VF continues to manage its brand portfolio consistent with its strategic imperatives. Before moving onto the financials, we’ll take a look at their decision to divest their occupational work brands. It’s consistent with other brand decisions they’ve made.

The Deal

Once they sell, as they’ve announced they will, the occupational portion of its work segment (Red Kap, FV Solutions, Bulwark, Workrite, Walls, Terra, Kodiak, Work Authority and Horace Small), their brand count will be reduced further. In the conference call, CFO Scott Roe notes that “…at the end of this transaction, our portfolio at 12 brands will be roughly half of what it was just a couple of years ago.”

The work brands they are selling represent B to B business where higher levels of inventory are required. Understandably, it’s not exciting to VF. This isn’t their word, but it feels to me like more of a commodity business than what VF wants to own.

“Our decision,” says CEO Steve Rendle, “reflects management’s continued focus on transforming VF into a more consumer-minded retail-centric enterprise with a portfolio of more growth oriented, outdoor active and work brands.” The sale won’t include Dickies and the Timberland PRO brands. “There are,” he says, “fundamental differences between the Occupational Work brands and the Dickies and Timberland PRO brands, including the ability to connect directly with consumers, distribution footprint, supply chain infrastructure and financial profile.”

The brands they are selling “…contributed about $865 million of revenue and $130 million of adjusted operating income in fiscal 2019.” But they have, we’re told, “only minimal exposure to VF’s international and D2C [direct to consumer] growth platforms.”

The last thing I want to say about this deal is that most of VF’s factories apparently go with it, and they’ll end up out of the apparel manufacturing business. As supply chains have evolved, becoming more sophisticated, and as consumers have demanded more newness and shorter timelines, I thought of VF’s manufacturing capabilities as offering flexibility and perhaps some competitive advantage. I guess getting out of a business that doesn’t fit their strategy trumps that.

The Financials

Here’s the summary for the quarter ended December 31st. Details follow. Revenue grew 4.9% from $3.228 billion in last year’s quarter to $3.385 billion in this year’s. The gross margin rose 1.1% to 55.7% “…primarily driven by a mix-shift to higher margin businesses and a favorable net foreign currency transaction impact.”

SG&A rose 5.1% from $1.242 to $1.305 billion, “The increase… primarily due to costs related to the relocation of our global headquarters and certain brands to Denver, Colorado and specified strategic business decisions in South America. The increase…was also due to continued investments in our key strategic growth initiatives.”

Net interest expense was down 33% from $25.2 to $16.8 million. They received a bunch of cash when the spun off the jeans brands as Kontoor and used that to repay debt.

Net income was up hardly at all from $463.5 to $465.0 million. They’d probably rather you looked at income from continuing operations, which rose 10.7% from $409 to $453 million. The difference is that last year’s quarter included after tax income from discontinued operations of $54.4 million from $712 million in revenue. For this year’s quarter, the number was $12.3 million just from an income tax benefit.

VF has a lot of brands coming and going, and for that reason I like to focus on plain old net income after taxes. Now for those details.

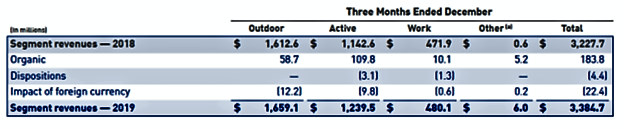

Organic revenue, as opposed to from acquisitions, contributed $183.8 million in revenue growth for the quarter. That’s more than 100% because it was offset by losses of $4.4 million from dispositions and $22.4 million from foreign exchange.

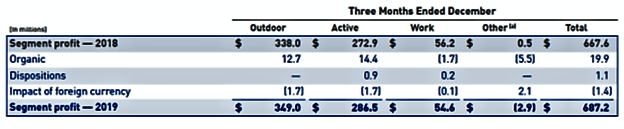

The charts below show the source of revenue and operating income for each of VF’s segments during the quarter with last year’s quarterly results being the starting point.

The outdoor and active segments, you can see, provided most of the revenue and operating profit for the quarter. Outdoor revenue rose 2.88% from last year’s quarter. Active was up 8.48%. Those two segments operating profit rose 3.25% and 4.99% respectively. The numbers for the work segment will decline after the sale of the brands.

The outdoor segment includes The North Face, Timberland (but not the PRO part of Timberland), Icebreaker, Smartwool and Altra. Active includes Vans, Kipling, Napapiiri, EastPak, JanSport Reef (until the sale date) and Eagle Creek.

VF’s four biggest brands by revenue are Vans, The North Face, Timberland and Dickies. Their respective growth rates for the quarter were 12%, 8%, (5%), and 13%. For nine months, the growth numbers were 15%, 8%, (3%) and 3%. “…Vans and The North Face, account for over 80% of our growth in the long-range plan.”

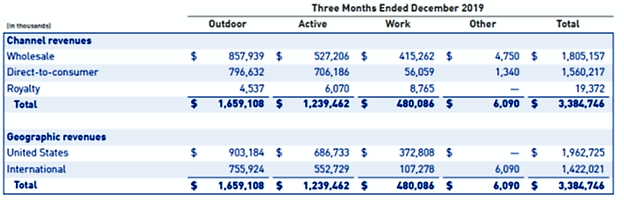

This next chart shows where the revenue came from by channel and location for the quarter.

If you exclude work, which remember will decline with the brand sales, you see revenues well balanced between wholesale/direct-to-consumer and U.S./international. Revenue growth during the quarter was 3% in the U.S., 4% in EMEA (Europe, Middle East, Africa), and 14% in APAC (Asia/Pacific). China by itself grew 30% and the non-U.S. Americas business was up 9%. Overall international revenue was up 8%. Wholesale was up 3%, direct-to-consumer 7% and digital (part of direct-to-consumer) 16%.

VF ended the quarter with 1,438 stores, up from 1,420 a year ago.

What’s it all mean? Let’s start with China. This is before the viral scare and VF isn’t finding a big impact from tariffs over the whole year. But ignoring the headlines, China has some longer-term financial issues associated with high levels of debt that are probably worse than in the U.S. CFO Roe said the following in the conference call: “The good news for us is that China and the region has really been strong and you saw 30%. That’s somewhat artificial. And we said there’s about 5 points due to the timing of Chinese New Year. So there’s a little quarter-to-quarter noise in that. But still if you look, we’ve been in that 25-plus kind of growth rate consistently in China. And that’s really driven the strength of Asia. And really why we’re at the top end of our long-range estimates overall.”

Not sure the 5 points due to the timing of Chinese New Year will have worked out. Longer term I’m wondering how long they can expect a 25% growth rate. I’m sure VF management wonders the same.

There seems to be only good news from Vans. “Vans® brand global revenues increased 12% and 15% in the three and nine months ended December 2019, respectively, compared to the 2018 periods…The increase in both periods was due to strong operational growth across all channels and regions, including strong wholesale performance and direct-to-consumer growth driven by an expanding e-commerce business, comparable store growth and new store openings.”

I’m sure we all miss the good old days of 25% quarterly growth for Vans. But neither you, me, or VF management expected that to continue and they told us so. So far, they seem to be managing the inevitable decline of the growth rate really well, if you want to somehow call a gain of 15% for the year a decline. What a remarkable brand and management job.

Dickies had a quarter over quarter increase of 13%. “Growth was strong across all key strategic growth drivers, highlighted by 68% growth in China and 16% growth in digital with category momentum across icons and new seasonal product. After a flat first half, we had high expectations for the Dickies brand heading into the back half of this fiscal year and the global teams delivered.”

In the same vein that I mentioned Van’s China growth, I wonder about Dickies. I assume it’s from a small base.

The North Face was up 8%. “…led by our international business. Growth was balanced across both our D2C and wholesale channels globally and we saw solid performance in our urban exploration and mountain lifestyle product territories as the brand continues to attract new consumers and capitalize on growth opportunities beyond the core mountain sports.”

Now we come to Timberland. VF bought it in 2011 and has been trying to get it to perform up to their standards since then. “Global revenues for the Timberland® brand (excluding Timberland PRO®) decreased 6% and 4% in the three and nine months ended December 2019, respectively, compared to the 2018 periods. The decrease in the three months ended December 2019 reflects overall declines in the wholesale and direct-to-consumer channels and an overall 1% unfavorable impact from foreign currency, which were partially offset by e-commerce growth and increases in China. The decrease in the nine months ended December 2019 was primarily due to an overall decline in the wholesale channel and an overall 2% unfavorable impact from foreign currency, which were partially offset by e-commerce growth and increases in China.”

Again, we see some amount of reliance on China.

In 2020, VF expects Timberland revenue to fall by between 1% and 2%. Previous guidance had been for 1% to 2% growth.

Some of their frustration with the brand comes out in the conference call. CEO Rendle, talking about Timberland, says, “…it absolutely aligns with the consumer, the position in the marketplace, and the ability to connect with consumers. My earlier points that we’re disappointed in our ability to execute and our conviction around the strategy that we have been working on, really, over the last 18 to 24 months that Martino articulated in Beaver Creek, we don’t have endless patience. We certainly have a very focused approach and clear sets of KPIs that we will look for our brand teams – all brand teams to deliver on a year-over-year basis. But I really want you all to leave this call knowing that we are still deeply committed to the Timberland brand. “

So deeply committed, but without endless patience. So, not too deeply, I guess?

Nobody challenges VF’s ability to manage brands. What’s going on here? Is there some fundamental problem with the brand as it relates to the market that VF’s tactics can’t fix? We’ll all keep watching.

VF has chosen to put itself through a lot of change. Not that it’s bad change, but it’s disruptive and costs a few bucks. The most important thing they can do is get Timberland functioning as well as their other big brands, but after eight plus years of ownership, they aren’t there.

Meanwhile, unless frustration with Timberland goes through the roof, I expect the work businesses will be the last divestiture by VF for a while. They are always on the prowl for acquisitions that fit their criteria and they think they can bring value to. But I won’t be surprised, given current economic conditions and prices, if they don’t keep their powder dry until conditions become more favorable for buyers.

VF can improve it’s bottom line without significant acquisitions right now, but with fewer brands in its portfolio the performance of each becomes more important.