Hibbett Sports, Inc: “At the end of the second quarter of Fiscal 2018, we successfully launched our e-commerce website.” Wait- What? That Can’t Be Right.

From time to time, just for fun, I review public filings of companies I haven’t written about. Hibbett Sports, with 1059 stores in 35 states at the end of their August 4th quarter, is one of those companies. The quote in the title got my attention, to put it mildly.

It’s not quite as bad as it sounds, because their fiscal 2018 2nd quarter was a year ago. Here’s a link to their web site. Everybody, even Hibbett management, will concede they are way behind the internet/e-commerce/omnichannel curve. How might this have happened and what are they doing about it?

Here’s how they describe themselves.

Hibbett Sports, Inc. is a leading athletic-inspired fashion retailer primarily located in small and mid-sized communities across the country. Founded in 1945, Hibbett stores have a history of convenient locations, personalized customer service and access to apparel, equipment and coveted footwear from top brands like Nike, Under Armour and Adidas…As of August 4, 2018, we operated a total of 1,059 retail stores in 35 states…

The Hibbett Sports store is our primary retail format and is an approximately 5,000 square foot store located primarily in strip centers which are usually near a major chain retailer such as a Wal-Mart store. Our Hibbett Sports store base consisted of 820 stores located in strip centers, 27 free-standing stores and 212 enclosed mall locations as of August 4, 2018.

Our primary strategy is to provide underserved markets a broad assortment of quality brand name footwear, apparel, accessories and athletic equipment at competitive prices in a conveniently located full-service environment. At the end of the second quarter of Fiscal 2018, we successfully launched our ecommerce website. We will continue to grow our online business aggressively, while continuing to enhance our stores to improve the overall customer experience. We believe that the breadth and depth of our brand name merchandise consistently exceeds the product selection carried by most of our competitors, particularly in our smaller markets. Many of these brand name products are highly technical and require expert sales assistance. We continuously educate our sales staff on new products and trends through coordinated efforts with our vendors.

There are a few phrases in that lengthy quote I’ll come back to.

- “…located in small and mid-sized communities…”

- “…provide underserved markets a broad assortment of quality brand name footwear, apparel, accessories and athletic equipment at competitive prices in a conveniently located full-service environment.”

- “…the breadth and depth of our brand name merchandise consistently exceeds the product selection carried by most of our competitors, particularly in our smaller markets”

- “Many of these brand name products are highly technical and require expert sales assistance…”

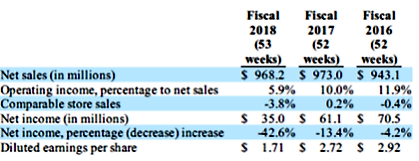

First, let’s look at their numbers to provide an introduction to Hibbett. Below is a chart from their most recent 10-K that gives summary income statement numbers for the last three years.

The most recent fiscal year ended February 2, 2018. As you see, sales and comparable store sales haven’t performed well, and net income is down a bunch. Note that the most recent year was a 53-week year, which adds a week’s worth of revenue ($16.9 million) compared to the prior two 52 week years.

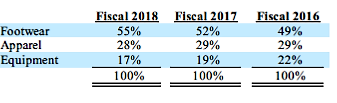

Here’s the breakdown of their revenue. They are increasingly footwear focused.

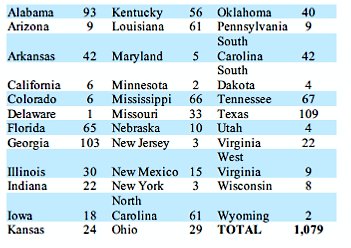

Below is a breakdown their store locations as of February 2nd. Texas and Georgia have the most stores. There are only 6 in California and none up here in the Northwest. The Northeast is also underrepresented. At the end of their February 1, 2014 fiscal year, they had 927 stores. At the end of their most current fiscal year, the number had risen 16.4% to 1,079.

The balance sheet at August 4, 2018 was pretty solid. $120 million in cash, inventory down 10.1% compared to a year ago even with quarter over quarter sales growth of 12.3%. Solid current ratio, no long-term debt. For the 26 weeks ended August 4, cash provided by operations was $62.5 million, up from $57.2 million in the same period the previous year.

Now that we’ve been introduced to Hibbett properly, Let’s get back to the phrases I pulled from the quote and try to figure out why Hibbett is so far behind the curb in e-commerce. They know they are, and their first listed risk factor is, “If we are unable to successfully maintain a relevant omni-channel experience for our customers, we may not be able to compete effectively and our sales and profitability may be adversely affected.” That’s from their 10-K from last February. It ought to say “implement” instead of “maintain.”

SGB Executive had an interesting interview with Hibbett management focusing on their e-commerce efforts. You can read it here. Hibbett has just launched “buy online, pick up in store” as part of their omnichannel efforts.

How does a large retailer get so far behind on something this fundamental?

Profitability and a strong balance sheet can have something to do with it. It reduces the sense of urgency, I guess. As you know, my point of view is that being profitable and having a great balance sheet are requirements for addressing the changing retail environment- not a reason to avoid it.

Perhaps that their stores are in smaller, under served communities has something to do with how they thought about e-commerce. I can understand that, but the definition of “under served” has changed in the days of the internet, Amazon, and endless places to get information on and buy anything.

I also question whether the “breadth and depth” of their merchandise is better than that of their competitors in the modern retail environment. I guess that depends on how they define their “competitors.”

Overall, their description of their business and competitive positioning with particular focus on smaller, underserved markets was valid- even insightful- in the brick and mortar environment of some years ago. That customers belonging to their loyalty program generate 60% of their transactions says to me it’s still important.

They are running as hard as they can to catch up with the online world but have a way to go. E-commerce sales represented 8% of revenue in the most recent quarter, and “the bulk” of their online orders are fulfilled from stores. I don’t know how much “the bulk” is.

Apparently, they used their web site to get rid of clearance product. That’s partly responsible for the decline in inventory. Hopefully, they’re through that problem and have realized that using their web site for too many closeouts can have a negative impact on the Hibbett brand. Management also talks in the conference call about e-commerce sales separately from brick and mortar. Encouraged by the analysts they talk about a $70 million in revenue breakeven for e-commerce.

The best retailers resist distinguishing between e-commerce and brick and mortar revenues, recognizing that there’s only one revenue stream. With total revenue declining in the last complete year, it’s kind of pyric victory for Hibbett to talk about a break even in e-commerce. An online sale that comes at the expense of a brick and mortar sale doesn’t help you. As most players have figured out, you end up with the same revenue but more cost.

Hibbett seems to be making some technical progress, though they’ve got a ways to go. Perhaps more importantly, it sounds like they require an attitude adjustment. I’ll feel way better about Hibbett once management sounds focused on how the integration of online and brick and mortar into a single revenue stream meeting customer requirements. Until then, I’m going to think of their e-commerce efforts as reactive and defensive.