Quiksilver’s 10Q; Not Really a Surprise

In the aftermath of Quik’s bankruptcy filing, the 10Q feels like an afterthought. Still, it’s worth a brief review. There was no conference call. Hell, what’s left to say?

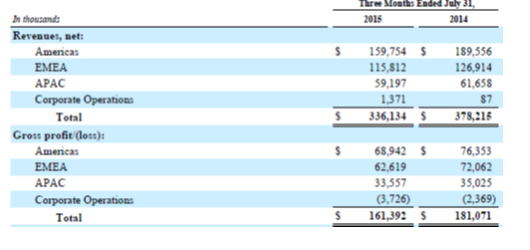

In the quarter ended July 31, revenues fell 11.1% to $336 million from $378 million in the same quarter last year. Gross margin didn’t do much of anything, rising from 47.9% to 48%. Below are the comparative sales and gross profit for both quarters.

Revenues as reported for the Americas, EMEA and APAC were down, respectively, 15.3%, 8.7% and 4.1%. Talking about revenues, Quik tells us, “Year-over-year net revenue and gross margin comparisons continuing to be unfavorable due primarily to the impact of currency exchange rates and licensing. We also expect our net revenues and margins to be unfavorably impacted by late deliveries in the short term and an evolving distribution channel strategy, particularly in North America.”

Revenues as reported for the Americas, EMEA and APAC were down, respectively, 15.3%, 8.7% and 4.1%. Talking about revenues, Quik tells us, “Year-over-year net revenue and gross margin comparisons continuing to be unfavorable due primarily to the impact of currency exchange rates and licensing. We also expect our net revenues and margins to be unfavorably impacted by late deliveries in the short term and an evolving distribution channel strategy, particularly in North America.”

I don’t know what they mean by the “evolving distribution channel strategy.” I hope they mean they are pulling back from some questionable channels.

By channel, wholesale revenue fell 15% from $233 to $198 million. Retail was down 9% from $123 to $112 million. E-commerce rose from $20 to $21 million, or by 5%. Licensing revenue was $5 million, compared to $2 million in last year’s quarter.

They note that the drop in wholesale revenue includes $21 million “…from licensed product categories.” Instead of getting that $21 million, they received $5 million in revenue, but of course they received it without any cost or effort. Ignoring for a moment the impact on the brands of where and how that product was sold, it seems like a pretty good deal if for no other reason than the positive impact on cash flow.

By brand, Quiksilver was down 6% from $141 to $132 million, Roxy by 18% from $118 to $97 million, and DC by 11% from $108 to $96 million.

We’ve got a 19.2% reduction in SG&A expense from $205 to $166 million. These numbers include asset impairment charges of $17.4 million in this year’s quarter compared to only $180,000 in last years. $16 million represented “…the write-down of the carrying value of the Quiksilver trademark…”

“The decrease in Americas segment SG&A was primarily due to reductions in employee compensation, advertising, and bad debt expenses. The decrease in EMEA and APAC segment SG&A was almost entirely due to changes in foreign currency exchange rates.” Remember that a stronger dollar makes things cheaper when translated into US dollars.

When we’ve got a goodwill impairment charge of $80 million, down from $178 million in last year’s quarter. We’ve got an operating loss that’s fallen from $203 to $102 million, but you can see that’s pretty much just the result of the impairment charge being $100 million lower. Interest expense at $18 million is a big lower than the $18.7 million in last year’s quarter and foreign currency produced a gain of $4.7 million compared to a loss of $2.3 million last year.

So the net loss fell from $223 to $125 million. Depending how you think about the goodwill impairment charge, you might conclude that this year’s quarter was pretty much the same as last year’s.

The key thing to note on the balance sheet is that the long term debt has been classified as a current liability due to the bankruptcy filing. That interesting, because obviously the September 9 bankruptcy filing occurred after the July 31 date of the financial statements. Quik says the reclassification is what’s required by generally accepted accounting principles. They also tell us, “As of July 31, 2015, the estimated fair value of the Company’s borrowings under lines of credit and long-term debt was $583 million, compared to a carrying value of $822 million.”

At the end of the day, the balance sheet as presented isn’t of much interest right now, as all the unsecured creditors have made a contribution to Quik’s equity by virtue of the filing. That is, they can’t get paid unless the court approves payment or until a plan is confirmed. Some will get more, some less and a lot nothing.

That’s pretty much the end of the shortest analysis of a Quik filing I’ve ever done. My two major concerns as we watch the current restructuring process move forward continue to be 1) where will the sales growth come from and 2) is existing, long term management the right ones to pull this off.

Leave a Reply

Want to join the discussion?Feel free to contribute!