You haven’t heard from me much. Spent the last few months trying to figure out just how I could be useful to the industry. I decided it wasn’t by analyzing publicly traded company filings. Truth be told, that wasn’t fun for me anymore. I also think covid/masks/lockdowns/caution changed my behavior. Permanently? Don’t know. How about yours?

This is my first attempt to help you think about some things that maybe you don’t often think about. They are all relevant to running your business, though not just if you’re in active outdoor.

Anyway, it’s been an interesting two years. Not just economically and financially, but socially. Especially socially. I read a short book called The Psychology of Pandemics, published in 2019 before our very own pandemic. It’s a short, academic book that you want to get out of the library, because it’s really expensive.

The takeaway is that pandemics cause disruptions in society (duh) and that human behavior just doesn’t change. You’ll relate to how people reacted to the Spanish Flu in 1918 (actually, 1917 to 1920 I’ve read). More troubling is that you’ll relate to how they reacted to the Black Death in the 14th century. I was chagrined to learn how little we’ve evolved. To top it off, his description of how he expected people to react to the next pandemic (written, remember, before covid) is spot on.

The common knowledge is that covid has accelerated trends already in motion. We mostly agree with that. Our trend lists are probably not that different. What I spend more time worrying about are the unknown unknowns. By definition nobody has a list of those and also by definition, you can’t plan for them.

But you can try to be open minded and stay flexible. Allow yourself to be surprised. Here are a handful of vignettes that you should be thinking about. Maybe they will lead us to an unknown unknown.

Back in December, SIA published one of its Consumer Insight pieces. It included a poll in which nearly 50% of respondents bought used hard goods. You can download it here. Happily, I guess, the numbers are much lower for apparel.

Is this trend going to last or is it covid inspired? Or sustainability or economically inspired? If it’s the later two, it might have legs. I think it will. What’s the life of used equipment? What’s the long term impact on production, distribution and store layouts? Fifty percent is a substantial number. Is it a problem or an opportunity? Both, I imagine.

Supply channel disruption is going to be with us at least through this year with gradual improvement. Definitely both a problem and opportunity. A problem because of the uncertainty around inventory management, rising costs, and difficulty keeping customers happy. An opportunity because people seem accepting of price rises and, as I’ve written for twenty plus years, scarcity can be an opportunity for brand building, higher gross margins and lower expenses (though not in shipping).

I’ve also written over the years that there are costs in supply/logistic systems that get too dispersed and complicated and that those costs don’t always show up on the income statement. They are showing up now.

Meanwhile, Diane and I can’t find the cat food our little four legged darling like. Last time at the store the poor things were down to like only seven choices. Maybe they’ll lose some weight. And I have no idea what I’ll do if I can only choose from fifteen single malt scotches. Now that’s a crisis.

It is a crisis if it involves medicines, protective equipment during a pandemic, or a bunch of other things and when it drives prices through the roof (cars, energy?). Make up your own list. On the other hand, the common knowledge we’ve been sold that we have a right/need for undifferentiated product brands that serve the same purpose (or no purpose) is troubling, if only partly because of the related sustainability issues.

I’d love to be challenged on this. It would make for a great conversation. I’m wondering if the social evolution we’re experiencing doesn’t have the potential to change the way we react to and interact with brands. There’s an unknown unknown for you. And an opportunity for somebody, perhaps selling “products you buy for life.”

I’ve harped on the importance of information systems not just as an accounting tool but for inventory and customer management for years. Supply chain screwed upness (if that’s a word) makes them even more important and simply necessary if you are going to not just manage your supply chains as best you can, but even try to take advantage of the disruptions. I watched an SIA sponsored online seminar this morning called “The Omni-Channel Imperative: Selling Across Channels” presented by Sharon Gee, GM of Omnichannel at Big Commerce. You can see that presentation and others at this link.

I asked how omnichannel tech connected to more traditional accounting and financial managements systems. She said there had to be a “harmonized data warehouse.” Great phrase. Sounds simple and obvious but is complex. And an existential issue.

Disruptions are an opportunity to build stronger relationships with your customers. How they shop continues to evolve, as does where they live and work. You’ve all read about people feeling angry, isolated, worried, anxious, lonely, and uncertain. You can’t necessarily get your customer the item they want when they want it right now (and certainly not at the price they’d like). But you can be a trusted, credible, reliable island of calm among all the uncertainty.

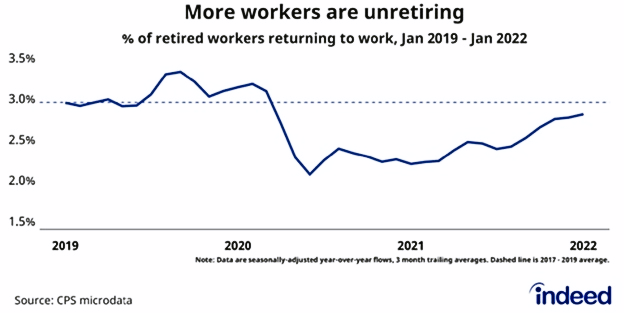

Let’s talk demographics. The birth rate in this country is flat and the population is aging. We desperately need a workable immigration system. Baby boomers retired in droves during the pandemic and don’t seem anxious to come back to work. I can imagine that changing as stimulus payments dry up, investment values decline and, someday, housing prices correct.

And in fact, it might be changing. Look what I found this morning.

And here’s one you may not have considered the ramifications of. There are million, and maybe tens of million, long covid patients in the U.S.- people who are having symptoms ranging from mild to debilitating for periods of from months to the rest of their lives. The likelihood and timing of their coming back to work is unknown. Take a look at the articles and slides on this page.

Not that you haven’t been thinking about this but where are employees going to come from? Part of the solution will revolve around 3D printing, vending machines, stores (like Amazon is opening) where you can just walk in and walk out, apps that let you see yourself in apparel? As has always been the case, the increasing cost of getting and keeping employees will encourage various forms of automation and I suspect that your customers are increasingly open to it.

As I reread this before sending it out into the ether, I’m guessing more than usual. Analyzing financial statements didn’t present that problem. That’s why flexibility and keeping an open mind are the best ideas I’ve got. You need to be able to learn from new experiences.

Next time, I’ll write about the Federal Reserve and debt. Why should you care? Because, as somebody who unfortunately wasn’t me said, “The Fed is trying to ride two horses with one ass.” Surely you want to know what that means. It’s not a good thing.

Hi Jeff, all rational and relevant questions. This is a complex paradigm shift at least for the near future. My personal belief is that as the pandemic is more and more in our rear view mirror people and work will get back to the way it was before. Me personally, I never slowed down. Never hunkered down. Just got vaccinated and moved forward. Even after getting Covid (non event). Ecomm for sure is now a retail foundation both direct and 3ed, party. I agree that immigration has to be dealt with, but allowing hundreds of thousands of uneducated people flood across the boarder with no technical skills is not the way we will continue to grow the Nations GDP or technological strength. I’m guessing the largest number of people retiring are Boomers like me. In this case, I think the stimulus gave many a false sense of security to pull the trigger, in others it was just a matter of timing. You and I spoke many timers years ago about about the need to not over produce as a way to better profitability. The “supply chain” situation has simply had the beneficial effect of forcing that on brands in spite of themselves. The results are clearly seen in the P&L’s of most larger companies. So hopefully (not holding my breath) people will have learned that over production only brings discounting/lower margins and slower growth. But I’m starting to ramble……Hope all is well Jeff. .

John,

Wow, that was quick. To be clear, there has to be some room for compassion in a new immigration system, but I am not an open boarders supporter. I also think a “fair” system has to be efficient which the current one is certainly not. With regards to covid, we kind of hunkered down at first, but once vaccinated, tended to go back more or less than normal. Haven’t done much traveling, but that’s been more because covid made it either impossible or inconvenient- not because of fear of illness. You can’t avoid all risks.

Our industry has shown no tendency over decades to avoid over production. Like you, I’m not hopeful. I am concerned about our tendency towards monopolies, or at least oligopolies in the overall economy. They keep capitalism from working the way it’s supposed to. Zero interest rates, (the price of money being the most important price in the world) and keeping keeping rates from finding a market level continues to be a disaster. It’s encouraged those monopolies and misallocated capital in horrible ways.

Been following some of your facebook posts. Seems like it’s a lot harder to get from Mexico from the East coast. Love to hear the story some time.

Best,

J.

Great article Jeff, I like this direction. Articles that stick with you for a few days making you think, investigate and explore. Much more interesting.

Looking forward to the one on the fed and debt.

Hi Jeff. I like your new direction of reduced focus on public behemoths and more on analysis of trends, observations and insights influencing specialty retailing and specialty brands. The pandemic disruptions enabled the big to get bigger in business and government and some small guys found success in new, creative channels. It’s the middle that either successfully charged through or got annihilated. Those are the stories I know I find of interest and suspect many others in order to better strive toward being the change in the world we want to see. Tkx. JP

Hi JP,

Glad you liked it. Much more fun to write, if a bit more challenging. I would say that the big were already getting bigger and being in the middle has never been a quality long term competitive position. Those were trends the pandemic just accelerated. I don’t like too much bigness. It reduces of destroys competition that is to the benefit of consumers.

Thanks,

J.