The headline is that given the pandemic, Globe had a reasonable result for the year ended June 30, 2020 and ended with a strong balance. In the press release, they say their performance held up “adequately.” That’s a fine word to describe it.

Australian accounting rules only require six months statements, rather than the quarterly ones we see from U.S. companies. When they come out with the year end statement, there’s no requirement that they include the second half of the year separately, and they don’t.

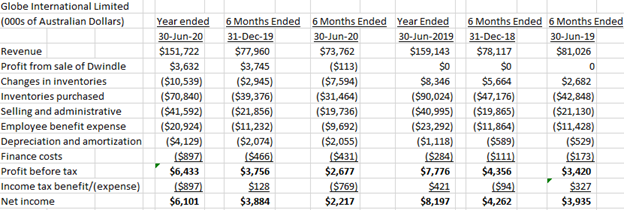

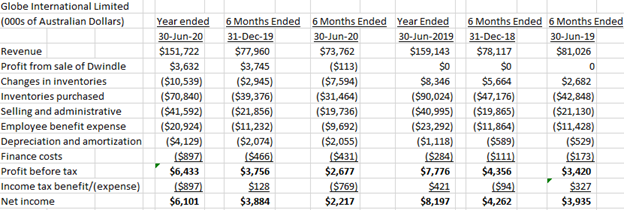

Unfortunately, that leaves me having to find those numbers the hard way, which I’ve done. They are in the chart below.

Pretax income for the year ended June 30, 2020 fell 17.3% compared to the prior fiscal year from $7.776 to $6.433 million. However, the 2020 result included a profit of $3.632 million from the sale of the Dwindle brand trademarks. Interestingly, the transactions costs associated with doing the deal were $1.631 million.

Globe also received some money from Australian government stimulus programs including one called JobKeeper. They don’t tell us the amount. I think we can assume it was received in the second half of the year. The program has been extended to March 28, 2021 so more payments may be received.

If we remove the one-time profit from the Dwindle sale, pretax profit was $2.801 million, a 64.0% decline from the previous year. If we knew what payments they received from the government, we’d have a better idea of operating results.

Despite the decline in income, revenue for the year fell only 5%, as you can see in the chart above- largely the result of the sale of the Dwindle brands. Globe sold Dwindle- a decision I’ve always thought a good one-to focus on what it calls its strategic growth brands. These brands- “…FXD, Impala, Salty Crew and Globe Skateboards all recorded sales growth compared to the prior comparative period.”

Gross margin fell by just 0.3% helped, I imagine, by the sale of Dwindle.

Globe suffered from, and reacted to, the pandemic much like other industry companies. In the six-month ended June 30, Globe had a pretax profit of $2.677 million, down 21.7% from the prior year’s six month. Revenue fell 9%. You can see they reduced expenses and purchased less inventory. Here’s what they tell us about how they managed when the virus hit during the second half of the year.

“There were a number of negative impacts on the business as a result of lockdowns which resulted in restrictions on the supply chain, operations, wholesale customers and end consumers. However, partially offsetting these negative impacts, there were also a number of positive factors that affected profitability. This included savings from short-term salary reductions, including at the executive level; discretionary and renegotiated cost savings; government stimulus received (including JobKeeper in Australia); rent relief from landlords; and sales growth in certain categories that continued to sell well online throughout Q4.”

For the year, Australasia revenues fell from $81.977 to $79.333 million, or by 3.23%. EBIT was down 15.5% declining from $13.176 to $$11.134 million. “The decline in Australian revenues was driven by its licensed Streetwear division, which was the Australian business unit that was hardest-hit by COVID-19.”

The North American segment reported a year over year revenue decline of 12.6% from $53.479 to $46.768 million. EBIT improved, rising from a loss of $144,000 to a profit of $2.656 million. This reflects the positive impact of the Dwindle sale.

In Europe, revenue rose from $23.656 to $25.598 million- 8.2%. But EBIT fell 80.8% from $1.094 million to $210,000. “…the earnings were lower as a result of extra costs to grow these brands in their earlier stages of development and a decline in gross profit margins, mainly due to the stronger USD.”

I’ve already noted that the balance sheet remains strong. They ended the year with cash of $26 million, up from $9.5 million at the end of the previous year. Even as I’ve grumbled about the paucity of information in their reports, I’ve always recognized that Globe was pretty damned good at recognizing inflection points and making required changes. Doesn’t look like this year, and half year, was any different.