Tilly’s: A Solid Quarter. What Did They Do Right?

In its 10Q and conference call, Tilly’s is kind of tentative in explaining what they are doing right. Let’s go through the numbers and review a few conference call comments to see if we can tease out an explanation.

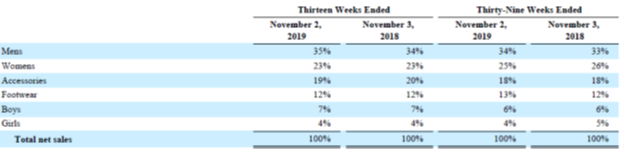

Revenue for the quarter ended November 2 rose 5.4% from $146.8 million in the prior year’s quarter (PYQ) to $154.8 million in this year’s. E-commerce revenues were 16.9% of the PYQ’s revenues ($21.2 million) and 17.2% ($22.7 million) in this year’s quarter. Revenue from proprietary brands were 25% of total revenues in the current quarter, the same percent as in the PYQ. Below is a table showing revenue by category for 13 and 39 weeks.

Comparable store sales rose 3.1% compared to 4.3% in the PYQ. That includes e-commerce sales, which means we don’t have an important metric of how their brick and mortar is performing.

The gross margin rose from 29.7% to 30.5%. They had a 0.8% improvement in the merchandise margin.

SG&A expense rose 6.9% to $39.5 million. The most significant increase was $1.0 million for e-commerce marketing and fulfillment.

Pretax income was up 17.7% from $7.32 million in the PYQ to $8.62 In this year’s quarter. Just to give you some perspective, pretax income for the first nine months of the fiscal year went from $22.0 to $22.3 million, an increase of 1.4%.

The balance sheet remains solid with lots of cash and no long-term debt. Equity declined from $183 million a year ago to $181 million, but this has to do with accounting for operating leases- something they didn’t have to do a year ago. They note that the $5.2 million increase in cash provided by operating activities was “…primarily due to lower inventory.” That’s a good thing.

Tilly’s starts its narrative by describing itself as “…a leading destination specialty retailer of casual apparel, footwear and accessories for young men, young women, boys and girls with an extensive assortment of iconic global, emerging, and proprietary brands rooted in an active and social lifestyle. Tillys is headquartered in Irvine, California and operated 232 stores, including one RSQ-branded pop-up store, in 33 states as of November 2, 2019. Our stores are located in malls, lifestyle centers, ‘power’ centers, community centers, outlet centers and street-front locations. Customers may also shop online, where we feature the same assortment of products as carried in our brick-and mortar stores, supplemented by additional online-only styles. Our goal is to serve as a destination for the latest, most relevant merchandise and brands important to our customers.”

Really nothing insightful or distinctive there. They seem to put stores almost anywhere, and I’ve always thought them as being particularly focused on their real estate- perhaps a source of competitive advantage. You can see that in the way they talk about the retail market and their brick and mortar strategy.

In describing the industry they say, “The retail industry has experienced a general downward trend in customer traffic to physical stores for an extended period of time. Conversely, online shopping has generally increased and resulted in sustained online sales growth. We believe these market trends will continue.”

Then they go on, “We continue to believe we have a meaningful number of opportunities to open profitable, new stores in the future. We believe we are under-represented nationally in terms of the number of stores in key population centers relative to many of our larger teen specialty apparel competitors who have a much greater number of stores than we do. We expect to finish fiscal 2019 ending February 1, 2020 with 14 new store openings. In fiscal 2020 ending January 30, 2021, we anticipate opening up to 15 additional new stores. We will continue to focus new store openings within existing markets and certain new markets where we believe our brand recognition can be enhanced with new stores that are planned to drive additional improvement to our operating income.”

They tell us they aren’t committed to closing any stores in in 2020. “Yet some may likely occur as we work our way through our continuous lease renewal negotiations.” Once again, there’s that real estate focus, though all retailers are looking for better lease deals these days.

They acknowledge the e-commerce trend, then, but are focused on new brick and mortar. Perhaps it’s because Tilly’s is so good at picking real estate. Partly, it’s because they only have 232 stores. They think new stores can enhance their brand recognition. There are hints of an undescribed strategy here, though I can’t figure out what they are doing that might give them better brand recognition than their competitors.

Towards the end of the conference call CFO Michael Henry talk about the relationship between brick and mortar and e-commerce in a way that gives some insight into their strategic thinking. “SG&A leverage,” he says, “is going to have a lot to do with how sales are balanced between stores and e-commerce.” He explains that growing e-commerce sales generates a lot of costs (they mentioned $1 million in the quarter we’re discussing here) while improving comparable brick and mortar sales generate a real opportunity to leverage SG&A expense. That is, higher sales in a store don’t mean you have to pay more rent and other expenses. Remember brick and mortar is still around 85% of their business.

They’ve got to have improvement in both e-commerce and brick and mortar, CFO Henry explains, “Because as you’ve seen in recent quarters when it’s only e-comm those are more expensive sales for us because of the shipping fulfillment and all the marketing affiliate costs that go along with the e-comm business.” Did you hear that? E-commerce sales are more expensive than brick and mortar I think he said.

So, what is Tilly’s doing right? First, they seem to be pretty good at managing their real estate and picking locations. Second, they believe they have some room to expand brick and mortar because they don’t have that many stores yet. Third they recognize, hopefully like all other retailers, the interaction between online and brick and mortar. E-commerce is critical for brand positioning and customer interaction- omnichannel and all that stuff. But it’s especially valuable if helps to improve brick and mortar comparable store sales and you can spread some of both e-commerce and brick and mortar SG&A across the store base, improving the bottom line.

Tilly’s isn’t the only big retailer in our space that understands this. We’ll figure out which ones don’t when they go away.