Here’s what I said six months ago about Billabong:

“Six months ago [talking about a year ago], reporting on Billabong’s results for the whole year, I said this was a challenging turnaround, Billabong was doing things right, they were starting to see results, but the market was tough, and implementing their plan was taking longer and costing more (perhaps because it’s taking longer) than they’d initially expected. That’s all still true…”

And it’s still, still true as we review the results for the year ended June 30, 2017. I thought the delay was especially highlighted in Billabong’s July 28 “Omni Update” press release where they noted they’d “…terminated the agreement with the Omni-channel solution provider…” and taken a write down of AU $11.7 million as a result. Billabong continues to try and change the engine oil while driving the car. Tough task- but it’s what they have to do.

Highlighting a Strategic Issue

I don’t know why this has escaped me until now. I want to highlight Billabong’s description of their business from the Directors’ Report. Here’s what they say.

“During the year the principal continuing activities of the Group consisted of the wholesaling and retailing of surf, skate, snow and sports apparel, accessories and hardware, and the licensing of the Group trademarks to specified regions of the world.”

The company has focused, since Neil Fiske became CEO, on its three most significant brands; Billabong, Element and RVCA. They sold Tiger Lily in April and, as I’ve said before, I won’t be surprised to see the sale of other small brands.

Here’s my question/concern. Does Billabong see themselves as an action sports company? The statement suggests they do, though they hedge a bit. The real action sports industry, I’ve argued and believe, is small. Yes, in the pre-Great Recession days it seemed, and maybe was, a lot larger, the beneficiary of a burst of debt created growth and cash flow.

Today I don’t think the real action sports market is large enough to support a public company. Element is a skate brand, Billabong a surf brand. RVCA is both skate and surf influenced. Pretty sure Neil and his team already know this. That’s why they focus on the three brands. Their goal is- it has to be- extending these brands into the broader active outdoor market.

Anybody with a sense of the history of the action sports market knows how hard that is. The further you get from your core market (whatever that word means), the harder it is to compete. The new customers you want to entice may know your brand, but they don’t know your story, I’ve been saying for years. If your product is differentiated only by your story and brand (product, I’m sorry to say, is hard to make truly different in this industry) you will have a growing competitive challenge the further you get from your core.

If then, you should happen to go to Billabong’s investor web site and look at page six of their 4G for the year you’d probably be impressed, as I am, by the seven strategic initiatives they’ve been following since Neil became CEO. If you delved deeper into the details they provide there and on their presentation (also available on the web page) you’d see they’ve made progress in sourcing, logistics, expense control and of other areas.

Good stuff. But it’s the stuff successful industry companies are doing. It’s necessary but not sufficient to compete.

But if you go to that chart on page six, you’ll see the first strategic initiative is “Brand.” As it should be. On page eight, where they list their Material Risks, the first one is “Brand.” Also as it should be. It defines the risk as, “Possible damage or loss of market appeal to the brands or the image of the Group’s brands.”

As you think about Billabong’s potential one question should be foremost in your mind; can they establish their brands in the broader market. Let’s look at some numbers.

Financial Results

For the year ended June 30, Billabong reported an 8.9% decline in revenue from $1,076 to $979 million (All numbers in Australian dollars). Australia generated 63% of Asia Pacific revenues, the same as in the pcp. The U.S. was 85% of the Americas, down 1% from the pcp. France was 88% of Europe’s revenues, up from 86% in the pcp. That’s quite a concentration. Hope it’s indicative of an opportunity elsewhere in Europe.

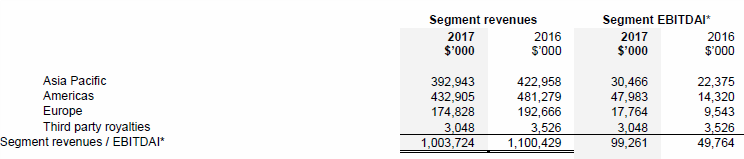

The chart below shows revenues and EDITDAI by segment for both years. These are the “as reported” numbers including the so called significant items and discontinued operations.

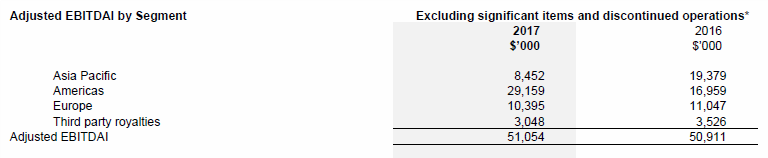

Here are the EBITDAI numbers excluding the significant items and discontinued operations.

Significant items this year totaled $64.5 million, up from $7.6 million in the pcp. I remember last year hoping we were done with these big write downs. Oh well. The two you should particularly know about are a gain of $47.8 million on the sale of Tigerlily, and impairment charges for goodwill, brands and other intangibles of $106.4 million.

Even with the decline in revenue, the adjusted EBITDAI rose if only a tiny bit. I hope that’s partly indicative of some success in brand building.

Billabong ended the year with 372 retails stores- 49 in North America, 104 in Europe, 105 in Australia, 26 in New Zealand, 46 in Japan and 27 in South Africa. They had 407 stores at the end of the pcp. Retail was 45% of Billabong’s total revenue, up from 43% in the pcp. Ecommerce revenues rose 22% and represented 4.7% of total revenue, or $46 million. They grew $8.3 million since the pcp.

The gross margin rose from 50.2% in the prior calendar period (pcp) to 51.1% in the most recent year. SG&A expenses were reduced 11.2% from $410 to $364 million. Other expenses rose from $120 to $222 million. Financing expense fell 10% from $43 to $38 million.

There was a loss from continuing operations of $130 million, up from $30 million in the prior calendar period. The net loss for the year was $77 million, up from a loss of $23.7 million in the pcp.

The current ratio on the balance sheet improved slightly from 2.29 2.42. Cash was down 20% from $89 to $72 million. Inventories fell 11% from $183 to $162 million, but revenue was down as well. They reduced their payables 12.6% from $173 to $151 million.

Long term debt was down 18.8% from $266 to $216 million as they used the proceeds from the Tigerlily sale to reduce it. However, total liabilities to equity rose from 1.93 to 2.30. Billabong paid about $16 million of the interest that was due during the year “in kind” rather than in cash. That is, it got added to the debt balance. The interest on the fixed term debt is 11.9%. Total equity fell from $253 to $175 million, or by 31% due to the loss and the asset write down. Net cash from operating activities was a positive $9.2 million after being negative $22.1 million in the pcp.

Between two and five years from now, Billabong has $259 in fixed rate debt maturing. Don’t know how much is in any individual year. I’d also note that as I write this, the stock closed its last trading day at $0.40 a share. There are 19.9 million issue options on Billabong shares at exercise prices between $1.23 and $2.50. Most of those options expire in 2020. I’m pretty sure the holders of those options would like to see the share price improve by then.

Data allowing us to compare the second half of the most recently ended year with the second half of the prior year is not provided. I’ve gone back and pulled out the top and bottom lines for the whole year and first half of the year so I can subtract and give us some numbers.

For the period January through June 2016, revenues were $538 million and the net loss was $22.4 million. For the period January through June 2017, revenues were $468 million (a 13% decline) and the net loss was $61 million. Not a particularly attractive half over half year result. No doubt if I didn’t have to go back, find the old reports, and subtract the first half from the whole year to get the second half I might be willing to get into more details and explain the how and why. Billabong, feel free to make that a little easier please.

We’re left with two important things to think about. First, how is Billabong doing in building brands that can grow revenues outside core markets? I think they are making some progress, but have no way to quantify that. Second, the debt repayment and option expiration schedules suggest there will be some additional pressure in the next couple of years to improve the bottom line results.

Can they grow fast enough to accomplish that but not so fast that they damage their brands’ competitive positioning? I suppose that’s what a management team gets paid to figure out.