How’s the Trade Show Business? Emerald Exposition’s Quarterly Results

Emerald didn’t report a great September 30 quarter. However, there are some mitigating factors. I’ll discuss those results and the factors below.

Before digging into the numbers, let’s focus on issues of strategy and tactics. Emerald’s previous CEO was resigned about a year ago. It happened suddenly and, to the outside world at least, unexpectedly. I wondered why but never was able to find out.

Now, I might have a glimmer. Sally Shankland has been President and CEO since June 2019. She used a presentation during the conference call to describe her actions since becoming CEO and the company’s new strategy. If you go to this link, scroll down a bit, and on the right, under “Third Quarter 2019 Earnings Call” click on “Earnings Presentation” you can see it for yourself. I recommend reviewing the slides.

If you do that, you’ll notice three major things.

First, there is what the presentation described as a “New Management Team.” Everybody isn’t new, but there are at least three senior executive hires since Ms. Shankland came on board.

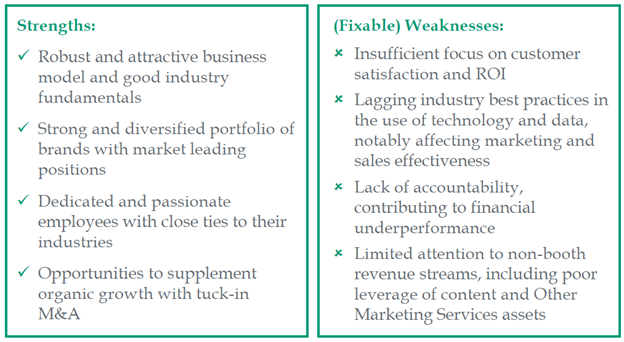

Second, take a look at the strength/weaknesses slide from the presentation below. There is more detail on each point in the presentation.

I can’t speak to the B to B trade show market outside of the active outdoor industry, but certainly the at least temporary cancellation of Interbike, the decision to consolidate two OR shows into the single end of January show in Denver with the Snow Show and what I see as the general industry desire to spend less money on trade shows suggest the first strength can be questioned in our industry.

I have no idea as to the dedication and passion of the employees. However, my experience in turnarounds (of which Emerald is surely one) makes me certain, given the weaknesses slide (more on that in a minute), that the employees must be happy and relieved to have new leaders acknowledging and addressing the weaknesses that I guarantee the employees all knew about.

Those weaknesses on the right side of the slide are, I agree, fixable. But as a group they are pretty staggering. The list runs the gamut of operations. Maybe 10 years ago when trade shows were “had to go to” events and when Emerald wasn’t a public company you could get away with this. But not now and I’m glad to see them getting on with it.

One of the outcomes of addressing these issues is the introduction of value pricing. As COO Brian Field puts it, “…this is research and analysis of live event pricing and promotion based on customers’ perceived values of available locations and packages.” They’ve already begun the value pricing process at six shows including OR and Surf Expo. They believe it can increase show revenue by four to eight percent.

For value pricing to work, the shows have to provide clear value. They are working to use what they describe as their “unlinked and underutilized” customer information. The idea is that “Bringing these types of data together allows for refinement in messaging, segmentation strategy and customer insights,” says COO Fields.

First, they have to identify the data. Then they have to develop the best ways to sort and access it. Then they have to look for insights. But booth revenues are two thirds of total revenue. CEO Shankland says she could “…see us in a place where our booth revenue is 50% of our total revenue. And the other half comes from conferences, from education, from sponsorships, from content marketing, from a whole list of things that we can be doing given the fact that we have a digital presence that we’re not offering today.”

Well, the digital presence not being offered is a little scary. But the real challenge is to take the insights they develop from their (long overdue) data mining and create value customers will pay for when the trend in our industry trade shows is to pay less.

The third thing I noticed, in both the presentation and the conference call, is what’s summarized in the last strength as “Opportunities to supplement organic growth with tuck-in M&A.” CEO Shankland puts it this way. “…we plan to continue to pursue M&A opportunities that make sense for us, which means where they meaningfully strengthen the existing business that we already own or where we bring considerable value to the acquisition that dramatically enhances the acquisitions growth trajectory. We will apply an even higher level of discipline and rigor to this process than we have in the past.”

When Emerald went public (May 2017) they presented the opportunity as a chance through acquisitions to roll up an industry with many small players. It was portrayed as a major focus. Now it’s not. That’s a good decision- especially if they can grow “non-booth revenue streams” as they are trying to do. Trade shows and conference events represented 83% of revenues in the nine months ended September 30.

Being public and having access to capital markets might make sense if you’re busily rolling up small players in a consolidating industry. If that isn’t the strategy anymore and you’re focused on operating better and generating non-booth revenues then perhaps you’d be better off as a private company.

Let’s spend a little time on the numbers.

Emerald currently operates 55 trade shows in additional to other conferences. Remember when looking at their balance sheet that they receive a bunch of cash for shows in advance of the event. They carry it as deferred revenue ($149.2 million at September 30) and don’t record it as income until the event is completed. Most of you reading this, including me unfortunately, don’t get cash for your product before you provide it.

Revenue was $75.6 million for the quarter, down $26.7% from $103.1 million in the same quarter last year. The reduction “…partly reflected a net $13.3 million reduction from several show scheduling differences in the third quarter of 2019, most notably Outdoor Retailer Summer Market, which staged in the second quarter of 2019 versus the third quarter of 2018. In addition, revenues for the quarter were further reduced by $7.1 million as our Surf Expo and ISS Orlando shows were forced to cancel due to the impact of Hurricane Dorian. We recorded the associated $6.1 million insurance settlement…as other income in the quarter. Further, acquisitions made in 2018 contributed $1.9 million of incremental revenue in the third quarter of 2019, while 2018 third quarter revenues included $5.3 million from discontinued events, primarily our Interbike show, which did not stage in 2019.”

They tell us that including these adjustments, organic revenue was down $3.7 million, or 4.4%.

Cost of revenue fell by $1.3 million compared to last year’s quarter to $24.6 million. SG&S expense rose 13.5% to $33.7 million. “The increase in selling, general and administrative expenses for the third quarter of 2019 reflected approximately $1.6 million in incremental costs from the 2018 Acquisitions and $1.2 million in higher non-recurring other items, offset by $0.6 million of lower costs attributable to show scheduling differences and $0.9 million in reduced costs related to discontinued events. The remaining $2.7 million increase in 2019 partly reflected additional senior management costs and incremental investment initiatives.”

There were also asset impairment charges of $26.3 million. There were none in last year’s quarter. “The impairment charges were due to a decline in fair value compared to the carrying value of goodwill, certain trade names and certain customer-related intangible assets, which were primarily driven by changes to future forecasted performance and decline in our stock price, which management deemed a triggering event and requiring quantitative analysis.”

Yes, it’s a noncash charge. But you can see it implies a decline in future performance so it’s very real.

Pretax income was a loss of $23.3 million, compared to a pretax profit of $28.8 million in last year’s quarter. For the nine months ending the same date, pretax income was $28.5 million, down from $86.7 million in last year’s nine months.

Sounds like the new management team is doing the right things and is fundamentally changing the business model. I haven’t been following Emerald Exposition every quarter, but I think I’ll start. This should be intriguing.