Retail Jobs, the Internet, and the Role of Customer Service

I want to introduce you to a web site I subscribe to called Wolf Street. It’s free and you can sign up for emails if you want. Here’s the link the chart below comes from. You don’t have to read Wolf’s article to follow what I’m discussing, but you might take a look at it.

If you did go through the article, you’d see that there were 15.8 million U.S. retail jobs at the end of April as reported by the Bureau of Labor Statistics. In terms of total number of jobs, that’s second only to health care at 15.9 million.

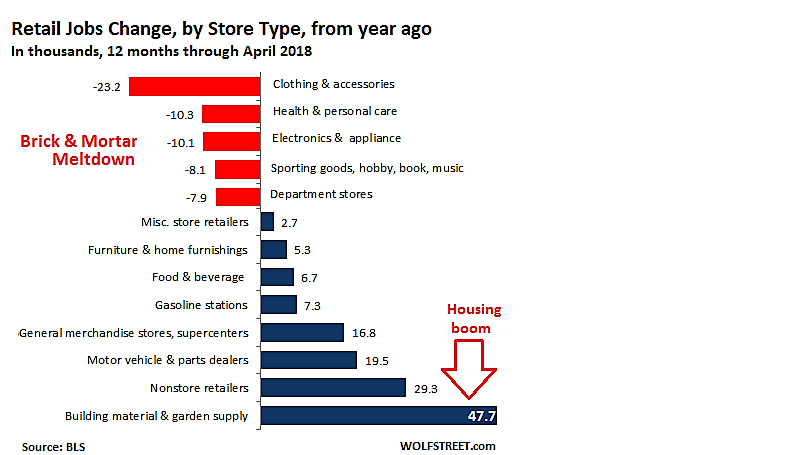

Retail has added 76,000 jobs in the last 12 months, the BLS tells us. From our more focused industry perspective, the picture is a bit different. Here’s the chart from Wolf’s article.

Look, I had my “Aw shit” moment when I saw this. But I’ve shaken it off and you should too.

First, it’s hardly a surprise. We’ve known for some time now that we were over retailed as a country and an industry. We’re going through an unpleasant but necessary process (The economist Schumpeter called it “creative destruction”) that I see ending with the next recession, whenever that happens.

Second, some part of the decline, as you can see above, is being offset by growth in ecommerce jobs- what the chart calls “Nonstore retailers.” That may not make you happy if you’re the business closing stores or going out of business, but I can assure you it makes the people getting those jobs happy.

Third, brick and mortar is obviously not going away. But it is evolving in response to the growth of ecommerce, improvements in distribution, and accelerating knowledge and connectivity among consumers. You can see in the chart it’s growing in those industries that don’t lend themselves to ecommerce and declining in those that do. Big surprise.

Fourth, talking about brick and mortar “declining” or “growing” misses the point. If you follow Tillys, The Buckle, Zumiez or other industry retailers you will certainly see a reduction in the rate at which they open stores or even, net of closings, no new stores openings.

Opening new stores, by itself, is no longer the obvious, standalone path to growing revenue and profitability. You know that. Retailers are struggling (a fair word I think) to figure out where to place stores, how to structure them, and what their role should be in an increasingly seamless, interconnected retail market.

Let me put this another way. If you forget about making a distinction between brick and mortar and ecommerce revenues, how do you use your store locations, budgets, staff and layouts to maximize the bottom line? What is a “store” and what is it supposed to do?

If you figured that out, based on your excellent and improving customer information systems, it might just be possible to improve revenue, or at least the bottom line, with fewer stores. I’m already certain it’s required, for both financial and customer relation reasons, that stores absorb much of what used to be thought of as the standalone ecommerce costs. Here’s why.

We’ve all known for years that ecommerce is expensive. The now obviously inadequate challenge I made years ago was to make sure your incremental operating profit from ecommerce operations at least covered those ecommerce costs and to not cannibalize your existing sales.

What I now know you need to do is make the issue of cannibalization irrelevant. The only way to do that is to have an organization structured to see no difference between online and instore sales and to place as much of the ecommerce cost structure as possible within the brick and mortar footprint. That might include, for example, eliminating any difference between ecommerce and brick and mortar inventory, making brick and mortar sales people responsible for the customer relationship online or in person, and no doubt a dozen other things I haven’t thought of. It’s already happening at many retailers.

If you do this well, can you grow your revenue? Probably. Can you reduce costs and improve the bottom line? Yes.

The very related activity I see changing is customer service. I started thinking harder about it when I read and pointed you to these articles on some emerging retail technologies, including 3D printing, and the millennials’ approach to money.

So what does the customer need you to do that we might call customer service?

Find and compare prices? Compare one brand with another? Locate the product? Understand features? Find out how the product wears/functions and what others think about it? Oops. That sounds more like the list of things they don’t need you to do any more. What should you do?

On May 3rd the FDRA (Footwear Distributors and Retailers of America) held an executive summit called Retail Footwear Revolution: Succeeding in the Age of Consumer Chaos. Good title- though it’s only chaos for the brands and retailers. The consumers are just fine.

Among the speakers was Footlocker CEO Dick Johnson. SGB Executive reported here on what he said. I couldn’t find a transcript. I strongly recommend you read it. It will resonate with all of you.

Among the interesting things he notes is that Footlocker has closed 1,000 stores in the last ten years, but overall square footage has grown. That, I think, is because the function of stores has changed. As he puts it, “…we’re building more exciting space.”

Also more expensive spaces I’m thinking. And just what does “exciting” mean? We all continue to try and figure that out.

The article continues, “Johnson said the discovery phase used to be heading to Foot Locker to find out ‘what was cool’ and that you ‘had to know the guy who knew the guy’ to find out about launch products. ‘Not anymore,’ said Johnson, ‘Discovery and researching happens constantly with our consumer. They know more than we know sometimes.’” Yes, they do.

The article notes that Footlocker is “…leveraging data to bring a higher level of personalization…Johnson said one of the biggest investments Foot Locker is making is in data, which is being used to drive messaging, merchandise decisions on its website and stores, product buys and even service levels and the overall customer experience. The focus is on tapping algorithms and machine learning ‘so we can learn faster’ and more quickly adapt toward where consumer preferences are heading.”

Wow. Is that customer service or customer management? Consumers, I’ve written, have found themselves in control. Retailers and brands want to (have to) respond to consumer demands, but it feels like they are also trying to get some of that control back. I don’t blame them.

Finally, the article reports, “Foot Locker plans to invest in local content and local artists to ‘change the way that people think about our stores.’ More experiences, such as bringing in a barber chair for a special promotion, or offering sneaker cleaning on certain days in exchange for loyalty points, will help local stores stand out. Data will be tapped to ensure marketing and product assortments are tailored to local tastes. Said Johnson, ‘Not every market is treated the same.’”

Can you, then, have hundreds and hundreds of stores and each of them, to a greater or lesser extent based on improving data, each act as a specialty store? That certainly seems like what Footlocker (and other retailers) is trying to do.

People will still want to come to brick and mortar stores, though perhaps not so many, not so often, and for different reasons. Customer service does not mean what it used to mean unless you have a product that’s distinctive and somewhat scarce. As I talk with executives and read what they say, I find them very specific about the problems, but often speaking in generalities about the solutions. Like I said, we’re all still trying to figure it out and, if we think we have, don’t want to tell our competitors.

Do two things for me. First recognize the difficult economic process we’re going through and prepare for it. Some people I talk with don’t precisely want a recession, but some part of them wants to get on with it to perhaps come out the other side and complete this consolidation. I’m generally in that boat.

Second, think hard about customer service. You can’t afford to do all the things you used to do in the same way and do all the new things the consumer wants you to do. If only financially a transition is necessary.

On a personal note, I’m just back from two weeks in Tuscany with my wife. Good food, good wine, nice people, beautiful country. Recommend not driving in hill towns.

I started this article in Tuscany when the jet lag started to wear off. I’m finishing it at home where the jet lag has not worn off. Moan. Maybe I need to proof read this after my nap. Thank you for reading. I really feel lucky you’re willing to spend a few minutes on my ideas and always look forward to your comments.