Some Waypoints in the Evolution of Retail

During the last couple of weeks, I’ve come across a number of articles that speak to the evolution of retail. Here they are for your consideration in no particular order.

During the last couple of weeks, I’ve come across a number of articles that speak to the evolution of retail. Here they are for your consideration in no particular order.

I like to characterize a sudden good idea as getting whacked on the side of the head by a two by four. Today, I got whacked by a lily. My wife’s birthday is tomorrow and I walked into a convenient florist to order some flowers. Except what I walked into was a little café. Quite nice really, with people sitting on casual, older comfortable furniture eating, reading, drinking coffee.

For just a couple of seconds, I was a bit put off, thinking calling the place a flower shop was some kind of clever marketing I wasn’t cool enough to understand. But the flower shop was in the same space, but towards the back. I cannot believe I didn’t take a picture.

On April 24th, the Seattle Times ran an article called “Amazon’s Imitation Game.” It starts by describing how Amazon has knocked off an aluminum laptop stand by Rain Design that had been selling on Amazon for 10 years at a price of $43.00. Amazon started selling a similar product last July for around half that price.

On Amazon, you can see various Rain Design products including a number of laptop stands and you can see the Amazon knock off at around half price. Amazon Basics, the article tells us, includes low price copies of a number of an increasing number of products (900 right now including 284 added in 2015).

My family has a beach house on Long Beach Island, New Jersey. I’ve been going there since I was a kid and still try to get back most summers. It’s where I learned to surf (I know- New Jersey surf? We work with what we’ve got).

Anyway, I was back there in September and as my wife and I headed back to the airport, Diane said, “Pull in there.” So I did. It was something called “Off Aisle” by Kohl’s and I gather this is their first store using this concept.

The store is a 30,000 square foot box with a cement floor. It’s filled mostly with racks on which apparel hangs, though they also offered some shoes, kitchen ware and bedding. Kind of like a Ross store.

The Buckle’s results for the year ended January 31st are certainly not news at this point, but I do think they have a few things to tell us about retail. There are some commonalities emerging among retailers in the active outdoor/fashion retailers that I want to highlight.

The Buckle is a retailer I think does a good job. I’ve been particularly impressed with their ability to integrate owned with purchased brands and the way they merchandise them together. Just to review briefly they had, at year end, 460 stores in 44 states. For the year they had revenue of $1.153 billion, up just slightly from $1.128 billion the previous year. Their gross margin didn’t change much and gross profit was up just a bit from $499 to $507 million.

Expenses rose a similar amount with the result that both operating and net income were more or less unchanged. Net income of $162.6 million was the same as last year. They haven’t managed an increase in comparable store sales for the last two years. No balance sheet issues to discuss.

That’s the shortest financial review I’ve ever done, probably to the relief of some of you.

Recently, some companies have said some intriguing things about the omnichannel and the relationship between brick and mortar and online (for the record, when I say “online” I’m including mobile devices). I’ve also read some interesting things about generational behavior that made me think about the future of brands and retail structure.

It’s no surprise that buying patterns are different for the millennials (born 1982-2000) than they are for the baby boomer (born 1946-1964). Millennials have faced (and will continue to face) different and more difficult economic circumstances than boomers. And of course, they take technology for granted. They shop differently, have different priorities, and are less likely to be brand loyal.

I’ve written about brands that were originally focused on the boomers aging out, and the complexity around maintaining the loyalty of your original customer base while trying to appeal to younger customers. The first thing to note is that right now, boomers spend way more than the millennials. But, for obvious reasons, that’s going to change. If you’re a company that likes customers with money to spend, it’s hard, right now, to ignore the boomers.

Lowe’s new in store service representatives won’t need bathroom breaks, vacations, or retirement account. They won’t get sick. Hell, you don’t even have to pay them a salary. And what’s even better, or maybe worse- I’m not quite sure- is that they may be able to help me find the esoteric piece of hardware I need better than the current human ones. And they will be able to do it in as many languages as are necessary.

They’re robots, and you can read about them here. Make sure you watch the video. Read more

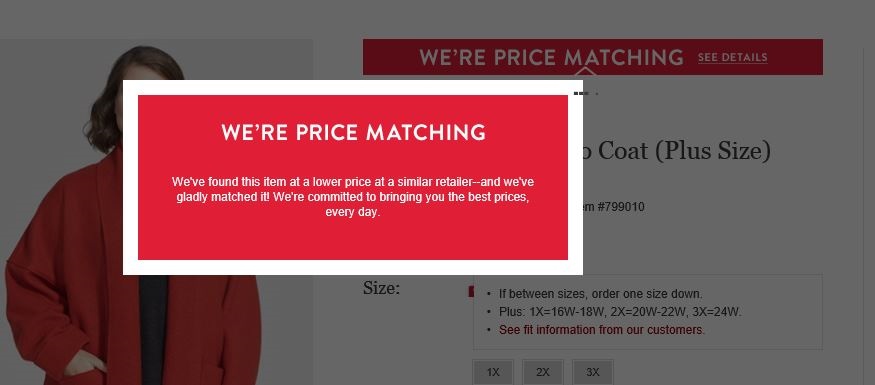

Okay, I don’t precisely feel like Julius Caesar when he was stabbed by Brutus (Hey, at least his problems were over!). But I was initially kind of surprised by what my ever vigilant research department fed me from Nordstrom’s web site.

I’ve written about the tough retail environment. Among the topics I’ve highlighted are how over retailed the country is, the difficulty in getting sales growth, how hard it is for independent specialty retailers to compete, that consumers are increasingly in control, the impact of online and mobile and probably other stuff I just don’t remember.

I’ve never claimed to have “the answer.” But I’ve suggested that part of the response of brands and retailers has to be to manage distribution, control inventory and have systems such that you can hope to improve your bottom line even when sales aren’t growing as quickly as they used to. And know your customer and market position. Yeah, easy for me to say in two sentences. Not so easy to do. I know.

So when my wife- uh, I mean my research department- showed me this link from Nordstrom’s web site, I glanced at it but didn’t think much about it.

My wife likes Eileen Fisher, but this was available only in plus sizes so it was no sale. I couldn’t figure out why you’d want to boil perfectly good wool. Fermenting hops and barley I understand, but boiling wool?

Anyway, I said something like, “Nice coat.” She urged me to look again and showed me what had just popped up.

To be clear, she hadn’t found a lower price herself and requested a better deal. Nordstrom found it for her and offered a lower price.

This is Nordstrom. As far as I know, they compete on quality, service and ambiance. You don’t go there for the best price. You go there because it’s Christmas or your wife’s birthday and you want to pick out something nice in clothing, but you know if you do it yourself it won’t be right and at Nordstrom, some nice woman will talk you down and help you figure out what size your wife is and not say you should have checked in her closet before you came and help you pick out something that your wife might actually like and you don’t care what you have to pay for it. At least that’s what I’ve heard.

How does their business and expense model support price matching?

Okay, here’s how it works. This is from their web site.

“Price Matching”

“We are committed to offering you the best possible prices. We will meet similar retailers’ prices if you find an item that we offer available elsewhere. We’ll also be happy to adjust the price of an item you’ve purchased if it goes on sale within two weeks of your order date. Please note that price matching only applies to items of the same size and color. Designer items can only be matched when purchased at regular price.”

“We are unable to match prices from auction and outlet stores or their websites, or other retailers’ discount promotions, shipping offers and gift card offers.”

I feel a little less aggrieved after reading that. This is carefully controlled and managed and focused only on retailers that Nordstrom perceived to be their direct competitors.

This is a tactic by Nordstrom that probably just formalizes what’s going on anyway, so I’m now feeling less flummoxed. Nordstrom controls who they compare prices with. It’s not Kohl’s. It’s only retailers who have what I expect are cost structures similar to Nordstrom. And apparently, they don’t price match if the other retailer has it on sale. Wonder exactly how they program for that? How do you decide how much lower the other store’s price can be before that product is “on sale” and you no longer offer the price match? There are some interesting issues here. All part of figuring out the omnichannel I guess.

Perhaps this discourages some shoppers from doing their own price shopping while at the same time limiting the discount and making the shopper feel that Nordstrom is looking out for them. Maybe price matching only happens if you are slow to put the item in your cart, or leave it and then come back.

And as long as we’re on Nordstrom’s web site looking at women’s coats, check out this page. Look at the list of featured brands part way down on the left. Notice that The North Face is the only brand we’re likely to recognize as part of our industry. They are also the first brand listed even before you click through to see their offerings and their page has 53 coats.

The reason you might reflect on it is that VF owned North Face has somehow navigated the branding and positioning wars so that it’s fine for it to be an outdoor brand and a fashion brand among other fashion brands that are clearly not outdoor brands. My perception is that somehow The North Face’s credibility as both an outdoor and a technical mountain product has been translated so it provides credibility as a fashion brand.

We’ve watched and are watching lots of industry brands struggle with this. What is VF doing with The North Face (and Vans) that other brands don’t seem able to do? No magic wand I’m afraid. It’s VF’s processes, operational discipline, and strong balance sheet that make the difference.

I have in front of me the pleasant task of reviewing the quarterly fillings of a bunch of our favorite retailers. But before I get to that, I thought I might point you at this article that talks about the future of malls in the U.S. It may have something to do with the evolution of retail.

Like me, you know that we’ve got way too much retail space in this country across all industries. But when the article tells us we’ve got 50 square feet for every man, woman, and child and Great Britain (which may be less great by the time you see this depending on the Scot’s independence vote) comes in second with 10 square feet, you began to get a sense of just how big the problem is.

The article (go read it) talks about anticipated mall closings, how no new malls have been opened since 2006, and that’s it’s only the high end malls that can expect to prosper. He also makes the rather obvious point that online is cannibalizing, brick and mortar sales.

Most of the retailers I follow, of course, are opening new stores. Those new stores are a critical part of their long term growth strategy. As they open these stores, they chant, “Omnichannel! Omnichannel!” like it’s a protective talisman with mystical powers.

For some I guess it will be. They will the ones who figure out how to integrate brick and mortar with mobile and online to generate enough incremental operating income to pay for all the costs they incur in the process. I’ve pointed that out before.

But that additional operating income won’t all come from more revenues. It will come from smaller stores, configured and merchandised differently. It will come from lower inventory levels as more sophisticated systems and increasing comfort with getting it next day or the day after means customers can be satisfied without having every piece in all sizes and colors in each store. I also think it’s going to come from increased U.S. manufacturing, resulting in shorter lead times.

Finally, and most importantly, it’s going to come from an increasing understanding of how mobile and online relates to brick and mortar. That is, the decision as to where and what kind of store to open will be influenced by the online/mobile activities and demands of customers in the area, or potential area, of the store.

And, by the way, I’m not quite sure I know what “store” is going to mean in the future. Larger or smaller? Permanent or temporary? What will location criteria be? How will they be fixture and inventoried? Will they sell the actual product or maybe just let the customer see the product then download the specs to be used at home on their 3D printer? You might want to listen to this Ted Talk on the subject. Consider the implications for manufacturing and supply channels.

Remember this is all going to be happening while brands stop telling customers what they should buy and have to ask customers what they want to buy and give it to them- quickly. I don’t know how this is all going to work out, but it should be fascinating. And it’s not all going to happen in malls.

A recent trip to the East coast found me in a mid-sized, somewhat economically depressed city that’s undergoing quite a revival in its downtown core. I had the chance to walk the downtown with one of the people intimately involved in that development as he explained the vision and showed me the construction.

Error: Contact form not found.