VF reported a 4.62% revenue increase in the quarter that ended June 30 compared to the same quarter last year (prior calendar period- PCP). The increase was from $2.402 to $2.514 billion. As usual, we’ll focus on the Outdoor & Action Sports (OAS) segment, as that’s where most of the action seems to be.

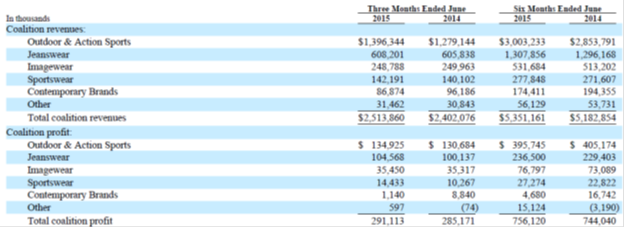

Below is the chart from the 10Q that lays out the revenues and operating profits of each of VF’s segments for the quarter and the half year.

What you’ll notice right away is that revenues in OAS rose 9.15% from $1.279 to $1.396 billion during the quarter. As that percentage increase is way more than the increase for the whole company, it’s clear that the net revenue of the other segments combined was down and you see that in the numbers above. But not by much. The decline was only half a percent, from $1.123 to $1.117 billion.

VF had 1,438 retail stores at the end of the quarter.

OAS accounted for 55.5% of total revenues in the quarter, up from 53.2% in the PCP. You’ll also see that OAS produced 46.3% of the company’s total operating profit, up from 45.8% in the PCP. In spite of the revenue declines in the other segments combined, their operating profit also rose, though just by 1.1%, from $154.5 to $156.2 million.

As is true for most companies that operate internationally, the dollar’s strength had a major impact. VF’s overall quarterly revenues were 5% lower than they would have been with constant currencies in the PCP. For OAS, it was 7%. International revenues were down 1% due to a negative 14% currency impact. They represented 34% of total revenues.

Dollar strength is not just against the Euro. Take a look at the Brazilian, Canadian, Mexican, and South African currencies. When companies start talking about achieving their “…currency neutral growth target,” you know it’s tough out there.

Gross margin fell a tenth of a percent from 48.3% to 48.2%. The decline included 0.4% from currency as well as a 0.3% increase “…due to the continued shift in our revenue mix to higher margin businesses, including Outdoor & Action Sports and direct-to-consumer, partially offset by higher costs.” Direct to consumer revenue rose during the quarter by 7% net of a 6% negative foreign currency impact. It was 26% of total revenue during the quarter.

The total negative impact of foreign currency was $119.1 million during the quarter and $286.8 million during the year. It’s good to have that information, but if you are a dollar investor, your investment is earning fewer dollars, regardless of the reason.

SG&A expenses were up 5.1% from $943 to $990 million. As a percentage of revenues during the quarter, the increase was from 39.3% to 39.4%. The increase was “…due to increased investments in direct-to-consumer businesses and slightly higher operating costs primarily due to the stronger Swiss franc, partially offset by the leverage of operating expenses on higher revenues. In addition, selling,

general and administrative expenses as a percentage of total revenues in the first half of 2015 benefitted from a $16.6 million gain recognized on the sale of a VF Outlet ® location in the first quarter of 2015.”

If you’re at all interested in currency movements, go take a look at what happened to the Swiss Franc when the authorities stopped supporting it against the Euro.

Interest expense during the quarter was $23 million, up from $21.3 million in the PCP. The increase was “…due to higher average levels of short-term borrowings, higher interest rates on short-term borrowings and lower amounts of interest capitalized for significant projects, partially offset by increased interest income on cash equivalents.”

Net income rose 8.3% from $157.7 to $170.8 million, but that includes an income tax expense that was $10 million lower than in the PCP. Without that, the increase is something less than 2%.

The balance sheet remains strong, but not as strong as a year ago. The current ratio fell from 2.6 to 1.7 times. Debt to total capital rose from 20.5% to 34.2% where capital is defined as debt plus stockholders’ equity. Long term debt didn’t change significantly, but short term borrowings rose a bunch from $581 million to $1.159 billion. The increase was “…due to commercial paper borrowings used to support working capital requirements and a $250.0 million discretionary pension contribution in the first quarter of 2015.” I’m always glad to see corporations being realistic about their pension obligations.

Shareholders’ equity fell from $5.65 to $4.96 billion. Part of the year over year change was due to “… a $396.4 million noncash impairment charge of goodwill and intangible assets recorded in the fourth quarter of 2014.”

Accounts receivables were up just 1.9% from $1.179 to $1.2 billion. However, “VF has an agreement with a financial institution to sell selected trade accounts receivable on a recurring, nonrecourse basis.” The receivables they sell come off the balance sheet. “During the first six months of 2015, VF sold total accounts receivable of $633.1 million.” As a result, it’s a hard to use the change in the receivables balance as any kind of measure of operating efficiency.

Focusing on the OAS segment, quarterly revenues in the Americas were up 15%. The number was 16% in Asia Pacific. Europe declined 5%. Those numbers include the impact of foreign currency.

By brand, The North Face rose by 6%, Vans by 17% and Timberland by 2% as reported. Direct to consumer grew by 11%, also as reported. The OAS operating margin during the quarter declined from 10.2% to 9.7% due to currency pressures.

As you probably know by now, I have a soft spot for Reef, and am always scouring VF reports for information on the brand. There isn’t much. CFO Scott Roe, talking about the whole company, tells us that, “In our wholesale business we also saw strong results, with revenue up at high single-digit rate with Vans, Timberland, Wrangler, JanSport, Reef and Lucy among the highest growth rates in the quarter.”

Later, an analyst asks specifically about smaller brands including Reef. CEO Eric Wiseman had positive comments about all the brands the analyst mentions (Eagle Creek, Kipling, Napapiijri and Reef) except for Reef, on which he was silent.

Well, damn those weak foreign currencies (wonder what happens when the Fed raises rates, whenever that happens) and I’m sorry we don’t get any glowing comments about Reef. What are VF’s plans?

When asked about their portfolio strategy, CEO Wiseman makes the following comment:

“You have heard us talk over time about our focus on the Outdoor & Action Sports space and those activity-based brands are where we are best and growing the most and investing the most. We invest disproportionately them in brand spend and we invest disproportionately them in new stores and new stores and e-commerce sites because we like the characteristics of them and the stickiness with consumers when we are helping them live out their lives doing the activities they like to do.”

“So, you will see us invest in that type of thing in our portfolio beginning with an emphasis on Outdoor & Action Sports.” That seems clear enough.

They also make an interesting comment on their sourcing strategy. CEO Wiseman states, “…our supply chain strategy about sourcing product has always been to have a balanced portfolio of countries that we can create our products in, not chasing lowest cost but chasing the best business model for us. As a result of that, we are spread pretty wide in terms of the regions of the world and number of countries that we have facilities in that we either own and operate or that we source from.”

Okay, I guess that’s really not new. But he goes on to talk about a new relationship with certain factories that is. They own factories, and they contract with factories, but they are also making deals with factories “… where we have a strategic alliance with the factory bringing everything we know about making product into a factory that’s owned and operated by somebody else.”

I hope we learn more about that concept in the future.

Finally, I want to highlight their discussion, especially with regards to OAS, about how they create experiences and build loyalty with customers. With Vans, they talk about “…the strong connectivity the brand has with their consumers who are often more loyal fans than consumers. This authentic connection is earned with youth culture and then translated back through Vans with innovative trend setting products and demand creation that’s both inspirational and experiential. This powerful loyalty focuses our execution and keeps us at the center of action sports, music, art and street culture.”

Yep, it’s that simple to explain and (I’m just guessing here) hard to do. Of course, that’s a statement from a conference call that, like conference calls for all companies, is part infomercial. I’m sure they’ve had their failures from which they learned, but at the end of the day I still think it’s VF’s operational rigor that makes them successful.