“When nations can trade directly via blockchain platforms, settle in their own currency, and store value in physically-backed gold contracts, the dollar becomes increasingly optional.”

Tariffs and the uncertainty of an irrational trade war, the weaponization of the U. S. Dollar, seizure of Russia’s dollar reserves, the impact of debt, the general historical cycle of world currencies, and an attractive and competitive alternative are all causing the dollar’s role to evolve. Let’s see how this is all coming together.

I was going to start with an articulate and insightful discussion of why tariffs are bad. Then Ronald Reagan ruined it for me. In this five minute speech from 1987 he explained why tariffs suck. This speech is the source of the Canadian ad run during the World Series. Here’s the link to that speech. Go watch it please. I couldn’t have done any better. I need more speech writers.

President Trump and his acolytes are claiming it’s a fake, taken out of context, blah, blah, blah. It’s not. Tariffs are paid by the importer, cause inflation, may limit your choices and generally make the world poorer. I have a very hard time understanding how President Trump can believe differently. If he does, we have an even bigger problem.

The world watched his April 2 tariff announcement with tariff rates calculated in a meaningless and inaccurate way (Go ask AI to explain that to you). We have seen the numbers and the deals change capriciously without any reasonable explanation. From what I have read, the fastest trade treaty we’ve ever negotiated took a year. That was with Singapore, a country without farmers or other constituencies with special considerations that have to be accounted for. How do you watch this happen and not be worried about the dollar?

Meanwhile, the world has watched our debt increase over the years, with presidents and congresses of both parties doing nothing about it. Hardly a surprise. Elected representatives who admit we have a problem unsolvable without pain aren’t likely to be reelected. How have governments going back at least 2,000 years handled this kind of debt crisis? Through inflation which reduces the value of the debt. I don’t know of an exception. No doubt this time will be different (note extreme sarcasm). If our inflation continues to run at its current 3% annually for a decade, the value of the dollar will decline by 74% Now that’s inflation. Your elected representatives are hoping you won’t notice.

The rest of the world has noticed. Foreign ownership of our national debt along with the percentage of foreign reserves held in dollars has been declining since 2014. Encouraging that has been our tendency to apply sanctions on countries whose behavior we want to change. The number of sanctioned countries is around 25, depending on what you mean by sanctions. Ridiculously, I have to include Canada in the group of sanctioned countries now since Trump raised their tariff rate 10% after that ad ran. More generally, sanctions often mean reducing or eliminating a country’s ability to use the SWIFT payment network in transactions. What percentage of payments go through SWIFT? There are various estimates. It’s north of 50% and below 100%. And I suspect it’s dropping.

The proverbial straw that broke the camel’s back was our seizing Russia’s dollar reserves following the invasion of Ukraine. When that happened, every country in the world had to ask themselves, “What if the U.S. doesn’t like something we do?” Notice even that hasn’t changed Russia’s behavior. It is not clear that sanctions work. Yes, they make things uncomfortable for a country. They change how it’s economy functions. But change long term behavior? How are we doing with North Korea or Iran?

Even if you don’t expect your reserves to be seized, you are watching them become able to buy less as the dollar gets devalued. The U.S. dollar hasn’t been just the world’s reserve currency. It’s been the overwhelming choice for all kinds of financial transactions, keeping it strong because as the world economy grew, it was always in demand. Increase in the world’s money supply wasn’t a problem as long as countries (especially China) took our dollars, sold us goods, and stashed their horde of dollars in U.S. Treasury securities. That funded our debt and kept those dollars out of circulation, controlling inflation. That appears to be over.

The U. S. dollar is not suddenly going to stop being important to the international financial system. But if it’s going to keep devaluing due to budget deficits and inflation (my baseline case) and if you are worried about your reserves being seized and your purchasing power decline, you might want to hedge your bets. How would you do that? You could put some of your reserves into Japanese Yen and Euros. Maybe hold some Chinese Renminbi (RMB). To some extent, this is happening. But there are no national currencies that can replace the Dollar right now. If you think China is a candidate remember that being the world’s currency requires open capital markets where money comes and goes and is freely exchanged for other currencies. China is not going to let that happen.

I know! Let’s go back on the gold standard. I heard you chuckling and we are not going to go back on the gold standard like it was in the good old days. But an alternative involving gold is starting to emerge. Actually it has emerged.

The Shanghai Gold Exchange (SGE) was founded in 2002 by The People’s Bank of China. It makes markets in gold, silver and platinum and emphasizes physical delivery. Prices are in RMB. It has a number of depositories in China and is developing a small but growing network around the world. If you are aren’t quite sure you trust the dollar, and no other national currency is a substitute for it, what do you do?

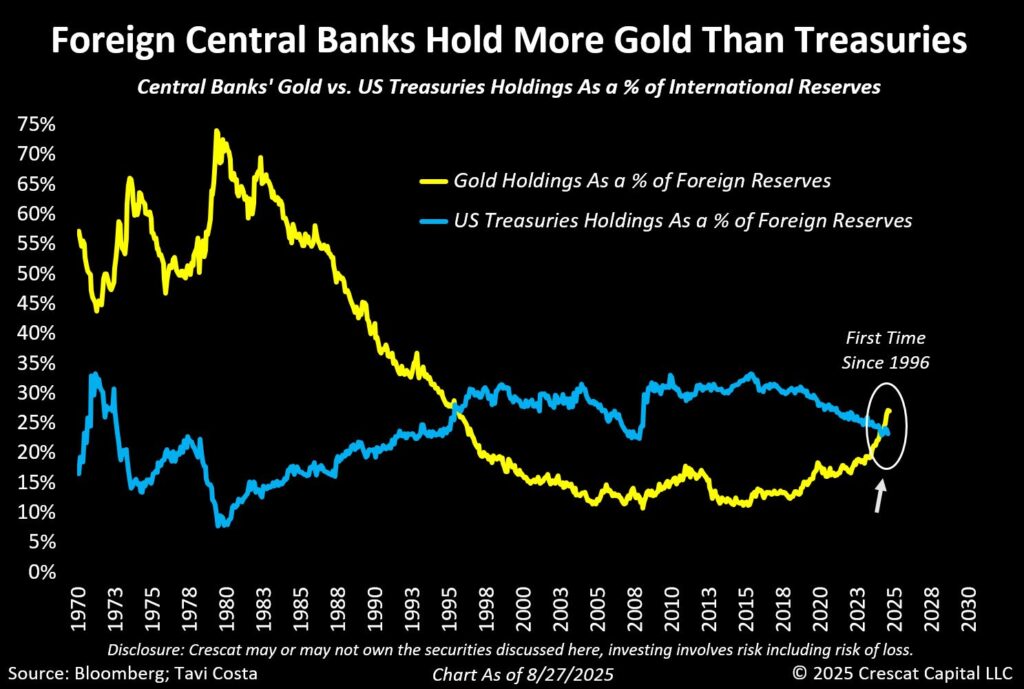

You don’t just go back to the venerable gold standard where country’s currencies were priced in gold. For one thing, there’s not enough gold. However, you may have noticed the price of an ounce of gold recently peaked around $4,300. It’s corrected to around $4,000 as I write this, but expect it to resume it’s climb. The chart below shows one reason why.

After a long decline, Central Bank holdings of gold are climbing. In the first page of my first economics book in my first economics course they told me that when demand goes up and supply can’t meet it, prices rise. A higher price makes it easier to use gold in trade. Calculate how many barrels of oil you can get for a ounce of gold now compared to when gold was $2,000 an ounce.

China is offering swap lines to its trading partners. Swap lines are agreements between two country’s central banks to exchange currencies temporarily. Let’s say Russia wants to buy parts for drones from China but, due to sanctions, can’t do it in U.S. dollars. Russia exchanges its Rubles for Chinese RMB and uses them to pay China. Now, China has some Russian Rubles. Maybe they want to use them to buy, oh, let’s say oil, from Russia. Obviously, I’m just making this up.

This goes on for a while with various trade transactions among various countries, some transactions larger, some smaller. Sometimes one country has enough of the other country’s currency that they don’t have to use the swap line. Sometimes not. Maybe Russia or China have swap lines with other countries. Maybe that country could use some RMB or Rubles and they take or pay those to Russia or China for some deal. Currencies are fungible and move around in all sorts of ways. Swap lines aren’t an innovation. Lots of countries have swap lines with other countries. Let’s imagine that after a period of time- who knows how long- after a whole bunch of transaction one country owes another country some amount of money- the net of all the transactions. To clean up that balance they pay off the balance in gold, using the exchange rate between their currency and gold’s price at the time of the final settlement. Maybe gold actually gets flown from one country to another. Or perhaps, as the Chinese build out their depositories the net settlement amount in gold just moves from one country’s vault in a depository to the other.

Notice that no U.S. Dollars needed to be involved, the SWIFT system was not necessarily used, and each separate transaction did not have to be settled in gold, which is a fundamental limitation of the traditional gold system. Now let’s make it really interesting. What if this all runs on the blockchain, is instantaneous, almost cost free, doesn’t require a trusted party like a bank, and can include data and required documents?

This is happening right now. Here’s the link to “The Dragon’s New Ledger” on Substack that describes it . Recommend signing up for this guy. It’s free at the moment.

Putting aside any competition with China, why wouldn’t you want to be part of this system? Maybe because you’re Jamie Diamond running J. P. Morgan and see a big chunk of your business being disintermediated. I used to be an international banker (no- really) and I know what the fees earned by banks facilitating trade transactions were like. AI working within the block chain? I wonder what that could be like.

Maybe it’s time for some companies to buy some gold and some bitcoin; especially if financial repression in the United States is going to drive interest rates towards zero again, causing inflation to rise. Even companies like to preserve their purchasing power. The system I’m describing- that’s better described in the article above- doesn’t care how big or small your transaction is. It’s still fast, safe and more or less free.

History tells us that world reserve currencies tend to last about 100 years, then no longer serve the interest of the currency issuer. The United States may be about there. But it will happen- is happening I think- with a whimper not a bang. I refer you back to the quote at the start of the article.

I am wondering if the Supreme Court strikes down the Tariffs and rules that they have to be repaid, would this create the trigger that spikes the debt, weakens the dollar and creates the necessary ‘event’ that knocks the dollar off its long-held pedestal?

Hi Mark,

I remind you that nobody alive has ever lived through anything like this and my crystal ball is hazy. The amount of tariffs being collected slow the rates of increase of the debt, but that’s all. Tariffs were never the solution. I’d also point out that tariffs either reduce corporate profitability or increase costs to customers or some of both. That reduces tax payments, increasing the debt. I guess they can strike down the tariffs but not require repayment. No idea how they might decide or what happens after that. What would it do to the dollar? I could make arguments that it would strengthen or weaken the dollar. But whatever happens in the short term, I’m pretty sure we’re going to get a weaker dollar over time for the reasons I outlined in the article. But maybe not next week or next year. Bluntly, to rebuild manufacturing we kind of need it. As I said in the article, I don’t think there will be a single “event” that clobbers the dollar. That’s not to say there won’t be a strong market reaction one way or the other on the announcement, but when we’re talking about this kind of change, it happens over at least years.

Thanks for the good questions.

J.

It’s like whittling with 1,000 grit sandpaper.

If it should change for any reason to a 100 grit, we’ll know.

J.