I’m going to try and keep this pretty short. Nothing has really changed strategically. Spy is still in business only because its major shareholder has lent the company around $20 million. In terms of operations and expense management, they’ve done everything that I can see they can do. They tried to stake out a differentiable market position with their “happy” campaign. I thought that was pretty creative.

But they are in a market (sunglasses) dominated by big players and luxury brands. It’s an oversupplied market and to many of the brands, it’s just an accessory rather than the place where they have to make their money.

Spy continues to try and figure find out where they fit and how they can grow lacking adequate resources and a competitive advantage outside of a small “core” market.

Revenues for the quarter ended September 30th dropped 14.6% to $9.37 million from $10.98 million in last year’s quarter. For nine months, they are down from $28.4 to $26.6 million. “The largest decrease in our sales came from a decrease in our sunglass and goggle product lines which decreased by $1.0 million or 19.3% and $0.4 million or 8.3%, respectively during the three months ended September 30, 2015 compared to the same period in 2014. The decrease was principally attributable to lower sales resulting from an increase in the value of the U.S. dollar in certain of our international markets… a decrease in sales to our smaller, independent accounts, and certain non-recurring product production issues. Sales also included approximately $0.5 million and $0.4 million of sales during the three months ended September 30, 2015 and September 30, 2014, respectively, which were considered to be closeouts…”

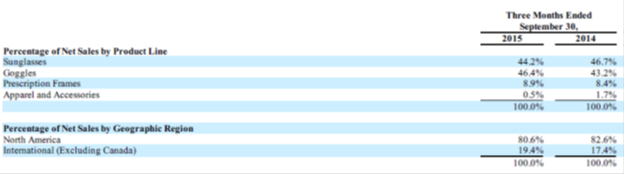

As you know, Spy does a lot of its business in goggles, and their relatively new prescription frame business has been growing. The chart below provides a breakdown of their sales by product and location.

The gross margin declined quarter over quarter from 49.2% to 43.7%. This “…was primarily due to: (i) higher sales of closeout products at reduced price levels, (ii) lower sales of higher margin prescription frames, (iii) increase in inventory reserves, (iv) higher proportion of discounts granted to lower margin products, and (v) foreign exchange prices impacting sales price.”

The significant change in operating expenses was the 18.1% decline in sales and marketing from $3.07 to $2.5 million. “The decrease is primarily due to lower commission expense of $0.3 million and lower marketing expenses of $0.2 million.” I’m guessing they’d like to be spending more, but just don’t have the cash flow.

Interest expense was half a million dollars. They had a net loss of $788,000 during the quarter compared to a loss of $19,000 in the quarter last year.

The notable changes on the balance sheet since the end of last year’s quarter are the decline in cash from $894 to $241 thousand and the 11.4% increase in inventory from $7.5 to $8.4 million even with declining sales. I imagine some of the cash went into the inventory. The higher inventory might lead to more closeout sales and more margin pressure.

They carry the debt to shareholder of $21.5 million as a long term liability, but practically speaking its equity.

So that’s pretty much it. They’re in a tough market (Isn’t everybody!) and their competitive advantage is only valid in a pretty small market segment. I don’t know about the dynamics of the shareholder group, but I’m wondering how long they continue to continue this way.