I was seriously stunned a month ago when The Robin Report told us that “Gen Z is a huge BNPL fan, with 72 percent using it.” The article goes on to say, “And more than 76 percent of Americans use BNPL with 49 percent having missed a payment. I can see retailers liking BNPL because they don’t take credit risk, increase the chance of closing the sale, and maybe get customers to add items to their basket. The retailer pays a bit higher credit card fee.

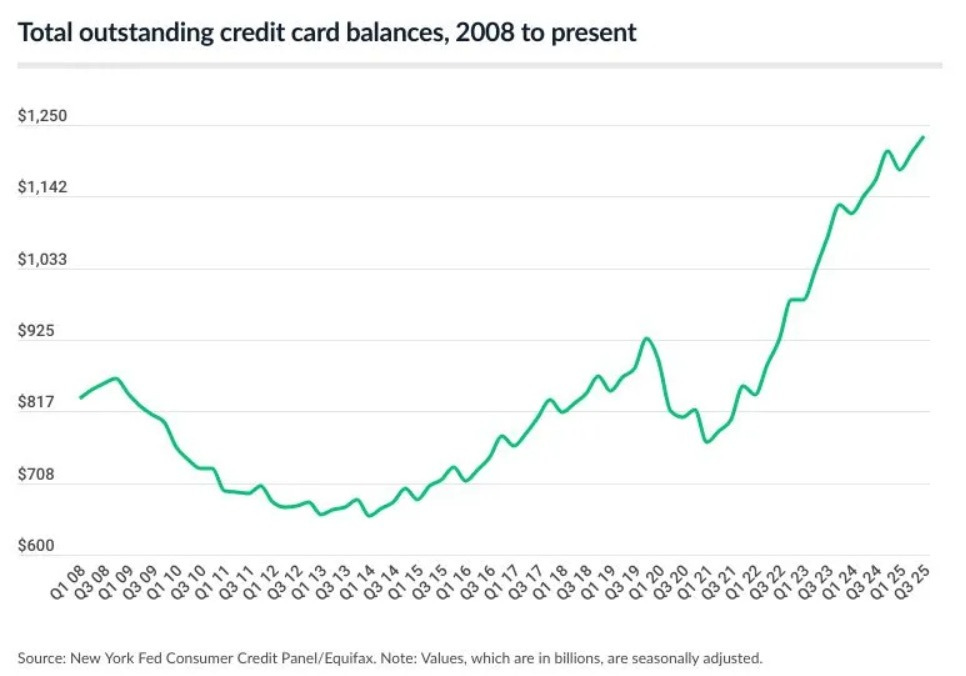

Then I saw this chart that Dave Hay in a newsletter I get. It doesn’t look too good economy wise either.

Before we go further let’s acknowledge the “K” shaped economy we live in. The up-sloping line on the K is the 50% of the population that own assets. The down sloping line is the 50% that doesn’t. That’s a gross generalization providing a useful way to think about our economy- half doing well, half struggling. If you’re a consumer facing business you can tell who’s in which 50% based on the use of BNPL.

With that as background, allow me to state my premise. The use of BNPL to buy food or a pair of jeans on the installment plan and the associated act with not paying off your credit card in full at the end of each monthly cycle (absent the kind of emergencies we all run into) is indicative of a level of need this country hasn’t seen in a long time. It also shows an appalling lack of financial literacy due partly to lousy education in basic math. But we also have to blame a consumer culture where buying things you don’t really need (and may not really want), motivated by advertising and branding that creates what is often only an appearance of value, has become a substitute source of self worth and status.

Why is that so bad? Because the cycle can only continue as long as debt can grow. We’re close to the point at which it can’t. Let me do a macroeconomic thing before getting back to BNPL.

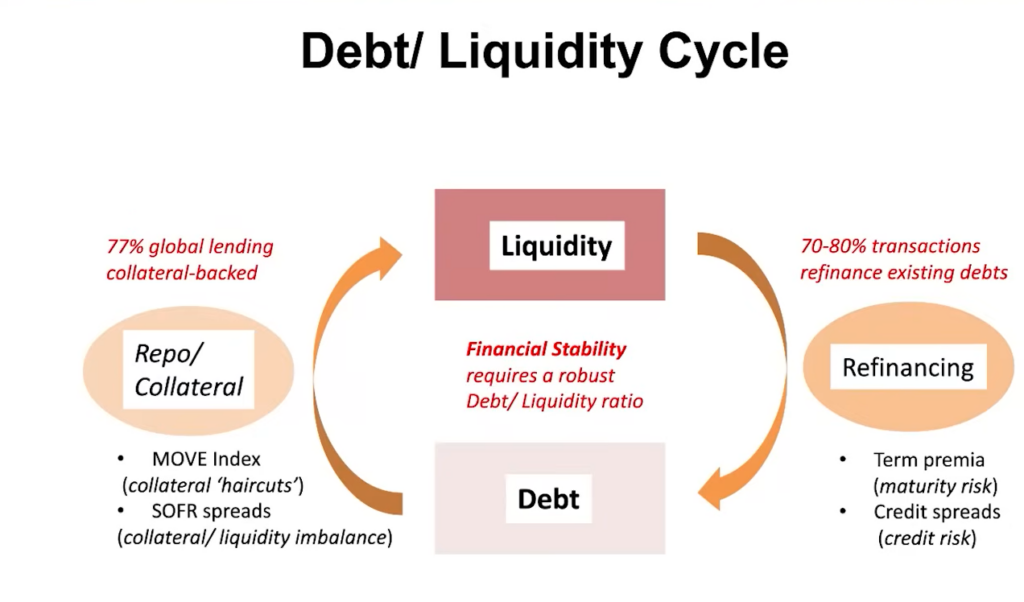

David Kotok, who’s free weekly report is available through the Links page on my website, posted this YouTube link to a discussion on liquidity and the credit cycle. The chart below is from it. David thinks, and I agree, that it’s the best way he’s seen to explain what’s going on. I urgently recommend you listen to the whole podcast, but here’s my summary explanation.

MIke Howell starts by telling us there’s $350 trillion of debt worldwide. He says that financial markets are no longer about raising money for productive purposes. They are about rolling over existing debt. He notes on the chart below that 77% of global lending is backed by some form of collateral and that 70 to 80% of transactions are refinancing existing debt. Long term interest rates are going up. Central banks can control short term, but not long term rates. Between refinancing existing debt and paying interest on increasing government debt that doesn’t leave much capacity for things like building out our electric grid or other worthy projects that might create some jobs.

Liquidity is balance sheet capacity, Mike says. That is, if you want to borrow money, somebody has to have a balance sheet they are willing to carry that debt on. They have to be satisfied the collateral you offer protects them. If/as interest rates go up carrying the debt becomes riskier because the debtor needs higher cash flow to repay it. Look at the chart below again and consider the numbers. We’re running out of balance sheet carrying capacity which is the same as running out of liquidity.

Debt is fungible, the pod cast reminds us, except in a crisis. As debt grows when will it be too much (or balance sheet capacity too little)? When won’t there be enough collateral to support the debt? Another subprime crisis like in 2009? A failed U.S. Treasury auction? The private equity market becoming paralyzed? Japan increasing interest rates, sucking capital out of U.S. markets? AI financing collapsing and the magnificent 7 dropping 35%? I have no idea. There are many other ways it could happen I haven’t even conceived of.

It is, I think, common knowledge how tightly connected the pieces of our financial system are. That exacerbates the impact of any single financial “accident.” In 2023 a couple of banks failed. It wasn’t that big a deal, but the Federal Reserve felt it had to guarantee all deposits in all the banks to keep it from spreading. There was a time when such a guarantee would not have been necessary.

The Fed also allowed banks to report the value of their Federal debt securities at face value, rather than at market value to preserve the appearance of the banks’ balance sheets and capital ratios. The Fed was just doing what it thought it had to do to stabilize the system. It, and the rest of central banks around the world, will do the same thing until they can’t. Think of it this way; The value of gold isn’t going up- the value of paper currencies is declining. Gold is the same it’s always been.

Now back to BNPL and a way maybe you could help your business and your customers improve their financial acumen.

My kids are millennials. They are distrustful of all traditional forms of marketing. Gen Z, from what I can tell, is the same only more so. They may have- maybe want to have- a relationship with your store/brand, but it will not be mediated by anybody but their own tribe. They want from you value (some combination of price and quality) and integrity. From what I can tell, they expect painful honesty.

Why don’t you make yourself part of improving their financial acumen? Put a link on your web site that discusses BNPL, credit cards, and the cumulative impact of 21% interest rates. “We really, really want you as a customer, but can you really afford to buy this if you have to do it this way?” A sign in the store that says “We are happy to have you use BNPL, but are you sure you want to buy it this way?” If they change their mind, give them some credit on their frequent shopper account. Put up a QR code for some financial education web site.

Being neither a Millennial or a Gen Z person, I have no idea what the right approach is. But I know that some to many of your customers are struggling economically and don’t know how to manage it.

Maybe sit down with some of your customer service people (likely to be from the younger generations) and ask them if there might be some value here and how to approach it. I’d love to be in the room when you do it. No charge.