It seems a hard time to be retailer in our space- at least that’s my general perception as I pour through conference calls and SEC filings. It’s not that Zumiez had a bad quarter. Both sales and earnings rose. But it wasn’t up to their standards or what they expect, as they make clear.

I’ll get to the numbers, but first I’d like to mention a few things they discuss in the 10-Q and conference call that highlight the issues all retailers are dealing with these days.

Zumiez ended the quarter with 616 stores; 557 in the U.S., 37 in Canada and 22 in Europe (under the Blue Tomato name). They are planning to open 57 more in fiscal 2015. There will also be some remodels and relocations of existing stores. 51 of the new stores will be in the U.S., six in Europe and I guess that means ten in Canada. I think they will end the year with something like 608 stores in the U.S.

They think they have lots of room to expand in Europe. Shall we think of Canada, as the conventional wisdom usually does, as 10% of the U.S. market, suggesting they might grow to perhaps 60 or a few more there?

In the past, they’ve talked about their limit for U.S. stores being around 700 as I recall. Might have been lower. They are starting to approach that. What happens then? Is that still a valid number?

Let me start by quoting CEO Rick Brooks from the conference call.

“We continue to see untapped potential in our North American markets and our goal is to maximize the long-term productivity of the entire portfolio by optimizing our physical store presence in each market as part of our omni-channel platform.”

“Our omni-channel strategy continues to drive expansion and enhancement of our digital infrastructure and shopping experience. With these investments, we’re able to better offer customers a consistent and genuine interaction with our brand regardless of the channel by which they’re engaging with us. We believe expansion in e-commerce works in tandem with expansion of our brick and mortar stores both domestically and aboard.”

And here’s what he says when talking about Europe. “We believe that our omni-channel strategy is going to win. Gerfried [Blue Tomato CEO and founder Gerfried Schuler] has been a big adopter of our omni-channel strategy. They are product lagging us in terms of some of our omni-channel efforts, just because of scale you have to have the physical scale to really rollout omni-channel initiatives. So Gerfried is as appropriate as rolling out the initiatives as they’re building marketplaces on that front.”

There are two things you should notice. The first is the unresolved issue of how many stores of what type you need where in the age of the omnichannel. Can Zumiez still utilize 700 U.S. stores in the day of electronic commerce? Maybe they need more smaller ones? Or fewer but larger ones? That’s a question for every retailer. The question for Zumiez is what happens to store openings as they approach a possible limit in the U.S. Does the omnichannel let them continue to grow even with limited store openings? Or will store growth in Europe and to a lesser extent Canada replace that?

Second, note the comment about Blue Tomato in Europe not being big enough to take advantage of all the omnichannel things Zumiez is doing. For better or worse, the omnichannel strategy favors big players.

Okay, on to the next conundrum. Rick mentions, in discussing some difficulties they’ve had in the shoe category that they don’t and won’t carry basketball shoes, but that those shoes are very popular right now.

But he also talks about giving the customer what they want, when they want it, the way they want it. “…we don’t care what we’re selling, we just want to sell what customers want and our job is positioning inventory properly to do that.”

You can see an apparent conflict which I’ve sort of set up as a stalking horse. “Well Rick, if you basically follow your customers and give them what they want and they want basketball shoes….”

If I were Zumiez, I wouldn’t carry basketball shoes either.

We who were once unequivocally the clearly defined action sports industry finds that we have more or less migrated, kind of, to the less clearly defined active outdoor space with a lot more products and competitors. It used to be a whole lot easier to know which brands to carry.

Figuring that out is now a prime management function (or should be) at every retailer. Zumiez manages this in two ways. First, they are always searching for and supporting new brands. Second, they rely on their active outdoor oriented employees to spot trends and brands that might work for Zumiez. Getting enough of those people, we’re frequently told, is a constraint on their growth. That’s the case in Europe right now.

On to the third issue. In response to an analyst questions and talking about the general business environment Rick Brooks says, “ … we’re still in this kind of recovery, this bumpy recovery mode from the great recession and in these low volume periods is I think there the trends are — the lack of trend is more pronounced and that’s really what drives weaker traffic.”

He included the lack of trend issue when he earlier talked about foreign exchange and the West Coast port slowdown as having impacted the business. What concerned me, and where Rick and I might disagree, is that he talked about the lack of a trend and the bumpy recovery like he saw them as tactical short term issues- or at least that’s how it sounded to me. I see them as potentially long term and strategic.

An economy can only grow when either population or productivity grows, and we’re not doing very well in either category. I hope that lack of a fashion trend that motivates buying is a short term issue, but I have a concern that it might be a longer term trend resulting from our slow recovery and the particular difficulties it has visited on our target customers.

That’s an issue for brands and retailers alike- not just for Zumiez. I think you need to plan for an extended period of slow growth and a customer who’s tighter with their money.

Let’s move on to the numbers.

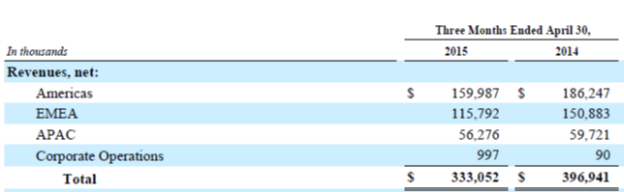

Zumiez’s sales rose 9% from $162.9 million in last year’s quarter to $177.6 million this year. North American sales were up $10.6 million or 7% to $161.2 million. European sales rose $4.1 million or 33.6% to $16.4 million. Comparative store sales rose 3% including ecommerce.

The gross profit margin rose from 31.0% to 31.8% mostly due to an increase in product margin. SG&A was up from $46.8 to $52.4 million or from 28.7% of revenues to 29.5%. Net income rose by 11% from $2.5 to $2.8 million.

The balance sheet was fine. There’s not a whole lot to discuss with regards to the specifics of the financials.

Feels like Zumiez’s issues are the same as those of other retailers and the key ones are long term and persistent. I’d feel better if that was more directly acknowledged in the conference call, but I can’t really expect that. It continually amazes me that the analysts don’t ask about things that seem obvious to me. Perhaps that’s not appropriate etiquette in that forum or they get asked later in private conversations.

Zumiez has a head start over most of the industry with regards to the omnichannel. And their action sport/active outdoor employees will help them turn in the right direction. But it’s a hard time to be a retailer.