As I’ve written before, I have a lot of respect for how SPY has restructured and repositioned itself. There seems to be an alignment of their corporate culture and market positioning that not only has the potential to differentiate the brand (in their market), but to save money and increase the efficiency of the organization.

Here’s how they put it in the 10K for the year ended December 31, 2014:

“We have a happy disrespect for the usual way of looking (at life) and this helps drive our innovative design, marketing and distribution of premium products, especially eyewear for youth-minded people who love to be outside doing what makes them feel most alive and happy. We feel a primary strength is our ability to create distinctive products that embody our unique, happy, and irreverent point of view, and this has helped us become what we believe is one of the most recognizable action sports and eyewear brands in the world, with a twenty-year heritage in surfing, motocross, snowboarding, cycling, skateboarding, snow skiing, motorsports, wakeboarding, multi-sports and mountain biking. We have a happy disrespect for the usual way of looking (at life) and this helps drive our innovative design, marketing and distribution of premium products, especially eyewear for youth-minded people who love to be outside doing what makes them feel most alive and happy. We feel a primary strength is our ability to create distinctive products that embody our unique, happy, and irreverent point of view, and this has helped us become what we believe is one of the most recognizable action sports and eyewear brands in the world, with a twenty-year heritage in surfing, motocross, snowboarding, cycling, skateboarding, snow skiing, motorsports, wakeboarding, multi-sports and mountain biking.”

So is irreverence really an attribute that can provide a competitive advantage? Think about that and we’ll get back to it after going over the numbers.

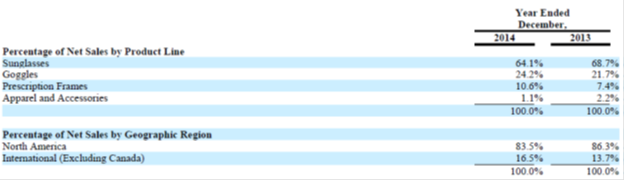

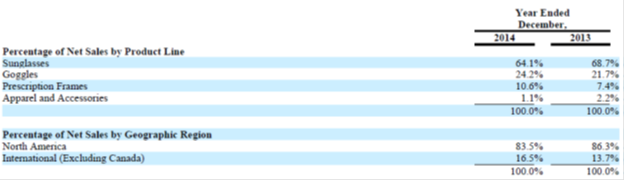

For the year, sales rose 0.9% to $38.1 million. Below is the breakdown of those sales by product line.

The sales increase was due to increases in prescription frames and goggles. Sunglass sales fell by 5.7%, or $1.5 million. They say that decline was “…principally attributable to an overall decline in the consumer market, particularly during the second quarter of 2014, coupled with several key retailers currently holding lower levels of inventory, lower closeout sales of our sunglass products and the loss of a key account.”

I’d note that SPY gets 64% of revenues from the very competitive sunglass category (down from almost 69% last year. 16.5% of revenue internationally is low compare to a lot of other companies, but that may turn out to be a good thing given the strength of the U.S. dollar. A strong dollar means that SPY’s product cost falls (same for all internationally sourcing companies). But it also means that the dollar value of their internationally sold product comes down when translated. The more international sales you have, the bigger the currency related decline in those sales.

Gross profit margin rose from 49.9% to 50.6%. The increase was due to purchasing more product from China (instead of Italy) and having lower closeout sales, which fell from $2.8 to $2.0 million.

Sales and marketing spending grew by $0.2 million to $11.5 million. I see they spent more on marketing events and promotions. Good. Advertising expense rose from $394,000 to $540,000. Also good.

Meanwhile, SPY cut general and administrative expenses by 6.9% to $5.7 million. They did it by reducing bad debt expense $0.3 million through better collections and consulting and outside services by another $0.3 million. They took a chunk of those savings $0.4 million) and invested them in salaries. I assume for people who are doing productive things for the brand.

The result was operating income that grew from $399,000 to $890,000.

Below the operating line, there’s that inconvenient line “interest expense.” It declined from $2.97 million in 2013 to $2.5 million in 2014. Remember the interest rate was reduced significantly during 2014 and you’ll see that impact even more in 2015.

Largely as a result of that interest expense, SPY reported a loss for the year of $1.9 million, an improvement from the loss of $2.9 million the previous year.

In terms of revenue, the fourth quarter was stronger than last year’s quarter, with revenue rising from $8.6 to $9.8 million. The net loss was $423,000 compared to $1.265 million in last year’s quarter. That explains most of the improvement in the bottom line over the whole year.

Over on the balance sheet, there’s still that note payable to shareholder of $21.6 million, but it’s up only very slightly from $21.5 million at the end of the previous year. However, the line of credit rose from $4 million a year ago to $6.8 million at the end of this year.

The current ratio has fallen a bit from 1.6 to 1.3. I see that receivables rose 9.6% with sales up just 0.9% and their mention of collecting receivables better. And I see yearend inventory up 31% to $7.7 million. I wonder if that might not have something to do with lousy snow conditions up and down the West coast making it difficult to sell snow goggles.

If so, SPY is hardly the only company with that issue. I see they’ve increased their allowance for returns from $1.6 to $2 million, so maybe I’m on to something.

As we transition from the financials to strategy, I want to remind you of the licensing deal SPY signed. Here’s how they describe it:

“In December 2013, we entered into a merchandising license agreement, pursuant to which we licensed the SPY IP [intellectual property] to a third party…The agreement provides that the licensee shall develop, introduce, market and sell certain licensed products incorporating the SPY IP, including men’s and boy’s apparel, bags and luggage, consumer electronics, protective cases, and other unisex accessories, throughout North America through certain distribution channels, other than deep discount retail channels.”

They expect those products to start generating revenue this quarter, but don’t offer any clue as to how much. Wish I knew what SPY’s definition of “deep discount retail channels” was. I also wonder if these products will get sold into any existing SPY accounts and how that will get managed.

To get out of its balance sheet hole, SPY needs more bottom line earnings. Perhaps these royalties will make a meaningful contribution to that. Meanwhile, SPY is a small company in a market of some big companies with much greater resources than SPY. The traditional response of smaller companies in this situation is to position itself as a niche company, and I’d say that’s what SPY has done.

Here’s how they describe it:

SPY “…is a creative, performance-driven brand that is fueled by collaborative efforts across various facets of youth culture, including competition, art, music and day-to-day athletic performance. We strive to ensure that our in function and design, as well as style. We do this, in part, through partnerships with our world class athletes who help us design, then wear and test our products during training and competition. We believe that the intimate knowledge of our customers’ lifestyles is what helps us develop a stronger, more relevant product offering for our market. We reinforce our irreverent brand profile through unique and disruptive marketing, using traditional and non-traditional means to convey our branded point of view to both entertain and edify people…”

You can’t have intimate knowledge of your customer’s lifestyle if that customer base is very broad- especially as a small company. This is a bit of a conundrum for SPY, and for similarly positioned companies. You need growth, but as you move to broaden your existing market, you may start to lose the thing that has made you special to the existing customer base without attracting the new customers.

What I think may happen is that the attitudes and lifestyles of the millennial generation (larger than the baby boomers) may reduce this challenge. Facilitated by mobile/internet/omnichannel/ecommerce, etc. certain traditional issues of segmentation and perhaps demographics are, I think, going to become less important.

That’s where SPY’s opportunity may lie.