Let’s review. Volcom and Electric are in Kering’s sport and lifestyle (S&L) division which includes PUMA. In 2014, Kering had consolidated revenue of 10.038 billion Euros. The S&L division’s revenue was 3.245 billion Euros. Of that, PUMA was 2.99 billion Euros and “other brands” in S&L had revenue of 255 million Euro and operating profit of 10 million Euro (see chart below).

Other brand revenue in the S&L division (which I think is Volcom and Electric) rose in the quarter ended June 30, 2015 to 64.8 million Euros from 53 million in the same quarter last year. That a gain of 22.3% as reported. For the six months ended June 3, revenue rose 15.3% from 112.6 to 129.8 million Euros. You can discern from those numbers that the second quarter was better than the first.

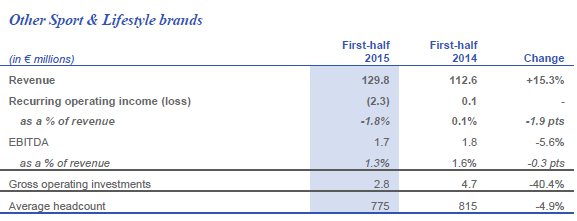

The chart below from Kering’s report shows the results for the first half of both years. You’ll note that there’s a small operating loss shown even with the revenue increase and a 5% reduction in headcount.

In the conference call, we’re told there was a “…muted first half…” for Volcom and Electric. Trends improved in the second quarter with revenue up 2.6% based on constant currency. Volcom’s second quarter growth was reported to be 6%, also using constant currency. If Volcom revenues were up 6% in the second quarter, but Volcom and Electric together were up 3%, then I have to conclude that Electric was down. That’s what the financial report says.

“After a major repositioning drive in the accessories market and a complete overhaul of its offeringaround new ranges of sunglasses, snow goggles and watches during the previous two years, Electric reported strong sales growth in 2014. However, as substantially all of the brand’s sales are now generated through the wholesale distribution channel, its revenue declined in the first half of 2015, weighed down by wholesalers’ wait-and-see attitude during the period as well as by a less favourable delivery schedule.”

Sunglasses are a tough business.

The financial report refers to “…ongoing tough market conditions for Surfwear and Action Sports.” Wholesale revenues rose 0.8% and store sales were up 6.6% and represented 15% of total sales. Those numbers are in constant currency. Volcom had 52 stores at the end of the quarter “…including nine in emerging markets.”

Talking just about Volcom, the report stated, “In North America – still the brand’s main market, representing 67.3% of revenue – sales rose 1.3% on a comparable basis. Revenue contracted in Western Europe and remained stable in Japan, although these effects were offset by extremely encouraging business development in emerging markets, particularly in the Asia-Pacific region.”

Well, that’s kind of it. As usual, there wasn’t a lot of information. Damn, it’s a tough market out there. I think Volcom can be more valuable to Kering than their revenues or results so far suggest because of who the customer is. I hope Kering understands that.