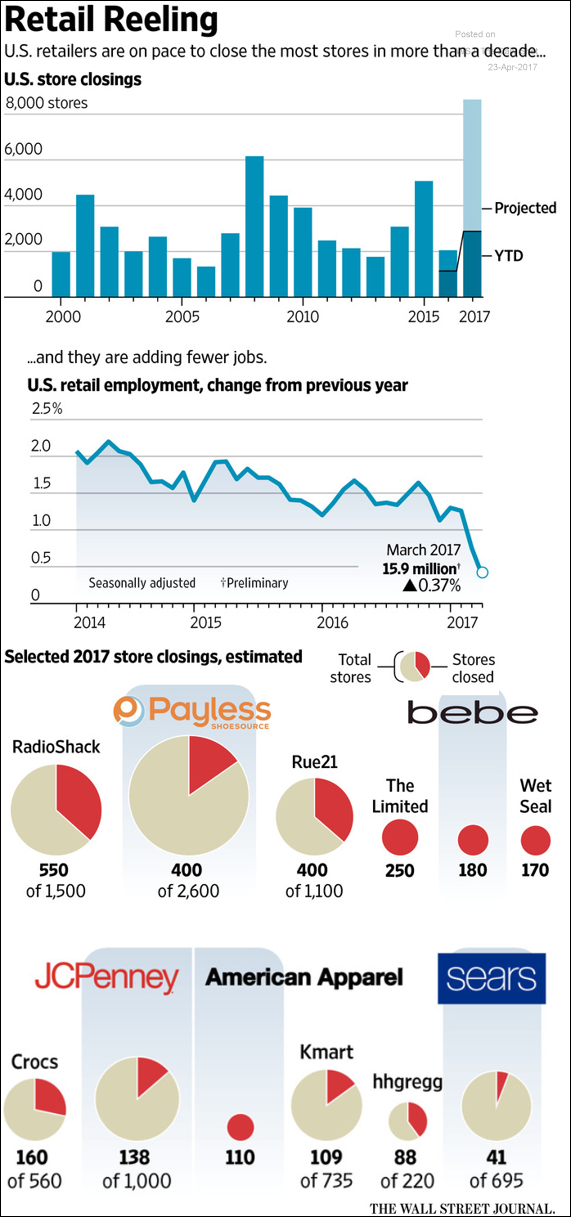

Projected Retail Closings and Job losses for the Year

People don’t like people who make them uncomfortable. And when I do it, like now, I’m pretty sure it makes it less likely I get calls for consulting. But I’m all about trying to help you to run your businesses better and think you need the bad news as well as the good. Probably you need the bad news more. But, in a sense, this news about retailers closing isn’t completely bad news. I say that because, first, it’s old news (though the acceleration of the trend this year seems significant) and, second, because it needs to happen.

When Sports Authority closed, you had various people bemoaning the impact of all the extra inventory thrown on the market. That trend will continue as long as stores are closing. Too much inventory, in any industry, tends to give a product more attributes of a commodity and hurt margins. The dynamics of supply and demand are mighty inconvenient . That’s especially true when products are way more similar to each other across brands than we’d like them to be.

Survivors will be better off when all the superfluous retail space is gone. I’d almost like to see it happen faster. I’ve been pushing the idea of limiting your distribution as a way for brands to differentiate their products. It’s a good idea, but it will be a way more effective idea when there’s less competitive product found everywhere on sale because stores are closing. I’d go so far as to suggest that the endless searching for and creation of new brands might decline.

Is north of 8,000 stores a lot? I don’t know. Seems like a lot to me. That we should be closing way more stores than we have since this chart starts seems a bit odd since we’re theoretically in the midst of, I think, the third longest economic expansion in our history. By the way, I don’t know if this is net of store openings or not.

The reduction in the growth of retail jobs should also concern us. I have no idea what’s going to replace them though historically, jobs have always come from new, unanticipated places. And a lot of these people are our prime customers.

The other thing that’s going to drive the retail consolidation is a continuing rise in interest rates, if it happens. I say if only because technically, the 10 year treasure bond 30 plus year downtrend hasn’t been broken yet. The Federal Reserve has pretty much screwed the pooch by keeping interest this low for this long. It’s allowed a lot of zombie companies that should have died to stay in business. Not just in our industry.

By the way, I stole these graphs from this morning’s Daily Shot. You can sign up to get their free newsletter here. If you already subscribe to the Wall Street Journal, you can get their more complete version free.

Leave a Reply

Want to join the discussion?Feel free to contribute!