A&F (owner of the Hollister brand) had a pretty good quarter. I’m thrilled that their sales fell a bit and want to start by reminding you why I’d think like that (though they tell us it was mostly caused by exchange rates).

Here we sit over retailed as an industry and a country with a cautious consumer, a lack of product differentiation and a still weak economy. Here’s how A&E describes what they are doing to improve their business in their 10Q for the quarter ended October 31.

“Our ongoing efforts to improve our business are focused on:

- Putting the customer at the center of everything we do.

- Delivering a compelling and differentiated assortment.

- Optimizing our brand reach domestically and internationally and optimizing our performance in each channel.

- Defining a clear positioning for our brands.

- Continuing to improve efficiency and reduce expense.

- Ensuring we are organized to succeed.”

All good things. They’ve always been good things regardless of economic conditions. But regular readers will know we’ve seen similar to almost identical lists from other brands and retailers I’ve written about. Some of this stuff is expensive to do. Unless you believe that the management team at A&F is better than the team at other companies, there’s no reason they can be a better competitor doing the same stuff as everybody else.

Well, maybe one reason. They’ve got a pretty strong balance sheet. That means that A&F (or any other company so blessed) can afford to take some of these costly actions, can wait for some other competitors to blow up (which they are and will), and can be discriminating in how and where they try to grow revenue. Operating activities generated $66.5 million in cash so far this year compared to $29.5 million last year.

As your competitors have problems, they make the market messy, spreading discounted closeout product all over the place. Your best response to that is building your brand and managing your distribution. It sounds like A&F is focusing on building brand strength and thinking about distribution as they both open and close stores.

“In addition to the 23 new stores opened year-to-date, we expect to open seven new stores in the fourth quarter, including five international stores and two North American stores. Also, in addition to the 19 stores closed year-to-date, we anticipate closing approximately 40 stores in the U.S. in the fourth quarter through natural lease expirations.”

They expect to continue closing stores. COO Jonathan Ramsden said, “We have indicated 60 closures across brands this year or something in that order of magnitude and likely continuing at that pace for the next couple of years…” They ended the quarter with 965 stores; 570 Hollister and 395 Abercrombie.

Not to sound like a corrupted file (best replacement for “broken record” I could come up with), but this brand building, distribution management approach is harder to do as a public company where your audience expects revenue growth.

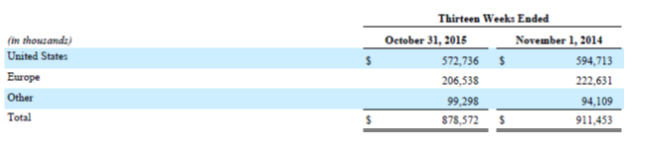

Anyway A&F’s revenue fell 3.6% from $911.5 to $878.6 million. The decline was almost all in Abercrombie, where revenues fell 6.5% from $440 to $411 million. Hollister was down only from $468.1 to $467.3 million. Below is the revenue by geographic area.

The U.S. was down by 3.7%, Europe by 7.2%, and other up 5.5%.

Abercrombie store comparable store sales fell 5% compared to last year’s quarter. In last year’s quarter they were down 7% compared to the year before. The numbers for Hollister were positive 3% and negative 12%. One caveat- those numbers are in constant currency.

You know, everybody is making pro forma adjustments to account for the impact of exchange rates that are hurting their results. Drives me crazy. I can guarantee that when the dollar weakens, someday, nobody will adjust their results down because a weak dollar helped them too much.

A&F increased their gross margin to 63.7% from 62.2% in last year’s quarter. “The increase was primarily due to a decrease in average unit cost coupled with an increase in average unit retail, as lower promotional activity more than offset the adverse effect from changes in foreign currency exchange rates.” That’s good news for all the right reasons.

They cut store and distribution expense by 5.1%, saving $20.6 million. “The decrease was primarily due to expense reduction efforts, partially offset by higher direct-to-consumer expense and the deleveraging effect from negative comparable sales.”

Marketing, general and administrative expense rose $12.7 million. Even with the revenue decline they increased operating profit to $41 million from $33.4 million in last year’s quarter.

Net income rose from $18.2 to $42.3 million, but that includes a positive $15.4 swing in income tax expense.

A&F brand president Christos Angelides talked a bit in the conference call about how they are providing managers with more ability to make decisions and change things in the stores. This isn’t the first time they’ve talked about it and it sounds like a good idea. There were also a couple of comments about traffic being “challenging” but conversion, once you got them into the stores, improving.

We’ve also noted that average unit retail was up and they tell us that product cost has been reduced. We see that in the higher gross margin. I can’t help but believe there’s a relationship between motivating your store associates by making them responsible and letting them make changes and selling more people who come into the store higher priced product.

A&F seems to be doing a lot of good things that are brand building and bottom line positive even if revenue growth, as for other retailers, is challenging. There’s a limit to what you can do when you do the same things everybody else is trying to do, but at least they have the balance sheet to try.