At the risk of sounding like a broken record….oh, damn, do I need to explain that outdated cultural reference? You see, back in the day when there was something called a record…never mind.

Anyway, I’ve said this a lot. It can be hard to do the right thing for the brand and still meet the expectations for growth of a public company. But what it now sounds like is that Quiksilver management has figured out that if they don’t do right by their brands, they won’t have to worry about the public company issue.

Here’s how CEO Andy Mooney put it in the conference call:

“We listen to the issues that were important to a longtime course our partners and based on their feedback made several changes to better support their business. First we’re holding back and [not] opening additional owned and operated retail stores in the areas that could negatively affect their businesses. Second we’re substantially altering the form and substantially reducing the frequency of promotions in our branded Web sites. Going forward, we will conduct limited promotions solely in past season merchandise and entirely exclude technical products like wetsuits from any price promotion in our direct-to-consumer channels.”

“With the restructuring of the company essentially completes, I am looking forward to now spending time with core surfer skates specialty accounts around the globe and we continue to allocate the lion share of our company’s marketing resources to the specialty channel. In Q1 for example, we increased media spending by 40% in core surfers’ stake media as well as trade marketing in various forms.”

This is the first time I’ve heard Andy put this “thing of importance” as directly as he just did, and it’s about time. I think (and so do a lot of other people, if my conversations are any indication), that Quik has missed some opportunities in this area over the last year or so, and I’m really happy to apparently see them acknowledge and move to correct it.

Regular readers will know I expect this to not only improve brand equity but to help with gross margin and maybe eventually allow some reduction in advertising and promotion expenses, or at least make what they do more effective.

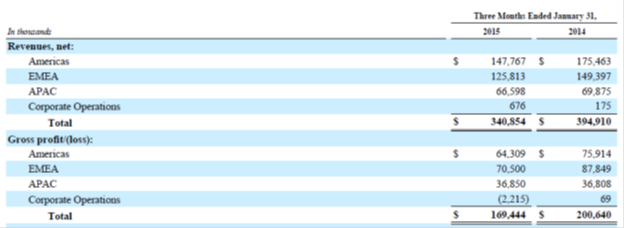

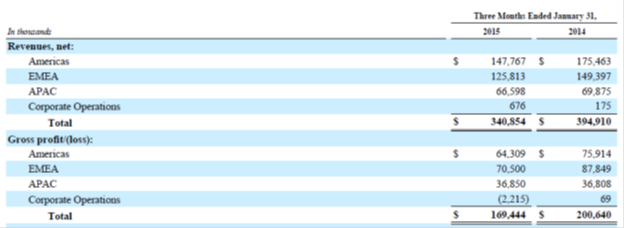

With that good news as background, let’s review the financial results for the quarter ended January 31. Before we jump into the explanations and adjustments, let’s look at the reported numbers.

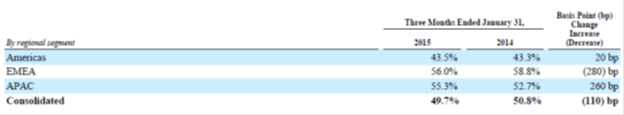

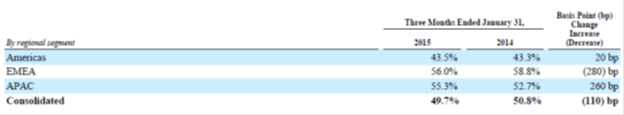

Revenues were down 13.4% from $395 to $341 million. The gross profit margin fell from 50.8% to 49.7%. Below are revenues and gross margin broken down by segment.

As you know, Quik licensed certain “peripheral” product categories in the Americas. There’s a chart on page 30 of the 10Q (here’s the link to the 10Q) that adjusts revenue for licensed product revenues as well as currency fluctuations. Licensed revenue during the quarter was $11 million compared to $1 million in last year’s quarter. Currency adjustments had a particularly significant impact in EMEA (Europe) because of the strengthening of the dollar against the Euro. It reduced reported revenue from that segment by $20 million.

In the Americas, “Net revenues on a constant currency continuing category basis decreased by $13 million, or 8%, due to a reduction in apparel category net revenues of $13 million in the Americas wholesale channel. Americas wholesale apparel net revenues decreased across all three core brands, but more significantly in the DC and Roxy brands.”

Ignoring currency impacts (which I’m reluctant to do if you’re a dollar investor) EMEA revenues fell just $3 million. “Net revenue on a constant currency continuing category basis decreased by $3 million, or 2%, primarily due to a reduction in apparel net revenues of $11 million in the wholesale channel. EMEA wholesale apparel net revenues decreased across all three core brands, but more significantly in the Quiksilver and Roxy brands.” Russia was down 29% as reported, but up 13% on a constant currency basis. Nothing like collapsing oil prices and economic sanctions to do a currency in.

The Quiksilver brand revenue was $141 million. It fell $23 million or 14% as reported. Ignoring the impact of currency and licensed products, it was down $6 million, or 4%. Roxy revenue was $100 million. It was down $18 million or 15%. Ignoring currency and licensing, it fell $7 million, or 7%. DC was down $14 million or 14% as reported to $89 million. Ignoring the usual, it was down $3 million or 3%.

Reported wholesale revenues fell from $211 to $192 million. Retail was constant at $119 million. Ecommerce revenues rose from $22 to $27 million.

The overall decline in gross margin “…was primarily due to unfavorable foreign currency exchange rate impacts (approximately 130 basis points), increased discounting in the Americas and EMEA wholesale channels (approximately 70 basis points), and increased air freight and other distribution costs associated with the U.S. West Coast port dispute (approximately 20 basis points), partially offset by net revenue growth from our higher margin direct-to-consumer channels (approximately 110 basis points).”

Here’s how it changed by region as reported.

Consistent with the revenue decline, SG&A fell from $204 to $171 million. As a percentage of revenue it was down from 51.6% of revenue to 50%. Remember that foreign expenses decline when the home currency appreciates. That impact was a positive $13 million for Quik during the quarter. Also, “Restructuring and special charges reflect a gain of $1 million versus a $6 million expense in the prior year period.”

Operating income improved from a loss of $4.03 million to a loss of $1.32 million. Below is operating income by region for the two periods. 2015 is on the left.

The next line troubles me. Interest expense was $18.4 million, an improvement from the $19.4 million in last year’s quarter, but still a sizable amount. What happens to Quik and other companies when interest rates finally rise? It depends on each company’s debt structure.

Due to all that interest, the loss before taxes was $20.4 million, compared to $26.3 million in last year’s quarter. Tax benefits gets us to a loss from continuing operations of $18.3 million compared to a loss of $21.9 million in last year’s quarter.

As you are aware, Quik has sold a number of businesses over the last year or so. In last year’s quarter those sales generated income of $37.6 million. The number in this year’s quarter was down to $6.7 million.

Lacking that big pop from discontinued operations, net income fell from a positive $15.7 million last year to a loss of $11.6 million in this year’s quarter.

The balance sheet has weakened from a year ago. Equity is down from $380 million to $26.6 million as a result of operating losses and non-cash asset and goodwill write downs. Total liabilities have declined only 5.2% from $1.221 to $1.157 billion with total debt making up $803 million, down from $828 million a year ago.

I’m encouraged by Quik’s apparent decision to refocus on brand building and support of specialty retailers and what I take to be their acknowledgement that it requires some caution is distribution and discounting. But the issue then becomes where does revenue growth come from? I’ve been asking that question since they completed the Rhone financing. As we’ve seen with other brands, getting your distribution and brand position right can cost you some sales in the short term.

In the 10-Q Quik notes they anticipate “Year-over-year net revenue comparisons continuing to be unfavorable due primarily to the impact of licensing and currency exchange rates. Within this trend, we expect the rate of year-over-year net revenue erosion to decrease in the North America and EMEA wholesale channels. Also, we expect continued net revenue growth in our emerging markets and our e-commerce channel.”

I hope at least part of that is due to their decision to support the specialty channel and that we see a positive impact on their income statement pretty quickly. At some point, a weak balance sheet doesn’t allow you to continue reporting losses.