Billabong presented its results on February 26th, which is a day before I took off for a week in Scottsdale to golf and have a drink or two with old friends. As usual, a lot seems to have happened while I was gone, and I’m working to catch up.

I agree with Billabong CEO Neil Fiske who said, “There are important positives to report among a mixed overall result this half.”

Let’s right get to the numbers as reported and then as adjusted. In this discussion, I’ll rely mostly on the formal financial report with the audited financials. All the numbers are in Australian dollars.

For the half year ended December 31, revenue rose 7.55% to $565.4 million compared to $525.8 million in the same period the previous year (pcp- prior calendar period). There was a net loss of $1.6 million compared to a profit of $25.7 million in the pcp. A larger loss on higher sales isn’t exactly exciting. Let’s see how they got there.

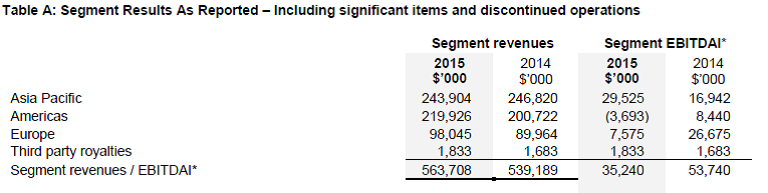

First, here’s a breakdown of revenues by segment and the associated segment EBITDAI as reported.

Here are the same numbers excluding “significant items” and then excluding “significant items and discontinued operations.”

Discontinued operations refer to the sale of Surf Tech and Swell during the first half of 2014. It generated pretax income of $13.7 million in the pcp compared to $0.00 this year. In addition, last year’s “significant items” included a $2 million inventory write down, a gain of $9.7 million adjusting the contingent consideration for the purchase of RVCA, $5.8 million in turnaround/restructuring costs, and some other items. In total, these items, including discontinued operations, would have reduced last year’s reported pretax income by $13.5 million if excluded from the actual results. In this year’s first half, the impact would be to increase pretax income by $2 million. Without all these adjustments, then, last year’s first half net income would have been a lot lower. This year’s a bit higher.

Here’s the link to Billabong’s investor relations home page. If you’re curious as to what they’ve decided to exclude, click on the third item under “Featured Report” and look at note 4 on page 22. Regular readers know I hate the overwhelming tendency among public companies to focus on proforma results rather than results based on Generally Accepted Accounted Principles. I worry about the amount of discretion management has to shape their presentations when they use proforma results even as I recognize the value of certain of the adjustments in understanding operations.

A key message Billabong wanted to get out was that their big three brands (Billabong, Element and RVCA) were all growing in constant currency. Respectively, they grew by 2.6%, 9.1%, and 20.6%. They don’t give us numbers by brand as reported anywhere.

This focus is consistent with what Neil has been telling us since he took over- Billabong is all about building brands and would focus on its three biggest first. In this environment, I think it’s the only strategy.

They note that they are gaining market share, and that’s certainly consistent with what I’ve heard. I do wonder how much Quiksilver’s issues have helped Billabong, as well as other industry companies.

We’re told that RVCA’s growth is from a comparatively small base. I’d remind you that they have also had financial statement gains both this year ($2.4 million) and in the pcp ($9.7 million) from reducing the anticipated contingent payments for the purchase of the brand. However well RVCA is doing, it’s not doing as well as they had expected it to.

When they talk about the three big brands performance in the Americas, they say that the growth includes “…wholesale equivalent sales to our own retail…” I wonder how that works exactly. I’d like to know just what “wholesale equivalent” means. Are there any consignments? Any returned merchandise? Credits for styles that don’t sell? Do the store managers get to pick how much of which product they take?

There are a host of issues and adjustments that Billabong might or might not have to take into account if they were selling this product into independent accounts and that they can choose to ignore when selling to their own stores.

It’s difficult to know how to think about the brand growth numbers unless you understand the magnitude of this practice and the specifics of how it’s handled.

Talking about the Americas, we learn that Sector 9’s EBITDA fell $2.5 million. That there’s a pullback in long board sales is hardly a surprise. Not even strong brands are immune.

The gross margin fell from 54.9% in the pcp to 51.7%. Eliminating Swell and Surf Tech, it would have been 54.3% in the pcp. The decline is due to some overbuying, the inventory impact of the west coast port strike, and exchange rate issues we’re told. As we’ll see, it’s reflected in the balance sheet inventory number.

They expect a strong recovery in gross margin. As CEO Fiske puts it, “…there’s a broad theme in this result around margin recovery. That’s the single biggest opportunity. We don’t need to grow sales any more than we do in order to deliver a substantial improvement in profitability, when we get our margins in line and to where we think they should be.”

To me, this approach is exactly in sync with the economic times we live in. Building solid brands requires some caution in distribution. Profitability created through better margins, more efficient operations, and lower expenses rather than unrealistic and brand destructive sales growth is where most brands need to be in their thinking.

And that takes us right to a discussion of expenses.

Selling, general and administrative expenses rose 7.6% from $203 to $219 million. I don’t have a detailed breakdown of these, but I’m not particularly upset by the increase. Billabong has been spending a bunch of money on creating or recreating and restructuring their omni channel efforts, sourcing, and distribution and logistics. Consistent with what I quoted Neil as saying above, this is all critical for driving profit even when sales may not grow as quickly as they have in the past.

From what they say, I have the sense things are a bit behind schedule (though progressing nicely) and perhaps costing a little more than expected. I’m not surprised. What they are undertaking touches every part of the organization. I guess maybe a reasonable analogy would be doing open heart surgery without stopping the heart.

However, Neil tells us they are now expecting “…a substantial decline in restructuring costs.” He further notes that they have “…brought all sourcing functions together into one global organization…” that the “…vendor base has been narrowed dramatically…” and that they are “…consolidating our purchasing power globally.” They are “…targeting 20% to 30% reduction in the time from order to the vendor and delivery to our DC.” I think DC means distribution channel.

Other expenses were down 8.4% from $66.9 to $61.3 million. Finance costs rose from $16.2 to $19.5 million, or by 20.5%. The increase in financing costs was the result of currency swings. One analyst asked if they were trying to refinance their debt to reduce interest costs. They indicated they were watching that, but thought it was a little way off.

I tend to agree. Their financial performance will have to reflect their efforts before a refinancing at lower interest rates can happen.

The balance sheet shows a solid, and pretty much unchanged, current ratio of 2.31. The 14.7% inventory increase from $181.3 million a year ago to $217.1 million at December 31, 2015 is not what we want to see, but it’s clear why that occurred. Total liabilities to equity are up from 1.62 to 1.87 basically due to the $30 million rise in long term borrowings that resulted from exchange rate swings.

I guess I’d characterize their balance sheet as adequate, and I look forward to seeing it improve as some of their programs really kick into gear this year and next.

For Billabong, as well as everybody else, business conditions are difficult. That shouldn’t require much explanation. Economic growth, at best, is slow. Monetary policy has pretty much stopped working and the various people responsible for fiscal policy won’t do what they know they need to do because they know their constituents won’t like it. Spending is soft, wages aren’t rising much (though that may be improving a bit in the U.S.) and we may already be in a global recession. Or not. But at the end of the day, there’s simply less discretionary income to go around for many of our customers and they seem to be spending what they have on experiences.

The internet has made our products more like commodities. That’s why I believe Billabong’s strategy of building brands (including cautious distribution), restructuring all their operations to run more efficiently, implementing a global omni channel strategy, and not relying on sales growth alone to boost profitability is the correct one.