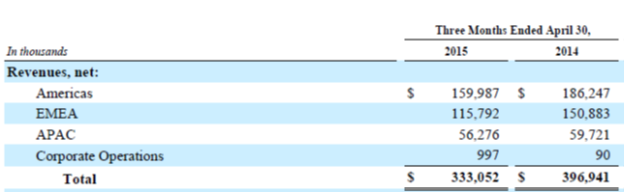

Quiksilver reported a loss of $37.6 million for the April 30 quarter compared to $60.9 million in last year’s quarter. Last year’s quarter included a loss of $23 million loss on discontinued operations. Ignoring that, the net losses are almost identical. Net revenue fell 16.1% from $397 to $333 million. The revenue results by operating segments are below.

As reported, the decline was 14% in the Americas, 23.2% in EMEA, and 5.77% in APAC.

The Quiksilver brand revenues fell 17% from $167 to $139 million. Roxy was down 13% from $120 to $105 million and DC dropped 21% (Yikes!) from $103 to $81 million. Across all three brands, currency was responsible for $44 million of the decline. We don’t get any discussion about how each brand is doing in various markets.

By channel, wholesale fell 20% from $286 to $230 million. Retail was down 6% from $89 to $84 million. Ecommerce declined 16% from $19 to $16 million. They think the ecommerce decline was due to their “…decision to significantly reduce the number of promotions and discounts online.” Good for them. No pain, no gain.

I want to discuss the licensing business briefly. CFO Thomas Chambolle notes that they are talking “…with our licensing partner and the idea was to take back the youth’s category in our core channel, and so we have done that nicely in the last few weeks.” From a branding and merchandising point of view, I was always cautious about licensing, and it doesn’t appear to have generated a lot of revenue so far for either Quik or the licensee.

I don’t know what “…take back the youth’s category in our core channel means.” Would Quik make youth product for core stores while the licensee made another line for Fred Meyer, etc.? But what really concerns me is that the licensing business hasn’t done better. I wonder why. Hopefully, it’s not that the brand wasn’t well accepted by consumers in those broader channels. If so, that’s a way bigger problem.

Gross margin fell from 48.9% to 47.1%. It was down only slightly in the Americas, from 42.3% to 42%. In EMEA it fell from 54.2% to 51.7%. The decline in APAC was from 55.9% to 53.1%. Currency had a significant impact in EMEA and APAC.

SG&A expenses were constant at 52.4% of revenues, but fell in dollar terms from $208 to $175 million. “Changes in foreign currency exchange rates contributed approximately $22 million of this decrease. The remaining $11 million decrease was primarily attributable to reduced bad debt expenses and employee compensation expenses.”

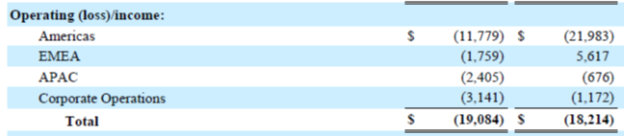

The operating loss rose from $18.2 to $19.1 million. Here are the numbers by segment.

Below the operating line we have interest expense of $18 million, down slightly from $19.2 million in last year’s quarter. I’m guessing that’s due to a stronger dollar. There was a foreign currency gain of $3.3 million compared to a loss of $887,000 last year.

I’m afraid we’re going to have to spend some time on the balance sheet. More than I usually spend. At the end of last year’s quarter total stockholder’s equity was $333 million. At April 30, 2015, it was a negative $14.6 million. At end of last year’s quarter cash, including $56 million of restricted cash, was $123.2 million. This year, it was $52.5 million.

Receivables were down 28.2% which you would expect with declining revenues. They were $252 million at quarter’s end. Inventories fell from $321 million at the end of last year’s quarter to $291 million this year. That’s a decline of 9.35%. They note in the conference call that inventory on hand increased by 10 days year-over-year. “We will continue to focus on reducing inventory to improve working capital in 2015.”

The current ratio is still more than two to one. Though down from last year, it’s still technically fine. Any debt/equity ratio you might want to calculate is meaningless given the negative equity.

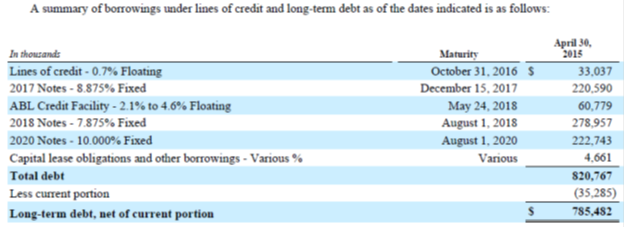

Okay, let’s dive into the debt situation a bit. Below is the chart from Note 10 of their 10-Q that lays out their debt position.

A year ago, long term debt net of current portion was $847 million, so the good news is that it’s down. Now note the $33 million debt that’s due October 31, 2016. Then focus on the $220.6 million due December 15, 2017. I know- that seems like a long ways off. But it’s close enough that an analyst thought he should ask about it. Here’s the question and answer.

Jim Duffy:

A couple questions around liquidity. I recognize there are challenges to profitability for 2015. As you continue to meet your interest expense obligations, can you speak to projections for availability of liquidity? Where would you expect the balance sheet to stand entering 2016?

Thomas Chambolle:

Our forecasts show that we have enough liquidity to get at least through the next 12 months. That assumes that we will renew our short-term facilities with French banks. We are already in conversation with them. So, that’s short-term facilities that we usually have to renew every year.

Jim Duffy:

Okay. Then, can you speak to some of the key financial strategies to manage capital structure and liquidity looking into 2016, and ahead of its position to refinance the €250 million notes for 2017?

Thomas Chambolle:

Yes, you know, we are considering all the opportunities to increase our liquidity for sure, but our main purpose remains executing our business strategy and to increase our profit and to be in good shape to be able to refinance in 2017.

What he says is that we have to do better so we can be in “good shape” to refinance. So the refinance is not a slam dunk. And if they don’t perform better, it might be tough. “Tough” can mean a wide spectrum of things.

A cash flow is a living breathing thing. You can massage it, push it, adjust it, manage it, talk nicely to it and make it work. Until you can’t. The “moment of truth” typically comes on you suddenly. Remember when Lehman Brothers was fine? Then they woke up one morning and nobody would roll over their short term debt and they had a cash flow problem. The same can happen to a company. They wake up one morning and a major supplier says, “You know, how about you pay cash before we ship you any more product because we’re a bit worried about your ability to pay. Don’t worry-we’ll give you discount.”

Suppliers, of course, talk and pretty soon others take the same approach because they don’t want to be left holding the bag. A cash flow that worked- by which I mean you can pay your ongoing bills in a timely manner- suddenly tops working when you lose terms from one or more major suppliers.

Does Quiksilver have this problem or one like it? Not as far as I know. But Jim Duffy is a bit concerned about liquidity. Me too.

Part of the reason I’m concerned is because Quik hasn’t given me any reason to believe that things will get better soon. In a section of the 10-Q called Known or Anticipated Trends they say, “Year-over-year net revenue and gross margin comparisons continuing to be unfavorable due primarily to the impact of currency exchange rates and licensing. We also expect our net revenues and margins to be unfavorably impacted by late deliveries and an evolving distribution channel strategy, particularly in North America and expect continued net revenue growth in our emerging markets.” They “…don’t expect our profit for the second half of the year to be much different than the first half of the year, but we think that all the improvements we have made will turn to meaningful profit improvements in 2016.”

Note they don’t say they expect to make a profit.

CEO Pierre Agnes notes that in additional to foreign exchange, the reason they have had to back off of their 2015 guidance is delivery issues.

Here’s why according to CEO Agnes:

To summarize, while there have been some positive structural changes over the last two years, there are still some critical areas that need to be addressed, and we have already moved quickly to make changes.

First, our planning and production processes are not operating efficiently yet and the impact on the entire supply chain continues to create delivery issues. Communication across the organization, process alignment and the use of the new tools, such as SAP and PLM, have not been acceptable and have not generated expected global improvements. This is mainly due to implementing so many major changes too fast. We have already begun to take actions to fix these issues, and we have already made significant progress in our IT globalization and ERP stabilization. However, delivery improvements will only be effective as of spring 2016, because of the product cycle calendar.

I can sympathize with Mr. Agnes. The extent of the changes they need to make, and the speed at which they tried to make them, inevitably meant some issues, surprises and dislocations. Yet nobody is saying they didn’t need to happen and a better question might be why changes, in whatever form they needed to take, weren’t in process before anybody ever heard the name “Andy Mooney.”

Greg Healy, Quik’s Global President and President of the America, tells us that Quik’s three priorities are people, enhanced sales quality and efficiency and reduced costs. Nothing wrong with those. In regards to sales quality he says, “…we need to focus on the quality of sales in North America to deliver more profitable margins, rather than just focus on top line growth.” Regular readers won’t be surprised to learn I think that’s a great idea. He continues: “To that end, our first priority is to earn back the trust and confidence of our core accounts,” and describes the process by which they are doing that.

Then he continues, “To be clear, our major accounts will also continue to play an important role in the future of our business here in North America. However, a core account serves an important consumer base that is all about authenticity. The incredible heritage and of our brands, combined with great product, is what will drive our overall success in North America.”

And this, I think, is where we pause to reflect. How do brands in our industry with roots in specific sports balance their positioning, distribution and growth requirements (especially as public companies) in a way that makes them credible and relevant along the whole customer chain? Quik isn’t the only company that has to figure this out.

Sinking ship. The comments on their last conference call told the story. It’s a story. There were many comments that sounded empty and hollow, like the attendants on the Titanic who already know the ship is sinking, but as they rearrange the deck chairs, give their perspectives on why they placed this chair here and that chair there. Mostly, I think their comments were last-ditch efforts to give investors the appearance that a valiant effort is being made to turn the ship around, but the analysts and investors aren’t buying the story, and the stock hit as low as .50 in the meantime. Maybe we should make that Greenwich mean time, as they always refer to when denoting Titanic.

Hi Big Guy,

Sorry for the delayed response. Been on vacation. I generally agree that things look grim for Quik. I still think the brands have value, but not enough to get Quik out from under it’s debt. As you know, I also think they have a hard time managing the brands how they need to be managed as a public company.

Thanks for the comment,

J.