Globe filed its annual report for the year ended June 30, 2019 pretty much concurrently with the announcement that it had sold Dwindle to Highline Industries Corporation. Skatewire reported that the purchase price was $1.5 million, but what the annual report says is that the carrying value of the assets was $1.5 million. I haven’t seen the purchase reported anywhere. The transaction will close and be accounted for in the first half of Globe’s current fiscal year. If you haven’t, you might also read the interview with Bod Boyle and Steve Lake on Shop Eat Surf about the deal.

According to Globe’s annual report, “The transaction includes the brands, working capital, domain names, social media accounts and the personnel attached to the Dwindle business.” Maybe they shouldn’t have worded it so it sounds like they sold the employees.

You may recall that Globe bought Kubic and Dwindle back in the middle of 2002. Here’s an article from Transworld Skateboarding on the deal where they state the original purchase price as $46 million. This was so long ago there were three separate Transworld Business publications.

Globe made the purchase at precisely the top of the skateboard market and, given how the market evolved, paid way too much. But the point is that Globe figured that out right away. And that’s what they’ve always done and continue to do. Fundamental to their success is their ongoing ability to recognize opportunities and mistakes and deal with them. You might go here and look at Globe’s historical time line as well as their current brands to get a sense for that.

As they say in the annual report, the Dwindle sale, “…was part of the consolidated entity’s ongoing strategic overhaul to reduce the number of smaller brands and move towards having fewer brands in each product category. Following this change the company has a much better balance of apparel, footwear and skateboard hardgoods brands proportionate to the revenue of each product category.”

I’m guessing they will also end up with a significantly higher gross margin. That, I think, is why they say, “The sale of this business is not expected to have any significant impact on Group profitability in the 2020 financial year and beyond.”

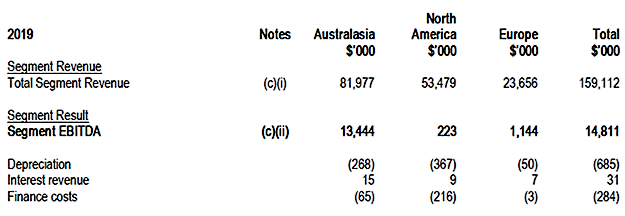

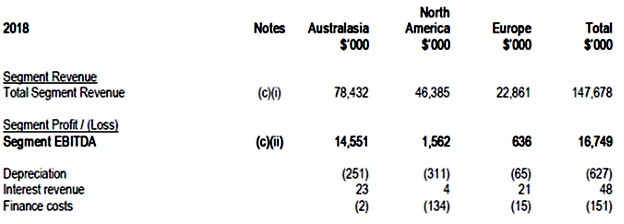

Revenue for the year rose 7.7% from $147.7 to $159.1 million Australian dollars (All numbers in Australian dollars). At the current exchange rate, that’s $107.2 U. S. dollars.Net profit fell 2.9% from $8.44 to $8.20 million. The charts below show revenue and EBITDA, along with certain allocated expenses, by geographic segment for each year.

You can see in the charts that revenue rose in all three segments. EBITDA, however, fell in both Australasia and North America while rising in Europe. If you subtract depreciation and net finance costs, you have something that approximates pretax income. Note that it’s a pretax loss in North America.

I can imagine the North American results have something to do with the decision to sell Dwindle.

Interestingly, these North American results occurred while what they call “External Segment Revenues” in the U.S. rose 23.9% from $34.6 to $42.9 million. External Segment Revenues “…are allocated based on the location of the customer.” External Segment Revenue in Australia rose from $74.1 to $75.9 million.

In Australasia, “Sales growth in the current year was driven by FXD apparel and boots, Salty Crew clothing and Impala roller skates…the $13.4 million EBITDA reported was $1.1 million or 8% lower than the pcp, mainly due to the impact of the stronger USD on gross profit margins which were lower by 1.8 percentage points than the pcp.”

In North America, “Sales growth was driven by Salty Crew and Impala roller skates. Despite the growth in sales, EBITDA profit was below the pcp…The lower profitability was driven by a reduction in gross margins due to customer mix…In addition, costs increased due to further investments in future growth brands such as Salty Crew, FXD and Impala in the North American markets. In future periods the cost base will be significantly lower with the divestment of Dwindle and related restructuring of the business during FY20.”

“The performance of the European business was largely flat in constant currency, from a sales and profitability perspective. During the year investments were made in Salty Crew and Impala for future growth.”

This is the part where we’d really like to know how much business Dwindle was doing and where. But what we do learn is that new brands and markets other than skate hard goods seem to be, according to the report, Globe’s focus and source of growth. As I said, they have always been prepared to evolve with the market.

Gross margin, they tell us, fell by 1.5%, “…driven mainly by the impact of the stronger USD on margins in the Australian business.” I can’t quite calculate the gross margin to show a 1.5% decline. That’s my problem. Australian financial reports provide a “cost of sales” number rather than the “cost of goods sold “we’d see in a U.S. report and I’m not sure if that’s more than semantic difference. But if I play around with their numbers and add a couple of small expenses I think would be included, I get a decline in the gross margin from 47.4% to 45.8% or 1.6%. Could be a rounding difference.

The balance sheet continues to be solid. There’s no long-term debt and equity rose from $41.0 to $44.5 million. Cash fell from $16.8 to $9.5 million with the increases in receivables and inventory going up by more than that. Globe ended the year with current borrowings of $1.64 million, up from zero at the end of the last fiscal year. Cash from operations was a positive $11.2 million last year, but a negative $3.45 million in the June 30, 2019 fiscal year.

My read is that Globe made a good decision in selling Dwindle consistent with their long-term tendency to go where the market offers opportunities. In six months, we’ll learn more about the impact of the sale on their financials.