VF’s 10Q for the quarter ended September showed another strong result. You can see the 10Q here. However, as with recent quarters, the good news was pretty much limited to their outdoor and action sport segment (OAS). I want to talk a bit about what that might mean, but first, let’s lay out the numbers.

VF’s revenue grew 6.8% from $3.3 to $3.52 billion. Gross margin rose from 47.6% to 48.3%. OAS has the highest gross margin of any of the company’s segments.

SG&A expense rose 8.1% from $0.989 to $1.069 billion. Operating income was $633 million, a 6.2% increase over the $580 million in last year’s quarter. At $20.7 million, net interest expense was almost unchanged. Net income rose from $434 to $471 million.

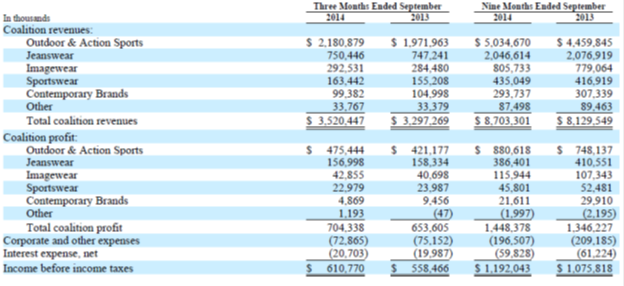

Okay, let’s break it down a little. Below is the chart from the 10Q that shows revenue and operating profit by segment- by coalition as they call their segments. I’ve included the information for both the quarter and the nine month period.

What do we see when we evaluate this chart? First, note that OAS revenues were up 10.6% for the quarter. Remember that total quarterly revenues for the whole company rose by 6.8%. That translates into a revenue increase of 1.1% for all the segments combined excluding OAS. So OAS saved the day for VF.

OAS represented 62% of total revenue for the quarter, up from 60% in last year’s quarter. And it generated 67.5% of all operating profits, up from 64.5% in last year’s quarter. OAS operating profit rose by 12.8% from $421 to $475 million, or by $54.2 million. Operating profits in all other segments combined actually fell slightly from $232.4 million to $228.9 million. That’s not good.

OAS, and especially The North Face, Vans, and Timberland, are the engines pulling this train right now. Their revenues grew by 9%, 12% and 15% respectively during the quarter. OAS revenues in the Americas, European and Asia Pacific regions were up, respectively, 11%, 10% and 13%. Direct to consumer (online and their own retail stores) rose 20%. Wholesale revenues were up 8%

Here are some comments from the conference call on brand performance. For The North Face, “In the Americas revenues were up at a low double-digit percentage rate with almost 30% growth in D2C and high single-digit growth in wholesale.”

In Europe, “…The North Face revenues increased at the low single-digit rate. Our wholesale business was essentially flat due to a combination of a sluggish outdoor retail environment and a shift in the timing of product shipments into the fourth quarter. However our D2C business was up nearly 30% in the quarter…” In Asia, North Face revenue rose “…at the mid-single digit rate.”

Now for Vans. “In the Americas, revenues increased at a high single-digit rate.” In Europe, “…revenue grew at the mid-teens rate with D2C growth of 25% and low double-digit increases in the wholesale business.”

“In Asia Vans revenue grew nearly 40% with China increasing more than 40%…”

And finally, Timberland. “Third quarter global revenues were up 15% driven by 18% wholesale growth and a 6% increase in D2C.”

“In the Americas, revenues were up 22% driven by more than 30% growth in the wholesale business. This growth, similar to the second quarter was very balanced across all products and channels…On the apparel side we continue to expand our distribution and see strong sell-through as our fall 2014 collection hits retail floors across our own and wholesale partner doors.” My guess is that Timberland has quite an opportunity in apparel.

“Timberland’s revenues in Europe were up 15% in the third quarter with balanced growth in both D2C and wholesale… In Asia, third quarter revenues increased at the low single digit rate.”

Not a word about Reef. That never surprises me, but I’m always disappointed.

For the whole company, direct to consumer revenues grew 16% quarter over quarter. VF ended the quarter with 1,333 retail stores with direct to consumer revenues representing 22% of total revenues. They expect add around 150 stores a year “…over the 2017 planning period.”

Here’s a quote from the 10Q about the company’s overall business. “VF reported revenue growth of 7% in both the third quarter and first nine months of 2014 [was] driven by growth in the Outdoor & Action Sports coalition, and continued strength in the international and direct-to-consumer businesses.”

I guess if I took the obverse of that, or maybe I mean the converse, it sort or says, “Our wholesale business in the Americas outside of OAS wasn’t specifically too good.”

The balance sheet is fine, and I won’t even risk putting readers to sleep by analyzing it. Current ratio, at 2.0, was the same as a year ago. I would note that inventory was up just 4%- less than the increase in sales. There’s a whole lot of money to be made in good inventory management and not just for VF. It is also, in my judgment, an important part of differentiating and building your brand.

All’s fine with VF as long as all’s fine with Vans, The North Face and Timberland. Some other OAS brands are doing fine we’re told, but those three are responsible for most of VF’s revenue and profit growth right now.

VF has 35 brands in total. They are interested in further acquisitions (because they’ve told us so in the conference call) and have been willing to sell brands that didn’t seem to have the potential they were looking for (most recently, John Varvatos in 2012). They are focused on OAS, they tell us, because that segment represents the best opportunity to increase revenue and gross margin.

The numbers we’ve reviewed above tell us there are some issues with certain brands in other of VF’s segments, though we can’t know exactly which brands. The 24 brands that are not part of OAS did not all grow revenue at 1% during the quarter. Some did better, some worse. It’s the nature, in fact the justification, for having a portfolio of brands that the overall portfolio can do well even when some brands aren’t performing. Over time, you can expect different brands to perform at different levels.

I’m wondering if VF, especially if they can find some attractive OAS acquisitions, might not consider selling some of these other brands that are apparently not performing.

Strategically, that’s what I’ll be watching at VF.

Rumors have been circulating that they would purchase the in trouble fox head apparel brand, with the notice that they are on the hunt for more OAS brands, this could give them something to focus on fixing.

Hi Geronimo,

I’ve heard the same rumors you have. And it would just make sense that VF might be interested. They like solid brands they can fix.

Thanks for the comment,

J.