Zumiez ended its fiscal year on January 31st with 603 stores; 550 in the U.S., 35 in Canada and 18 in Europe. How many stores do they expect to ultimately have? In the past, they’ve opined that 600 to 700 might be about the limit in the U.S. Obviously, they’ve got some head room in Canada (Maybe 70 stores total?) and a lot more in Europe. I imagine that limits of growth in North America had something to do with their acquisition of Blue Tomato.

But the Omni Channel changes things. One of their risk factors in the 10K is “Our growth strategy depends on our ability to open new stores each year, which could strain our resources and cause the performance of our existing stores to suffer. That’s true, I guess, but is kind of a normal business risk.

I haven’t read every word in Zumiez’s (or anybody else’s) list of lawyer induced cautionary risk factors. But I don’t think I’ve seen anything about the omni channel in them. Seems to me the risk factor above has to go away, or maybe changed to say something like:

“The omni channel changes things in ways we’re still trying to figure out. It’s not just about opening stores; it’s what shape and size of stores to locate where to make sure that they integrate with everything online with particular attention to how our mobile customers want to shop. If we don’t do this right, we’re screwed.”

Okay, lawyers might put it differently, but I think you see the point. This is something every retailer is thinking about (I hope) and I want to talk about how Zumiez views it.

They get right to it on the first page of their 10K where they say, “We operate a sales strategy that integrates our stores with our ecommerce platform. There is significant interaction between our store sales and our ecommerce sales channels and we believe that they are utilized in tandem to serve our customers.”

That’s clear enough, except it isn’t. What exactly does it mean to have a sales strategy that integrates stores with ecommerce? There are clues all over the 10K and conference call.

First, let’s go with a lengthy (sorry) quote on Zumiez’s systems and procedures:

“We have developed a disciplined approach to buying and a dynamic inventory planning and allocation process to support our merchandise strategy. We utilize a broad vendor base that allows us to shift our merchandise purchases as required to react quickly to changing consumer demands and market conditions. We manage the purchasing and allocation process by reviewing branded merchandise lines from new and existing vendors, identifying emerging fashion trends and selecting branded merchandise styles in quantities, colors and sizes to meet inventory levels established by management. We also coordinate inventory levels in connection with individual stores’ sales strength, our promotions and seasonality.”

They also note that no single brand was more than 8.7% of net sales in 2014. CFO Chris Works, in the conference call, notes that in the last 12 months they’ve seen “…a decentralization of our top 10 brands being less of a percentage of the overall business while the top 20 brands has really gained in its contribution to the entire business.” They are clear that this is a good thing- not a problem for the top ten brands. The more brands you sell, and the more you slice and dice the assortment at individual locations, the more important your systems become.

CEO Rick Brooks gives us some more hints about strategy by cautioning an analyst not to think of the ecommerce business as separate. He goes on:

“And we are blurring the lines for our customers. And actually, a better way to say it is our customers are blurring the lines between what’s ecommerce, what’s store. They’re in charge, they’re choosing, they’re driving it. We’re just enabling their ability and enabling our teams to meet their needs, our customers’ needs, wherever they may be, however they may want to interact with us.”

Chris makes the point even more strongly when he says, talking about all the U.S., Canadian, and European stores and ecommerce wherever it originates, “We really do view these as one business that’s tied together with one set of inventory.” I don’t think he can put it any more directly, but it’s still like he’s trying to convince them.

Now the plot thickens as Chris notes, “And part of the importance of us opening stores both in the U.S. and in Europe is really filling in so we can have a better omnichannel presence.” Current plans are to open 57 stores in 2015 including six in Europe. Rick says that when they enter new markets with brick and mortar stores, “…our web business grows significantly in those new markets.” He specifically remarks that they have to expand their store base in Europe to take advantage of the omnichannel.

What kinds of stores? Where? What kind of inventory? Rick says, “…we are experimenting, as we have talked about on past calls, with stores in different formats, strip centers, street stores.”

There are three things I want you to come away from this part of the discussion thinking about. First, there’s a need to make the mental breakthrough to where you think of all your stores and all your in the cloud stuff as one business. Sounds simple, but reread some of the comments above and think about it for a minute. In a lot of ways, what I hear is that Zumiez is building, or maybe rebuilding, parts of their business to accommodate this idea. And the blue prints aren’t completely clear.

Second, systems matter more than ever. Where and how the customers shop is up to them. Zumiez just sets things up for maximum flexibility. There are new brands and brands coming and going and growing and shrinking. There are different assortments for different stores and/or regions. There’s an ongoing need to react quickly and the continuing desire to minimize markdowns and excess inventory.

Go read the long quote on systems again.

And finally, there’s what Zumiez doesn’t talk much about directly, because I think it has some elements of being their secret sauce. And I suspect they are still figuring it out, though they believe they have a head start. What does the performance of online/mobile sales tell you about where to site stores, how many to have, and what they should look like? How do you massage all this data to tease out the relationship between the two while treating them as one business?

It’s interesting to think that it wasn’t too many years ago when a business was supposed to be proactive. Now, we’ve moved into a market where the customer has to be able to get what they want when and where they want it. If you still have to be proactive, it’s so you can be reactive.

Now for the numbers. This won’t take long.

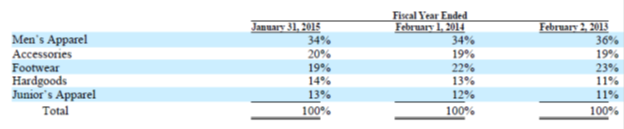

Revenues for the year rose 12% from $724 to $812 million. Sales in the U.S. were up 9.9% from $664 to $708 million. Foreign sales rose 29% from $80 to $103 million. Comparable store sales (which include ecommerce) were up 4.6% after declining 0.3% in the prior year. The chart below shows a breakdown of their sales for the last three years by product segment.

The gross margin fell from 36.1% to 35.4%. “The decrease was primarily driven by a 40 basis points benefit from the correction of an error in our calculation to account for rent expense…, 30 basis point decrease in product margin, 10 basis point impact due to deleveraging of our store occupancy costs, and 10 basis points impact of the increase in ecommerce related costs due to growth in ecommerce sales as a percentage of total sales… partially offset by 20 basis points impact due to distribution center efficiencies.”

SG&A expense rose 9.5% from $189 to $216 million. As a percentage of sales, it was up from 26% to 26.6%.

“The increase was primarily driven by a 110 basis points impact from the expense associated with the estimated future incentive payments to be paid in conjunction with our acquisition of Blue Tomato and 10 basis point impact due to an increase in incentive compensation. These increases were partially offset by a 40 basis point impact due to corporate costs savings, and 20 basis points impact due to a litigation settlement charge incurred in fiscal 2013.”

Advertising expense, included in SG&A, was $9.4 million for the year, up from $8.7 million.

Net income for the year was down from $45.9 to $43.2 million.

For the fourth quarter, revenue rose 14% to $259 million. Comparable sales were up 8.3%. Rick notes, “Our outperformance was aided by our omnichannel infrastructure that fully integrates our stores and digital platforms with our highly differentiated product assortment.” You might think about that in the context of what I talked about in the first part of this article.

Net income was $17.5 million, down from $26.9 million in last year’s quarter. That includes a charge of $6.4 million for an earn out they now believe they will have to pay Blue Tomato. There was also a $4.5 million negative impact from exchange rates in the quarter. Obviously, both these things impacted the whole year.

The balance sheet is in good shape. The decline in year over year net income isn’t what we expect from Zumiez, though I understand why it happened. My real interest right now is in watching how they manage the omnichannel and trying to discern how it impacts their brick and mortar footprint.