Kathmandu released its number for the six months ended January 31 and I’ve finally gotten through the statements. Maybe the first thing you should do is go read what I wrote when Kathmandu acquired Rip Curl on October 31, 2019. Here’s the link. I thought the deal could work, but I was concerned by the lack of solid financial information and wasn’t quite sure the integration was likely to go as smoothly as they projected. Then the virus hit.

Like I did with Zumiez, I want to focus on the world as it now exists- Not so much on the results for the six months Kathmandu is reporting. What does that mean exactly?

Here’s how a smart guy named Peter Boockvar described how we need to think about reported financials right now.

“Earnings per share will be meaningless as the first two months of the quarter was quite different than the 3rd. It’s irrelevant if companies tell us that January and February was fine because that is not a world we will get back to for a while. And there won’t be Q2 guidance worth its salt because without any visibility how can anyone be confident to give it. The most important thing to watch this earnings season will be the balance sheet, not the income statement. Not only what is your debt to equity ratio or debt to total capital but what is your interest expense coverage ratio? What debt covenants are you bumping up against? Have you tapped your credit line and if so, what is left on it? Have your accounts payable piled up in order to preserve cash? Have your accounts receivable risen as your customers are late in paying? We need to know who will get by and who will struggle, who needs help and who won’t make it.”

Here’s a link to his web site. Least I can do since I’m probably not supposed to be stealing his quote. Note that he offers some free material I recommend.

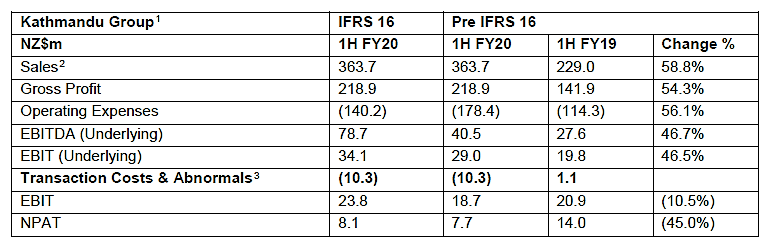

Let’s look at a few income statement numbers for the 6 months anyway, for old times’ sake. The numbers are in New Zealand dollars. Right at the moment, one U.S. dollar will buy you 1.64 New Zealand dollars.

IFRS 16 is a new accounting standard adopted during these six months. Above, you can see the six months numbers with or without implementation of that standard. But here’s the headline. Sales rose by 58.8% but net profit after tax fell by 45% or so, depending on whether you include ISFR 16 or not.

Meanwhile, Rip Curl was included for 3 months and generated revenue of $134.9 million. They tell us that “Surf segment (Rip Curl) up 3.7%.” compared to last year’s six months when Kathmandu did not own Rip Curl. Without the Rip Cure revenue Kathmandu’s revenue for six months was flat. Rip Curl contributed $80.7 million in gross profit. The whole company’s gross profit was $218.9 million, so it actually fell very slightly without Rip Curl’s contribution.

Rip Curl also contributed $15.7 million to EBIT, which means Kathmandu’s six-month EBIT would have been lower than in the same period last year if not for the impact of Rip Curl.

This is pre virus, and it’s not a strong result. Meanwhile, CEO Xavier Simonet seemed to be positively radiant over these results.

“Over the half year the acquisition of Rip Curl underpinned a significant increase in our scale and substantially diversified our revenue and earnings streams. At the same time, we were able to continue growing organically given our strong customer engagement, unique products and well-known brands.”

Later he says, ““Sufficient inventory levels are in place for the forthcoming season for all brands, assisted by the longer lead time of technical product categories, and a diversified supplier base.”

“While we are acting to limit the impacts of the COVID-19 pandemic, our long-term strategy does not change. We are striving to be a global outdoor and action sports company underpinned by iconic brands, technical products and a focus on sustainability. In Kathmandu, Oboz, and Rip Curl, we believe that we have authentic and inspirational brands that will attract loyal customers for the long-term.”

Unless Kathmandu is different from other companies, that inventory level has gone from a positive to a negative and the idea that their long-term strategy will not change may, conceivably, be true, but I kind of doubt it. Everybody’s long-term strategy is going to change, though I grant you we don’t know how yet. These comments, by the way, are from April 1st.

Footnote 16 in the financial statements is called “Going Concern and the Impact of Covid-19.” In it, Kathmandu describes the potential impact of the virus and the steps it’s taking- not that much different from what other companies are doing and good for them for getting on it.

Even with these steps, the company expects to “…breach its bank covenants within the immediate future.” The proposed solution?

“The Directors have therefore decided to proceed with a capital raise to provide sufficient liquidity headroom given the uncertainty of future earnings presented with the COVID-19 situation. In addition, the Group has sought support from its banking syndicate in the form of a waiver of current covenant measurements until the 31 July 2021 measurement point and is renegotiating the terms of its banking facilities. The covenant waiver is dependent on the successful completion of the proposed capital raise by April 2020.”

This has got to be the worse time ever in the history of the world since the universe was created to be selling equity.

The footnote continues:

“Having taken these actions the Directors have concluded that it is appropriate that these financial statements are prepared on a going concern basis. However, it is acknowledged that there are material uncertainties with respect to the Group successfully renegotiating revised terms on its banking facilities, forecasting revenue in the COVID-19 environment, whether the capital raise can be achieved and whether the amount raised is sufficient to meet the Group’s funding requirements for the next 12 months.”

“The Directors acknowledge that if the Group does not complete its capital raise and successfully renegotiate revised terms on its banking facilities or is unable to secure alternative funding then the going concern assumption may not be appropriate. These matters therefore indicate that there is a material uncertainty that may cast significant doubt on the Group’s ability to continue as a going concern and, therefore, that it may be unable to realize its assets and discharge its liabilities in the normal course of business.”

It’s not a slam dunk to do the equity raise and if they can’t things could go seriously south. If you follow this link, you’ll see as of April 1st that Kathmandu’s largest shareholder, concerned with its own balance sheet, won’t be participating in the capital raise. As it turns out, institutions purchased $154 million of the $207 million offering. The rest is being made available to retail investors. It closes April 17.

I think it’s time to take a look at the yearend balance sheet. It’s a little hard to make a comparison between last January 31st and this January 31st because of the new accounting change and the acquisition of Rip Curl, but let’s try. Cash is up from $5 to $40 million. Receivables have risen from $11 to $81 million. Even with the Rip Curl deal, that seems a bit high to me. Inventories jumped from $130 to $255 million. Before the virus, they saw that as an appropriate level.

The current ratio has fallen from 2.06 times to 1.80 times. Long term debt, as a result of financing the Rip Curl acquisition, is up from $84 to $313 million, with the associated increase in interest expense on the income statement. Net financial expense was $9.5 million, up from $1.45 million in last year’s six months. But they’ve only had the Rip Curl associated debt for three months.

If I’d seen this balance sheet before the virus was inflicted on us and thought about the profit levels and increased interest expense, I think I would have been kind of indifferent to underwhelmed. But now, with stores closed etc., I can see why they need to raise some cash.

Any, after the presentation made during the conference call, the first question from an analyst is, “So just to summarize, have the banks held a gun to your head, or are you just being really conservative?” I wish they’d ask questions like that in U.S. conference calls.

Like most of our industry companies, Kathmandu is looking at too much inventory, closed stores, slashed revenues, possibly trouble collecting receivables and no idea when things will get better. I don’t know the size of the gun held to their head by the bank, but given their balance sheet, they needed to raise cash. And if it wasn’t urgent, they wouldn’t be doing it via equity now.

Go back to the start of this article and read the quote from Peter Boockvar again. It’s all about the balance sheet. Those with the strongest have the best chance to get through this. The longer it lasts, the stronger it needs to be.