Billabong published its results for the year ended June 30th last week. The headline numbers (all numbers in Australian dollars) are revenue from continuing operations of $1.10 billion and a net loss after tax of $23.7 million. The numbers for last year (pcp- prior calendar period) were revenue of $1.06 billion and a profit of $4.15 million. Pretax loss actually declined from $20.2 to $15.9 million. Those are the numbers from the consolidated income statement.

However, those summary numbers are not the whole story. There are the usual discussions to be had and adjustments to be made (or not) with regards to taxes, exchange rates, discontinued and sold operations and the inclusion or exclusion of the “significant” items. Before we have fun with all that, how about we take a moment and look at Billabong’s overall situation? It’s kind of like I’m doing my conclusion first, but I think having this stuff in mind will help you understand Billabong’s challenges and opportunities when we start to get down into some of the weeds.

There are four things I want you to recognize:

- This is a tough turnaround. They are doing the right things, they are making progress and we’re starting to see results. But it is complex and all-encompassing and, I hypothesize based on my own turnaround experience, taking longer than CEO Neil Fiske thought it would take when he took the job. Someday, I hope to have the chance to ask him about that.

- The economy and business environment sucks pretty much worldwide. Industry CEO’s are putting it perhaps a bit more eloquently than I just did, but they are all saying the same thing. And they are right.

- All the actions Billabong is taking are mostly the same things other industry brands are doing. Billabong has an advantage in being a relatively large company. However, they are still selling product which it is hard to argue is fundamentally “better” or “different” than that of their competitors.

- Product differentiation for Billabong and most industry companies is based on branding. In today’s environment, thoughtful and cautious distribution is a critical component of branding. As I’ve written to the point where you’re probably tired of hearing it, that implies a focus on the bottom, rather than the top, line. That’s fine for a private company, but harder for a public one.

So there you have it. Now, let’s visit those weeds.

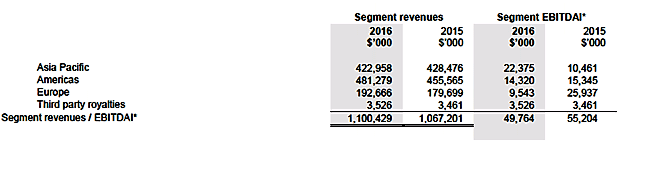

First we’ll start with revenue and EBITDA by geographic segments as reported for both years.

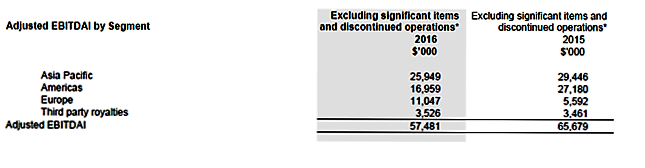

Next, here are the segment EBITD “Excluding significant items and discontinued operations.”

Before I go any further, those of you who loves weeds can go to Billabong’s investor home page, and click on “Preliminary Final Report & Full Year Statutory Accounts” under “Featured Reports” if you want more information than I give. The charts above are from page 3. I’ll provide some additional page numbers as I go along.

Where to begin? I guess I’ll start by reminding you that I’m at least cautious about removing items from financial statements that are actually part of the year’s results. Cautious is how I characterize it when I’m in a charitable mood, which I guess I am today. You see, these things actually happened. They actually cost or earned the company money. Next year, there will be more of them. They may be larger or smaller, different or the same, but they will happen.

Management (of any company) will argue that the adjustments provide a better picture of ongoing operations. There’s some truth in that, but I still don’t feel comfortable with it because I don’t understand the process by which things are either included or excluded.

Billabong does a pretty good job of distinguishing between the statutory and adjusted numbers (though it does introduce a certain complexity into reviewing their results). I won’t tell you to ignore the adjusted numbers, but I’d be cautious in using them.

You can see in the charts above that the EBITDA for both years looks better after the adjustments.

The discontinued operations are SurfStitch and Swell, which Billabong owned for part of fiscal 2015. The report tells us that “The results of Sector 9 did not meet the conditions under AASB 5 to be disclosed as a discontinued operation during the year ended 30 June 2016 and are therefore included in the above figures.” We’re told in the conference call presentation that Sector 9 accounted for $4.5 million of the EBITDA decline.

The significant items had a positive impact on profit before of tax of $7.6 million this year and $11.0 million last year. Pages 48 to 50 for those of you who want to see the breakdown. Good to see that number declining.

Let’s continue to look at the segments focusing on the legally required, statutory numbers- Australia’s equivalent to GAAP in the U.S. In Asia Pacific, Australia represented 63% of revenue, down from 65% in the pcp. The United States generated 86% of revenue in the Americas segment, up from 84%. France was 86% of revenues in Europe, also up from 84% in the pcp.

43% of total revenue was from retail. It does not distinguish between brick and mortar and online, so I assume it’s both. It was 65% in Asia, 26% in the Americas, and 38% in Europe. Billabong ended the year with 407 stores worldwide.

Continuing to talk about retail, we’re told in the presentation that accompanied the conference call that comparable retail revenue (brick and mortar and ecommerce) rose 1.8%. However, comparable brick and mortar by itself fell 2.0%. Ecommerce sales were up 52%. The slide says that “ecommerce as a % of sales” was 3.8%. I can’t tell if that’s 3.8% of retail sales or of total revenue. In any event, they acknowledge that they’ve got some growth opportunities in ecommerce. The trick, always and for everybody, is to grow it without hurting your brick and mortar revenues.

In the same presentation we’ve got a chart that shows that the Big 3 brands (Billabong, Element and RVCA) grew by a combined 5.3% globally in constant currency. Billabong grew 1.9%, RVCA 18.1%, and Element 5.3%.

But now we come to a bit of a conundrum. The chart showing this says, “Wholesale Equivalent Sales by Brand*). I have no idea what wholesale equivalent sales means so you can imagine my relief when I saw the asterisk that means it’s footnoted.

Unfortunately, the footnote defines it as, “Sales to external wholesale accounts and related retail.” I have no idea what that means either and there’s no footnote to the footnote. Nor could I find an explanation in any of the documents. So I emailed Billabong Investor Relations asking them, but so far haven’t heard back. I also checked with somebody in Australia who would be likely to know, but they can’t figure it out either.

I know what wholesale means. It’s sales of your branded product to a third party retailer. That’s easy. But wholesale to related retail? Does that mean what Billabong “sells” to its own retail stores?

Well, how does that work exactly? It’s not an arm’s length transaction. How is it decided how much of which product goes to which store? How’s the pricing set? When is it marked down? How are returns managed, whatever a return means when you’re returning it yourself? How are margins calculated and when is revenue booked? I’d really like to understand the accounting for this.

Certainly “sales” to your owned retail isn’t necessarily an indication of demand- at least not without a lot more information. I find myself confused about just how the big three brands are doing. I’m not necessarily against this wholesale to related retail concept, but it bothers me because they haven’t explained what it means.

The gross profit margin, calculated on revenue from continuing operations, fell from 53.1% to 50.9%. Interestingly, the statutory report, except for noting that the pcp gross margin would have been lower (52.7%) if “…adjusted for the impact of divestments…” says nothing about why the gross profit margin is lower. They expect it to improve in the second half “…with improvements in inventory and sourcing.”

We do learn in the presentation that exchange rate variations caused $17 million in product cost increases. How much of that flowed through to cost of goods sold for the recently completed year? Maybe they mean to say it all did, but I can’t tell.

SG&A expenses fell 3.25% from $429.6 to $415.6 million. The presentation notes that they had a $19.5 million reduction in the cost of doing business. Good to see some of their programs for expense reduction and efficiency taking hold.

Finance costs rose from $34.3 to $42.3 million. There was about a $4 million increase in interest expense and they wrote off capitalized borrowing costs of $3.6 million- a noncash charge. “The increase in net interest expense…was mainly driven by foreign exchange differences.” Hopefully, the time will come when they can refinance their expensive 12% debt. Billabong chose to pay $8.6 million of interest “in kind” rather than in cash. That is, it adds to the total debt outstanding.

The pretax loss, as I already told you, declined from $20.2 to $15.9 million. The tax provision, as they point out, is a little weird. Last year Billabong reported a tax benefit of $12.2 million. This year, even with a loss for the year, they had a statutory tax expense of $7.8 million. We’re told the cash cost was only $1 million. Overall, that’s a $20 million year over year negative change in their income tax expense that had a big impact on the bottom line.

On to the balance sheet (page 39). Current assets declined from $524 to $464 million, but that’s almost completely due to cash falling from $153 to $89 million. Receivables and inventory were pretty stable from a year ago. Billabong reminds us they had some problems with mostly U.S. inventory during the year but that it’s now solved.

Non-current assets are pretty much unchanged at $280 million, so the net decline in assets from $804 to $744 million is largely because of the decline in cash.

Current liabilities are down as well from $237 to $198 million. The largest component of the decline is a reduction in trade and other payables of $15 million and the elimination of a $20 million deferred payment. Part of the payables reduction is due “…to the Group’s supplier consolidation strategy.” The current ratio is pretty constant at 2.34 times.

Non-current liabilities are pretty constant at $287 million so total liabilities are down to $259 million due to the decline in current liabilities. Total equity fell from $282 to $259 million, but total liabilities to equity was effectively constant at 1.87 times.

The cash flow for the year shows a cash outflow from operating activities of $22 million, up from an outflow of $14.6 million last year.

Pages 6 and 7 of the statutory report outline Billabong’s strategies and activities. They are divided into seven parts: brand, product, marketing, omni-channel, supply chain, organization and financial discipline. They haven’t really changed. Feel free to read all about them yourself. The headline, as I indicated at the start, is that they are making progress and doing the right things. It’s taking longer than they hoped it would.

I’ll stick, then, with the four points I made at the start of the article, but add a couple of more. First, I’m expecting the sale of some additional brands. I don’t have any specific information about sales. But aside from believing that focus on their three largest brands is the correct strategy, I don’t think Billabong’s balance sheet supports the investment required to grow them all.

Second, I’ll watch with interest what happens with Element. It’s a core skate brand which Billabong has seen, since it was purchased all those years ago, as an opportunity to get into the apparel business. It’s not that Billabong is against selling hard goods, but it’s not what they do. They are an apparel company. Success, then, means expanding Element outside of the core market while keeping it credible in that market. As I’ve written about many brands, that’s not an easy thing to do these days.

Third, the “Wholesale Equivalent Sales by Brand” thing bothers me because I don’t know what it means. I’m not saying it’s good or bad. I’m just saying I don’t understand it and it makes it hard for me to evaluate how the big three are doing. If Billabong gets back to me with an explanation, I’ll make sure you see it.

Fourth, I would have expected to have seen more overall growth in the Billabong brand. The company has been pretty explicit about how well it’s doing, and I just would have expected more visible growth.

So, a tough turnaround in a difficult market is getting some traction and the company is doing the right things, but it’s taking longer than expected. And that’s the story.