Liquidity in our financial system refers to the overall amount of readily available money and credit in the financial system that can be used for spending, lending, or investment. It includes cash, bank reserves, money market balances, and short-term funding available to financial institutions and markets. You’ve heard about the Fed increasing or decreasing liquidity. You may also know that running big budget deficits also keeps liquidity high. High liquidity energizes asset prices and the economy.

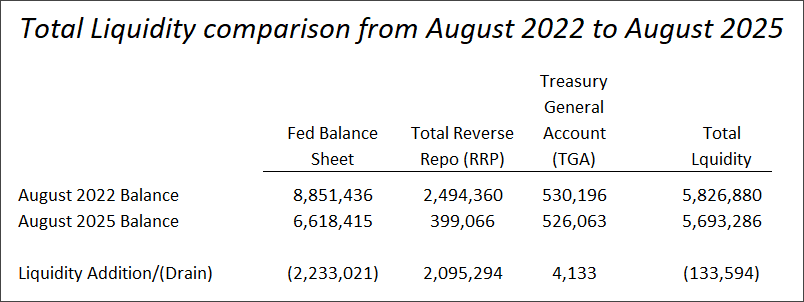

The Fed increases liquidity by buying assets. Paying for them puts cash in the system. It reduces liquidity by selling assets, taking cash out. You’ve heard about the Fed reducing it’s balance sheet and see in the chart below that they’ve reduced it by $2.2 trillion in three years. That’s a big reduction in liquidity and nothing went wrong, right?Sadly, it’s not quite that simple. The chart also shows the balance of the Treasury’s reverse repo fund fell by a little over $2 trillion. That adds liquidity to the system mostly offsetting the Fed’s liquidity reduction.

The Fed, you may have read, recently reduced the amount by which it was reducing liquidity. I wonder if that was because they knew, as we now know, that the decline in the reverse repo fund was no longer available to offset their liquidity tightening.

WHY YOU MIGHT CARE: Because further reductions in the Fed’s balance sheet may soon start to represent actual reductions in liquidity, not offset by the drawdown of the reverse repo fund. All things being equal, that’s bad for the economy.