VF’s secret sauce isn’t secret. It’s just hard to do. Executing the strategy takes leadership, a quality team, organizational consensus, and a certain level of confidence and perhaps willingness to fail to take advantage of uncertain times.

You’ve probably realized that every company needs those things. So let’s take a deep dive into how VF does what it does with less emphasis than usual on the nuts and bolts of the financials. The results for the year were strong and some numbers will show up in this discourse. Here’s a link to VF’s 10-K. Not suggesting you get down into the footnotes but reviewing the first maybe 10 pages on their business and strategies might be useful.

At the end of the fiscal year (3/30/19) VF operated in four segments. Outdoor (North Face, Timberland, Icebreaker, Smartwool Altra), Active (Vans, Kipling, Napapijri, Eastpak, JanSport, Reef, Eagle Creek), Work (Dickies, Rep Kap, Bulwark, and a bunch of others), and Jeans (mostly Wrangler, Lee, Rock & Republic).

As you probably know, the Jeans segment has been spun off as of May 22,2019) as a separate public company called Kontoor Brands that includes the three jeans brands mentioned above as well as VF’s outlet retail business. Here’s what I wrote last August when they announced the spinoff plan.

When I’m buying a pair of Lee jeans at Sears for $23.95 and end up using them to work in the garden it becomes clear that jeans isn’t the high margin brand distinguishable market VF want to be in.

That leave us with outdoor, active and work. I’m sure you see the relationship and crossover between outdoor and active. In the 10-K, they describe Dickies as “Work and work-inspired lifestyle apparel and footwear.” CFO Scott Roe notes in the conference call that they see opportunities for Dickie beyond traditional work wear. CEO Steve Rendle says they see a similar opportunity with Red Kap. It sounds like they see opportunities for some of the interrelatedness and cross marketing between Work and Active and Outdoor that already exist between Active and Outdoor.

With the spinoff of jeans and the sale of some other brands (Nautica, Reef, Van Moer, the licensing business including JanSport collegiate) I see VF having a generally higher margin business full of interrelated brands that can support each other. Let me show you VF’s four long term growth strategy drivers from the 10-K.

- Reshape our portfolio. Investing in our brands to realize their full potential, while ensuring the composition of our portfolio positions us to win in evolving market conditions;

- Transform our model. Becoming consumer- and retail-centric to meet and exceed consumers’ needs across all channels, and operate our business differently – from the design studio to the factory floor to the point of sale – by thinking and acting more like a vertical retailer;

- Elevate direct-to-consumer. Investing in our direct-to-consumer business to make it the pinnacle expression of our brands, and prioritizing serving consumers through e-commerce and digitally enabled transactions; and,

- Distort Asia. Accelerating our actions in Asia, especially China, to unlock growth opportunities for our brands in this fast-growing region.

They made the comment that neither the senior management team or the employees would mind if there were no more acquisitions for a while given the work load the acquisition and integration require.

They commented in the conference call that VF would continue to reduce balance sheet leverage as previously indicated. The balance sheet has allowed VF to make opportunistic investments in brands and they will continue to do that. They’d probably prefer, however, that a little time passed before a larger portfolio reshaping opportunity appeared.

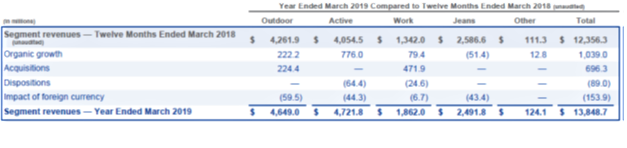

As described, transforming the model is pretty much what all brands want to do in our current environment. No choice. VF’s size and flexibility help. For the year ended March 31, 2019, VF’s revenues were $13.8 billion. Of that growth, $1.039 billion came from brands they already owned, and $696 million from acquisitions. Foreign currency cost them $153 in revenue and sale of assets reduced it by $89 million.

Net income was $1.26 billion.

VF’s direct to consumer were 33% of total revenues during the year from 1,551 retail stores (including 79 outlet stores now spun off) and ecommerce sales. Ecommerce represented 25% of direct to consumer revenue, or $1.14 billion. In addition, there are “…approximately 1,200 concession retail stores located principally in Europe and Asia.”

“In addition to our direct-to-consumer operations, our licensees, distributors and other independent parties own and operate over 3,000 partnership stores. These are primarily mono-brand retail locations selling VF products that have the appearance of VF-operated stores. Most of these partnership stores are located in Europe and Asia…”

They opened 110 stores during the year (focusing on Vans and The North Face), but note they are being more aggressive in closing unprofitable stores and thoughtful in what kinds of new stores they open and where they open them. That, I hope, is an approach most brick and mortar retailers are taking. Of the stores VF operates, there are 200 The North Face stores, 250 Timberland, 30 Icebreaker, 700 Vans, 80 Kipling, 25 Napapijri, and 65 Dickies.

“VF sourced or produced approximately 560 million units spread across our brands. Our products are obtained from 19 VF-operated manufacturing facilities and approximately 700 independent contractor manufacturing facilities in approximately 60 countries. Additionally, we operate 40 distribution centers…” Ignoring the Kontoor brands, the cost of goods sourced in China during the year is just 7%.

They produced 21% of their units in their owned factories in the U.S., Mexico, Central America and the Caribbean. They have 3 “…strategic global innovations centers that focus on technical and performance product development for apparel, footwear and jeanswear.” I’m guessing the last one might have gone away with the Kontoor spinoff. Remember that Jeans is gone as of May 22nd.

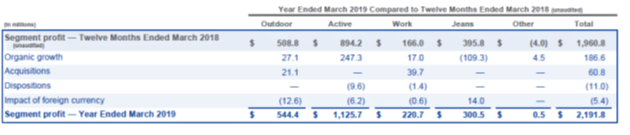

The two charts below show their diversification and growth of revenue and operating profit over the last year.

Among their three largest brands, they expect Vans growth to moderate (almost has to), and The North Face and Timberland’s to increase. They also see a lot of potential in the work wear business. This is how the textbooks say a portfolio of brands should work. Excluding the spun off jeans brands, revenue growth was 18%- 11% organic. Their two largest brands- Vans and The North Face- grew 26% and 10% respectively.

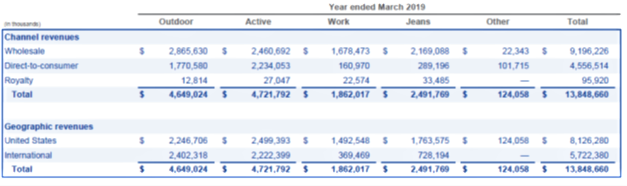

One more chart- here are revenues for the year by channel and geography broken down by segment.

Go back to the four long term growth strategies for a minute. Reshape portfolio, transform our model, elevate direct to consumer are the first three. As you look at their interrelated brands, their willingness to massage the portfolio, the flexibility their supply network including the owned factories gives them, the growth of the DTC business and the consistent message of the strategy within the organization, you can see the first three happening. Though they didn’t talk about it in these documents, I’ll remind you that VF has noted in the past the amount of work they’ve done on customer and market segmentation to get them to this strategy.

The final strategy- distort Asia- is to me just an indication that’s where much of their growth opportunity lies.

Think of VF as an octopus- able to think (octopi are supposed to be smart) and move quickly, change direction, and work each tentacle separately, but with an ultimate coordination. I’m been predicting a bump in the road for Vans for a while now as I don’t know where else they can sell it- perhaps the opportunity is in Asia. But if they can handle their distribution judiciously a managed decline in it’s growth rate offset by other brands is a possible. Certainly, that’s the strategy.

The information I write publicly about inevitably comes from company produced sources and- big surprise- they want to put their best foot forward. I suppose more often than not that can tend to give me a positive bias, though I like to think I’ve seen through that with certain public companies.

VF is not invulnerable to a U. S. recession. Or a bank problem in Italy, or a trade war, or a debt crisis in China (which I don’t really expect. Yet.). But they are one of the companies that can come out of any kind of economic dislocation better positioned than when they went into it.

Keep deleveraging that balance sheet VF. When the inevitable recession finally happens, there may be some solid brands available as screaming deals. And don’t try and tell me you haven’t thought about that.