I’ve decided that my best recent article was “How Brick and Mortar Retail Has to Change,” written last June. I was surprised it got so little feedback. Probably because the list of what customers don’t need us to do anymore is a little intimidating, and we aren’t sure how to respond.

Even if, like Zumiez, your plans are responsive (as I see it) to the changing conditions, there’s still going to be a recession (not just in the U.S.), there’s too much product and manufacturing capacity, too many brands, too much retail space, too little product differentiation, and many customers have too little income. And they have to spend more of that income on necessities. I guess a cell phone is a necessity. Certainly housing, food and health care are.

It’s not that Zumiez had a bad quarter. It’s just that looking at quarterly results and comparing them to last year’s quarter doesn’t seem as relevant these days. Boy, it’s a pain to be public. Nevertheless, we’ll look at Zumiez’s quarterly results and, yes, compare it to last year’s quarter. But we won’t spend much time doing it. I want to move to the discussion in the conference call where, as usual with Zumiez, we find more to sink our teeth into.

The Numbers

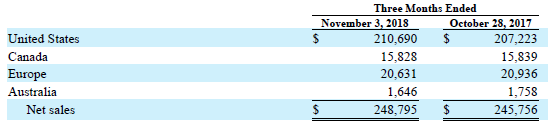

Revenue in the quarter ended November 3 rose 1.24% from $245.8 to $248.8 million. “The increase primarily reflected an increase in comparable sales of $11.1 million [4.8%] and the net addition of 9 stores (made up of 8 new stores in North America, 5 new stores in Europe partially offset by 4 store closures in North America) subsequent to October 28, 2017 partially offset by a decrease of $9.6 million due to the calendar shift to exclude an additional week of back-to-school season.” The chart below shows the increase by geographic segment.

Zumiez ended the quarter with 703 stores; 609 in the U.S., 50 in Canada, 37 in Europe and 7 in Australia.

The gross profit margin rose 1.0% to 34.9% compared to the same quarter last year. “The increase was primarily driven by 70 basis point increase in product margin and 70 basis points in lower shrinkage of inventory partially offset by 30 basis points in higher shipping and fulfillment costs.”

Shrinkage has been a reported problem for Zumiez. Seems they are getting it under control. Higher shipping and fulfillment costs are a fact for most companies.

SG&A expense rose 6.1% from $64.6 million in last year’s quarter to $68.5 million in this year’s. “The increase was primarily driven by the $9.6 million sales movement related to the calendar shift resulting in 60 basis points deleverage in store costs, 40 basis points from higher corporate costs and 20 basis point increase related to the accrual of annual incentive compensation.”

Pretax income was up slightly from $18.6 to $18.8 million. Net income rose from $11.9 to $13.8 million, or by 16.0%, but only because the income tax provision fell from $6.67 to $4.99 million.

The balance sheet remains strong, with a big increase in cash to $128 million from $86 million at the end of last year’s quarter. There’s no long-term debt. Inventory rose by $30 million- in excess of sales growth- but that is a great segue to the conference call.

Conference Call Insights

What we learn from CFO Chris Work is that the inventory increase was “…driven primarily by the planned timing of inventory receipts as we brought in products from certain vendors ahead of the fourth quarter in anticipation of the holiday season.”

I might be in danger of giving Zumiez more credit than they deserve. But it’s occurred to me that as a retailer’s (or a brand’s) customer information and algorithmic performance improves (which is a “must do”), and as supply channels become more flexible and faster, we should see more variability in inventory numbers as companies get better at getting the right product to the right place at the right time while reducing inventory risk. I’m not sure the inventory number on the balance sheet at the end of a quarter will have the same meaning it has had. Just something to think about.

Meanwhile, CEO Rick Brooks provided his usual soliloquy on Zumiez’s continually improving process for identifying and onboarding (and offboarding- 20% to 30% turnover annually) new brands. His comments included their “…strong recruiting, training and sales culture to drive more personalized human-to-human connections, which is resonating with our customers.”

Now I’m pretty sure that when Zumiez was founded in 1978 by Thomas Campion and Gary Haakenson those guys didn’t sit around and say, “Hey, let’s make sure our culture will work in the 2020s when there’s an internet.” But flexibility and the ability to push decisions down in the organization is what’s called for right now.

Rick also talks about their “…strategic presence in seven countries across three continents with a digital presence that allows us to reach even further.” I’m guessing we won’t see much more store growth in Canada, and it will be slow at best in the U.S. I don’t have a sense of how many stores Australia might support. Europe can support plenty, and there’s a comment that the infrastructure for growth there is in place.

But what’s strategic is the ability to exchange brands, products, and ideas and to have one global, unified brand even if the store numbers don’t increase quickly.

Here’s how Rick puts it earlier in the call.

“With the increasingly blurred lines between retail channels, we have moved toward a channel less world in which the empowered consumer isn’t focused on going into a store or buying online, but rather transacting with a trusted retailer. With the barriers between the physical and digital worlds coming down and increasing speed at which individuals communicate, trend cycles are rotating faster than ever before. The same holds true for the pace at which demand for emerging brands can go from local to global in nature.”

One smart analyst asked about Zumiez trade area concept and how that was going. A Zumiez’s “trade area” seems to be a collection of stores and online business which is only partially geographically defined and may turn out to be fluid. It feels like the almost inevitable outcome of a business model where there’s no distinction made between online and in store revenue.

Ricks comment is that they’ve been working on it for a long time but are early in the process of figuring it out. He talks about localized fulfillment as a benefit, but my own guess is that’s just the tip of the iceberg.

“We’re going to spend a lot more time defining what trade areas are with the role of different elements of different locations, how people — people around these concepts all these things are in the works. Chris’s team is working on measurement of profitability it’s going to require all sorts of new thinking around assortment planning yet in the process. And again, the roadmap just keeps going on and on and on.”

After all the discussion during the call and the similar discussions going back quarters and years about how retail and online were the same revenue channel, and fulfillment was done in stores, and the store associate owning the customer relationship and the advantage of leveraging store costs, and ecommerce and brick and mortar sales influencing each other, it must have been frustrating when somebody asked how the digital comp compared to the store comp.

This highlights why it’s disadvantageous to be a public company right now as an active outdoor retailer or brand. The pace of change and the number of moving parts makes it hard to present a consistent, comfortable picture of a business when you have to do it on a quarterly basis. My expectation is that we’ll have to evolve new ways to evaluate companies.

For the full 2018 year, Zumiez projects mid-single digit revenue growth, but operating profit growth in the mid to high teens. How is Wall Street going to react to lower revenue growth and having to focus on different metrics? For example, Zumiez management expects faster growth in digital than in in store sales. But that’s not to suggest the two should be considered separately. In fact, they are relying on leveraging their store expenses with those digital sales to produce a bigger than might have been historically expected improvement in operating income.

What’s the metric for measuring how that’s going exactly?

I spend a lot of time on Zumiez because they have typically presented the most complete, cogent and open explanation of what they are doing and why it’s necessary. It is worth reading the conference call carefully.

Jeff, happy holidays and interesting analysis. As someone who has now spent a little more than a year in a new town a interesting perspective: Zumiez needs to be on point all the time which has got to be a long term challenge. Most people here would dread ever going to the mall and Zumiez would be the only reason. We all support the old line skate and snowboard shop in town and from what I have seen, folks with higher disposable income are always in the local shop. Plus every core kid wants a job at the shop and is depressed if they have to work at Zumiez or Bob Wards.

Now if you could explain how everyone from the dirt bag ski bum to the Yellowstone Club billionaire here wears Arc’Teryx? All the best.

Hi Chuck,

Hope all is well in the land of the actual white Christmas. First, if Arc’Teryx can get all those groups to buy their product without screwing up the brand, good for them- that’s the holy grail. Like you, I don’t think they, or anybody for that matter, can keep it up. All retailers- not just Zumiez- have to be on point all, or at least most of the time. If their balance sheet is strong, it doesn’t quite have to be all the time. And those are the circumstances which will make thing even more interesting when there’s finally a recession.

It’s great you all support the local shop. But that doesn’t mean there’s no online shopping going on, does it? We all like those local shops- we just don’t need as many of them. Have any closed in recent years where you are? I’m prepared to believe smaller towns might be different.

You going to Denver?

Thanks,

J.

Yes going to Denver and yes definitely those folks are definitely shopping online primarily, Steep & Cheap, The House and maybe Sierra Trading. Ha, we are old enough to remember when the only reason we knew about The House was that was the sole online outlet for Burton to dump stuff.

All the best. -cc

See you in Denver.

J.