Moss-Adams Capital is the mergers and acquisitions, capital raising, strategic advising arm of Moss-Adams LLC, which does accounting, wealth management and taxes. As you may be aware, they’ve been pretty active in our industry, whatever industry we’re now in. For some time, they’ve published a report that provides information on which deals have been recently completed at what prices. I’ve always reviewed it, but never highlighted it.

Now, it seems that they’ve expanded that report to include some good information on the size of and trends in the online market. This is definitely worth your time as it’s pretty short and includes some ideas and data you may find interesting. Thought provoking? Call to action? Downright scary?

Some of the ideas, hopefully, won’t be new to you, but it’s succinct enough that I bet it find its way into some of your planning and strategy discussions.

As we all struggle to figure just what the hell “omnichannel” means and what, exactly, we need to do about it, I’ve seen some companies find themselves in an uncomfortable defensive position. What I mean by that is that they spend a bunch of money on their online presence but the additional gross profit they generate doesn’t cover those costs.

Moss-Adams notes that online (including mobile) sales accounted for 7.3% of total U.S. retail sales in 2015 and two thirds of total retail sales growth that year. Obviously, if your brick and mortar sales should be down 7.3% but you’re up 7.3% in online sales but have all the additional costs associated with online (depending on the comparative gross margins) you’re in a bad place.

This, essentially, is why your engagement with the omni channel has to be the place where the whole is greater than the sum of its parts. You have to be online, but spending money to cannibalize your brick and mortar sales is completely defensive and maybe destructive.

Here’s the link to their report.

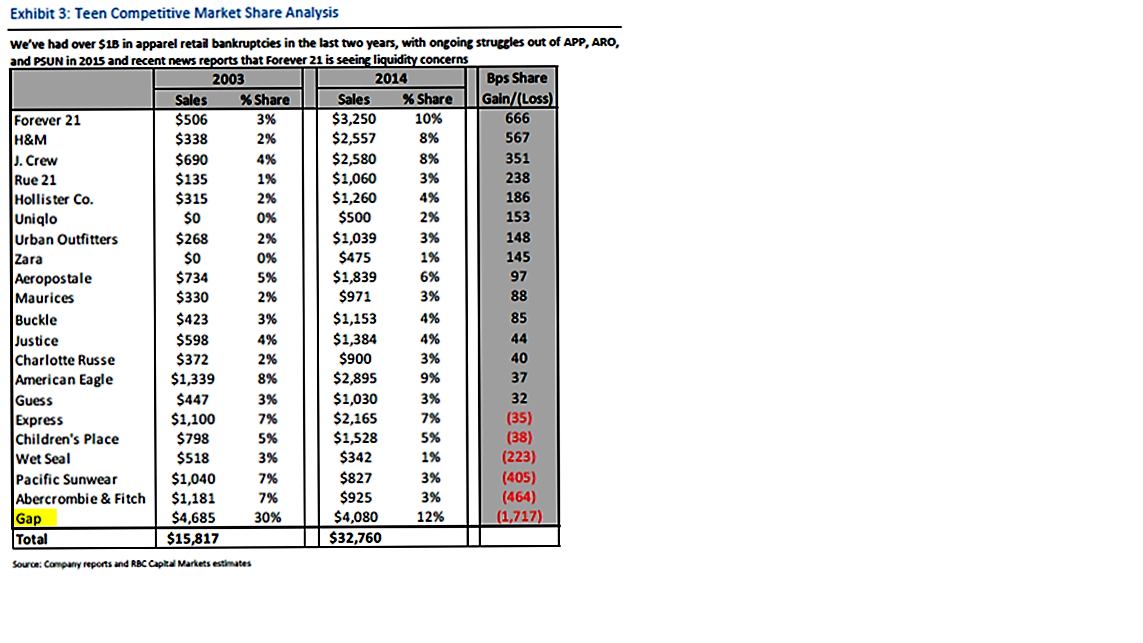

Meanwhile, I came across a chart with some information on the evolution of the teen retail market between 2003 and 2014. I imagine you’ll want to think about what it means. Though maybe it doesn’t have any deep meaning and is just good information. I got it from a free publication I get five days a week called The Daily Shot.