It’s accurate to say that VF ran into the same issues and economic dislocations as other brands and retailers. During their fourth quarter, ended December 31, 2016, revenues fell 2.7% from $3.41 billion to $3.32 billion in the quarter ended December 31, 2015 (the prior calendar period- PCP). Net income was also down from $312 to $264 million, or by 16.7%.

For the year, revenue was almost the same at just over $12 billion. Net income fell 12.8% from $1.32 in 2016 to $1.07 billion in 2015 (also the PCP). More details and nuance later. I wanted you to have those numbers as we talk strategy.

VF’s Strengths and Strategies

Right from the start, I want you to focus on how VF competes. Here’s what they say on page one of their 10K:

“VF’s diverse portfolio of more than 30 brands meets consumer needs across a broad spectrum of activities and lifestyles. Our ability to connect with consumers, as diverse as our brand portfolio, creates a unique platform for sustainable, long-term growth. Our long-term growth strategy is focused on four drivers:

- Lead in innovation by delivering new products and experiences that consistently delight customers, to drive core growth and strong gross margins;

- Connect with consumers by gaining a deep understanding of their behavior, values and preferences to inspire brand engagement and loyalty;

- Serve consumers directly, reaching them across multiple channels — wherever and whenever they shop; and,

- Expand geographically, taking advantage of VF’s scale within every region and channel in which we operate.

VF is diversified across brands, product categories, channels of distribution, geographies and consumer demographics.”

As you read those four bullet points, you might tend to think, “Well, sure. Those are the same four things everybody wants to do.” You’d be right. Why can VF hope to do them better than other players?

- Size

- A strong balance sheet (bet you’re stunned to hear me say that).

- Diversification

- Flexibility (partly due to owning some of their factories, which produced 22% of their units in 2016).

- Rigorous management processes.

- A strong balance sheet (Oh-wait- Did I say that before? That’s okay).

- A certain level of caution in distribution.

Five is my opinion and not as directly supported by public information as the others are. I also want to suggest there might be one more, though I’ve never heard them discuss it.

That one more is how their 30 plus brands interact with each other. How do ideas, customer information, designs, materials, practices from one brand provide insights and ideas to other brands? They’ve got their investor day coming up. I’d encourage them to address that.

The Results for the Year

I’ve already given you the revenue and net income lines. Other revenue related facts are that VF’s top ten customer generated 21% of revenue during the year and that direct to consumer revenues (stores and online) were 28% of revenue, up from 26% the previous year. Ecommerce is 18% of the direct to consumer business, or $605 million. That’s 5% of total revenue. They expect direct to consumer to grow faster than the rest of VF.

They ended the year with 1,507 stores worldwide, 155 of which were opened in 2016. 600 of those stores are Vans, 200 The North Face, and 250 Timberland. The stores opened in 2016 focused on those three brands. They’ve got 80 VF outlet stores. They expect to add 50 stores during 2017.

Gross margin rose from 48.2% to 48.4%. Pricing gave them a 1.2% boost, but they lost 0.8% due to foreign exchange and 0.2% due to some restructuring costs.

SG&A expenses rose from $4.009 to $4.244 billion. Advertising and promotional expenses were $674 million, or 6% of sales. Many small brands would love to get that expense category down to 6%.

“This increase is primarily due to restructuring initiatives of $34.8 million, a pension settlement charge of $50.9 million, investments in our key growth priorities…and the benefit of a $16.6 million gain on the sale of a VF Outlet ® location in 2015.”

Revenues are constant and net income is down, but they are still investing in “…direct-to-consumer, product innovation, demand creation and technology initiatives…” They are also making sure their pension plan is funded so it doesn’t come back and bite them in the buttocks in the future. There’s the benefit of a strong balance sheet again.

I’m going to give you all a break and not carry on about all the underfunded pension plans out there that are deluding themselves about their earnings assumptions over the next decade or so. If you are counting on one, you might check out how secure it is.

Speaking of various charges, VF had a few others.

“As a result of management’s decision to merge the lucy ® brand into The North Face ® brand , VF recorded a $79.6 million noncash impairment charge to write-off the goodwill and intangible assets of the lucy ® reporting unit during the fourth quarter of 2016.”

There was also a $58.5 million charge for Nautica, “…writing the goodwill down to its estimated fair value.” Reef took hits “…of $31.1 million and $5.6 million related to the goodwill and trademark, respectively.”

It’s nice to get a little information on Reef, even if it isn’t good news. Here’s how VF describes the analysis that lead to the Reef write-down.

“Recent performance by the brand has been negatively impacted by isolated events such as an unseasonably cold spring in 2014, supplier issues in 2015 and bankruptcies of wholesale customers and an inconsistent retail environment in the U.S. in 2016. However, VF is optimistic about the brand because of the nature of past challenges and the expected success of new product offerings. Key assumptions developed by VF management and used in the quantitative analyses of the Reef ® reporting unit and trademark include:

- Minimal revenue growth in the wholesale channel driven by door expansion with existing and new customers

- Modest growth in the e-commerce business

- Modest gross margin expansion based on updated strategies

- Increased leverage of selling, general and administrative expenses on higher revenues

- Market-based discount rates

- Royalty rate based on active license agreements of the brand”

As always, and as with all companies, VF wants you to know the Lucy, Nautica and Reef charges are noncash. However, that doesn’t mean they don’t imply a reduction in future cash flow and performance by the three brands.

Finally, speaking of one time charges, VF sold its contemporary brands coalition. The deal closed on August 26 and generated an after-tax loss of $104.4 million. Through the sale date, that coalition generated $188 million in revenue. Ignoring that coalition, income from continuing operations fell from $1.71 to $1.42 billion.

VF’s operating margin fell 2.4% from 14.9% to 12.5%. 1.5% of that decline was the result of the various charges described above.

It’s not a big deal, but “Net interest expense increased $4.0 million to $85.6 million in 2016. The increase in net interest expense was primarily due to higher interest rates on short-term borrowings and an increase in long-term debt due to the issuance of €850 million euro-denominated 0.625% fixed-rate notes in September 2016.”

If rates continue to rise (don’t be deluded into believing that the Fed controls interest rates) it’s going to be interesting to watch companies that have borrowed lots and lots of cheap money scramble. VF is not a company with a problem in this area but even for them, higher interest rates increase costs and reduce net income. VF’s weighted average interest rate was 3.5% in both 2016 and 2015.

Not too much to discuss on the balance sheet. It’s “fine.” Cash provided by operations rose from $1.20 billion in the PCP to $1.48 billion in 2016. The current ratio improved from 2.1 to 2.4. Long term debt rose from $600 million (they borrowed 840 million Euros in Europe), from $1.4 to $2.0 billion, but used the money to reduce their short-term commercial paper borrowings from by over $400 million. Equity declined from $5.4 to $4.9 billion and debt to total capital rose 25.6% to 31.9%.

Outdoor & Action Sports

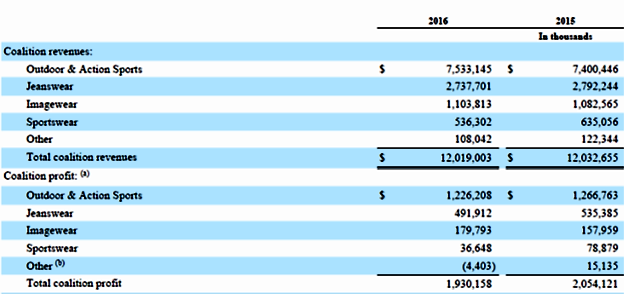

The chart below shows revenue and operating profit for all of VF’s coalitions. You will note the continued and increasing dominance of Outdoor & Action Sports in terms of both revenue and operating income.

“Global revenues for Outdoor & Action Sports increased 2% in 2016, reflecting strong growth in the direct-to-consumer channel, partially offset by weakness in the U.S. wholesale channel. Revenues in the Americas region were consistent with 2015, and revenues in the Asia Pacific region increased 4% in 2016 despite a 2% negative impact from foreign currency. European revenues increased 5% in 2016, representing operational growth of 4% and a favorable impact from foreign currency of 1%.”

“Global direct-to-consumer revenues for Outdoor & Action Sports grew 13% in 2016, driven by new store openings and an expanding e-commerce business. Wholesale revenues were down 4% in 2016, primarily due to retailer bankruptcies and reduced off-price shipments in the U.S., and a negative impact from foreign currency of 1%.”

Some themes are consistent across the industry; weak U.S. wholesale, the impact of bankruptcies, the impact of foreign currencies.

“Vans ® brand global revenues were up 6% in 2016, reflecting strong operational growth in the direct-to-consumer channel, partially offset by declines in the wholesale channel and a negative 1% impact from foreign currency.”

“Global revenues for The North Face ® brand decreased 2% in 2016 [7% during the 4th quarter], as strong operational growth in the direct-to-consumer channel was more than offset by declines in the wholesale channel in the U.S. and an unfavorable foreign currency impact of 1%. The wholesale revenue declines for The North Face ® brand were attributable to retailer bankruptcies and management’s proactive approach to managing inventory levels in the market by reducing off-price shipments in the U.S. during the fourth quarter. The combination of both factors negatively impacted revenue growth for the year by approximately 4%.”

“Global revenues for the Timberland ® brand were up 1% in 2016 driven by growth in the direct-to-consumer channel and international business, partially offset by weaker wholesale revenues in the U.S.”

The coalition’s 2% growth was a bit below what they projected last October. However, “The shortfall was due in part to our strategic decision to ship less North Face product into the off-price channel in the Americas.” That gives me warm fuzzy feelings. I think judicious distribution management is a requirement of brand building these days.

CEO Steve Rendle, responding to an analyst asking about pulling back some distribution, addresses the issue this way.

“I guess, if you think about the distribution strategy, that’s an every season, every year opportunity for our businesses to look at the channel partners that they work with and how we are segmenting our products and really thinking about what partners to place our products in. I wouldn’t say, Jim, there’s anybody that we would back out of. I would say, each of our groups are focusing on their key partners, and that’s true for Vans, that’s at North Face, that’s at Timberland, SmartWool. And I think probably more attention is being put into the right assortment, the right levels at the right times of the year, so really leveraging that retail discipline and becoming more retail centric looking at the quality of flow and the frequency of new delivery. I think that’s more of our focus than pulling back on or limiting any of our partners.”

There’s a sort of warm fuzziness to the answer meant to reassure existing partners. What you should take away, however, is the subtlety and complexity of addressing distribution these days.

It’s not that VF isn’t impacted by all the change, uncertainty, and softness of markets. But for the reasons I’ve outlined, they (and some other companies) can muddle through while weaker competitors flounder and clear the playing field. Consolidation- remember?

I’m sure VF management would have preferred I use a term other than “muddle through.” But damned if that isn’t what we’re all doing. The day after we get an idea what tomorrow might look like, it changes again.

Well, Zumiez’s 10K is out, I’ve got some ideas around Dick’s decision to reduce its number of brands, and the article I wrote on Intel’s garment printing system makes me want to speculate some more on the future of brick and mortar. Oh- and I have some actual work I need to do. Better get busy.